Worried about Estate Taxes? One Strategy to Try

If your heirs might face a big estate tax bill one day, an irrevocable life insurance trust could help protect your legacy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Imagine having a thriving family business that you plan to leave to your heirs.

Or maybe there’s a substantial piece of land that you want to leave your children.

During the estate-planning process, however, you discover your beneficiaries will be subject to a $10 million tax bill. (That may sound impossible, considering the $11.4 million federal estate tax exclusion, but it can happen with a large family business — especially when you take into consideration possible state taxes.) And the only way for your estate to pay this tax liability, in the absence of additional advanced planning, may be to sell the family business or the land you hoped to pass on.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You don’t want your heirs to be forced into a fire sale, where they would have to take any offer just to liquidate as quickly as possible. But what can you do?

Fortunately, there is another way for people with multimillion-dollar estates to address these potential liquidity needs by using an irrevocable life insurance trust (ILIT) strategy.

How It Works

High-net-worth individuals and families often wonder about the best way to create a seamless estate plan. Though there are many options, trust-owned life insurance (TOLI) is frequently a good fit for those who have illiquid assets (such as businesses, land or qualified plans). It enables the trust to balance inheritances among beneficiaries estate-tax-free, which is one of the top issues among wealthy individuals. It’s also useful for individuals who want to give to charity when they die.

With an ILIT strategy, assets owned by the trust pass to the beneficiaries according to the grantor’s wishes, without being subject to federal estate taxes. This is possible because the owner is the trust, which now removes the proceeds from the insured’s estate. The trustee then maintains the policy or policies, which opens up the family to a variety of important tax-planning and charitable giving opportunities. At death, the death benefit proceeds will be paid to the designated beneficiaries of the trust both income and estate tax-free.

TOLI premiums are typically funded by annual exclusion gifts, but they also can be funded by using private financing or premium financing.

An Illustration: One Couple’s Story

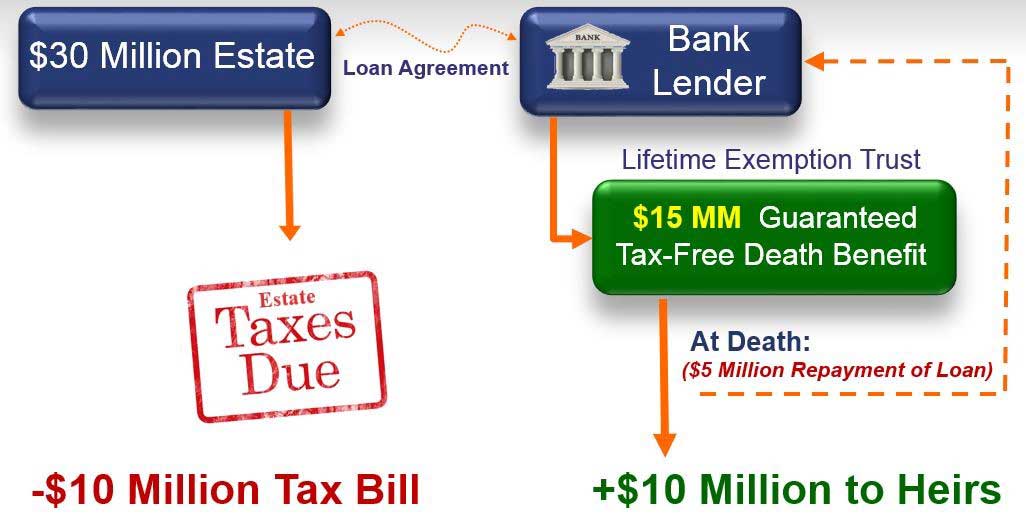

To see this strategy in action, let's consider an example. Dr. & Mrs. Anderson have a $30 million estate and are approaching a $10 million tax bill upon their passing. They are somewhat “cash poor” but do not want to liquidate assets. Premium financing will prove to be beneficial to them. Let me explain how.

Fundamentally, premium financing is a planning strategy that enables Dr. & Mrs. Anderson to pay the premiums for the coverage they need without having to liquidate assets. The Andersons will come to an arrangement through which they will borrow money at a competitive interest rate from a bank to pay for their life insurance policy with an approximate $15 million death benefit. The policy cash value is generally used as the majority of the collateral for the loan.

Put visually, it would look like this:

By leveraging the lender’s capital rather than their own to pay annual premiums, they will be able to retain their capital in high-returning investments. The loan could be paid off from: 1) a portion of the death benefit proceeds upon the death of the insured, whether it is Dr. or Mrs. Anderson, 2) a tax-free withdrawal from a portion of the cash value, or 3) an asset sale in the future.

Advantages of Trust-Owned Life Insurance

Not only can this strategy help achieve effective tax planning, but it also allows for the proceeds to be used to help the estate pay expenses and taxes once the grantor passes away. This liquidity opportunity is available through a provision that allows the trust the discretion to purchase assets from either spouse’s estate or to make loans to either estate, which keeps cash available.

An ILIT also gives an individual the opportunity to donate to a charity while preserving an inheritance for any chosen beneficiaries. The ILIT provides a death benefit that replaces the value of the gift made to charity.

In addition, gifts made to the ILIT eventually will reduce the overall value of the estate, which will, in turn, reduce the amount that would be calculated in the taxable amount.

Potential Pitfalls

If you are thinking about gifting to your life insurance policy, it’s important to be aware of the gift tax liability. For 2019, any gift that is greater than $15,000 for the year ($30,000 for married couples) applies against the gift-tax exclusion and requires filing Form 709. So, the maximum premium you would be able to gift without gift-tax liability would be $30,000. Many times, this just isn’t enough to properly plan one’s estate.

Many people need large policies that require much more than what the annual gift exclusion allows to cover their needs. This is where premium financing can be a valuable tool for those who want to maximize their estate with a substantial life insurance death benefit and without having to liquidate and pay taxes on other investments to make large premium payments. Premium financing also avoids using up your annual gift tax exclusions and reducing your overall lifetime exemptions.

In addition, by leveraging a lender’s capital rather than your own to pay annual premiums, you retain a significant amount of capital you can use to maintain or make investments or preserve your savings or cash flow needs. If the policy performs favorably compared to the loan interest rate, premium financing offers you the opportunity to potentially earn a higher level of interest from the policy than the interest you pay for the loan. In essence, we finance our homes, our businesses and practically everything else, so why shouldn’t we finance our life insurance?

But premium financing does have some risks. For example, lending rates may increase to a higher level than projected, which may require posting collateral with the bank. Financial institutions typically require borrowers to provide collateral from liquid assets, such as securities, and if those securities decrease in value, the lender may require additional collateral. Longevity also can be a risk; the longer the insured individual lives, the greater the amount of cumulative loan principal and interest, which could reduce, and even possibly eliminate, the ILIT’s remaining net death benefit.

It’s Complicated, So Get Help

Though an ILIT strategy can be a valuable option for those who want to protect their estate from a burdensome (or even nightmarish) tax bill, it requires several complex legal and financial decisions. A premium-financed plan, in particular, can require constant monitoring. To help you navigate the nuances, you’ll want to tap an experienced and independent financial professional and an estate attorney.

As difficult as it is for you and your loved ones to think about your death, having a plan in place is the only way to ensure your legacy carries on. Gifting, taxes and charitable giving should be a priority if you hope to efficiently and effectively transfer the estate you worked so hard to build. If you don’t have a plan, I can assure you the government has one for you.

Kim Franke-Folstad contributed to this article.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Jankowski is president and CEO of the Chicago-based wealth management and estate planning firm Wealth Planning Network (www.wpn360.com). A frequent seminar leader and lecturer, he specializes in working with physicians, business owners and corporate executives.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.