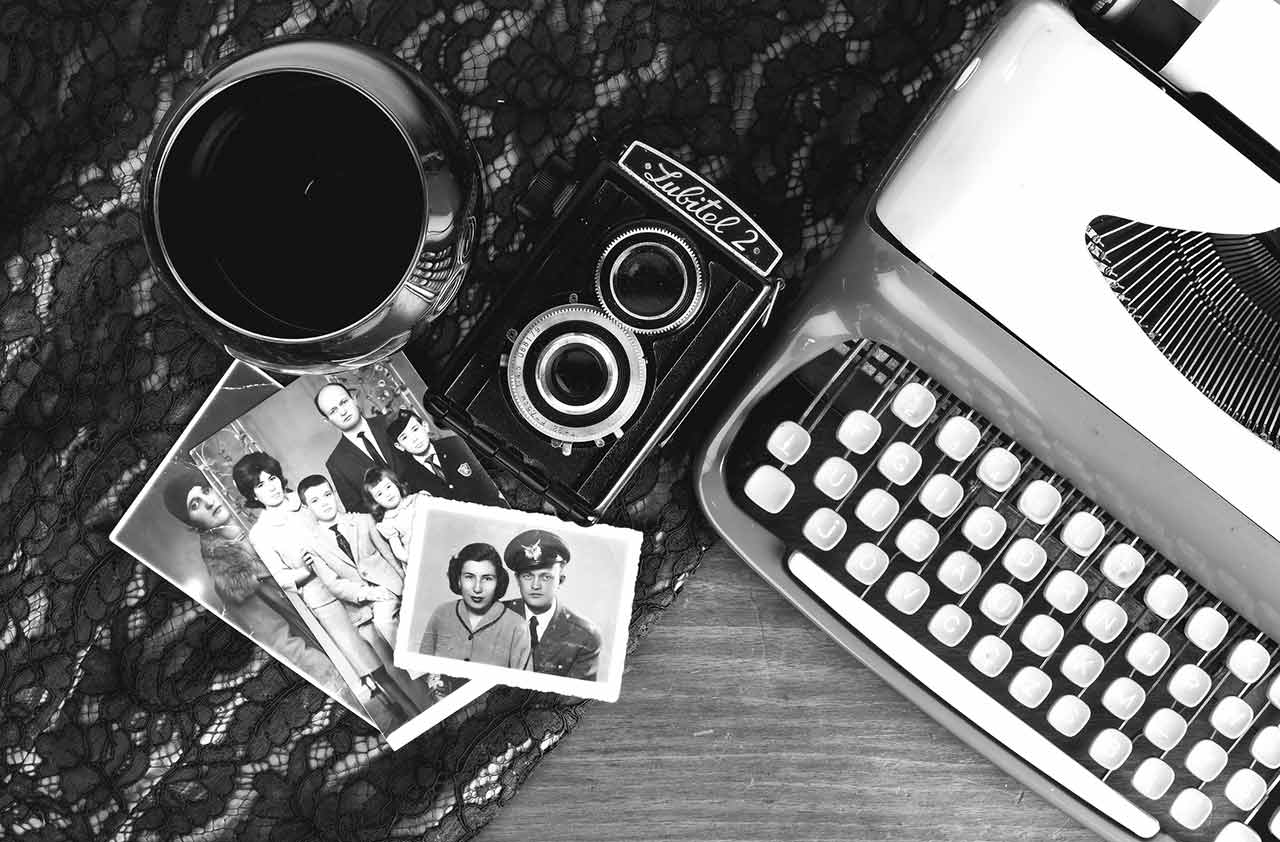

How Personal-Finance Advice Has Changed Over the Past 70 Years

The guidance may have changed, but the dedication to our readers has remained constant.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“The Republicans are back in Washington, all set to take control of the new Congress.” News ripped out of today’s headlines? Actually, those words appeared in the first issue of the Kiplinger Magazine in January 1947. Other stories from those early years also have a familiar ring: “But What Kind of Tax Cut?”; “Buy Stock in Investment Trusts?”; “Retirement by Easy Stages”; “How to Buy a House” (see our current housing outlook); “Be Prudent About Inflation” (see our inflation story); “Your Income Tax: Do It Right This Year” (see tips for lowering your 2016 tax bill); “ ‘No-Load’ Mutual Funds”; “The Way to Buy Stocks Today”; “The High Cost of Drugs.”

Some stories were eerily prescient. In November 1947 we published a special section on life in the future, in which we foresaw a convertible car that would boast such amenities as an “underseat toilet, television receiver … and a compartment for telephone and directory. It is hard to escape the telephone anywhere. …” Except for the underseat toilet (are you listening, Elon Musk?), we were right on the money.

We missed by a mile, however, with our infamous “What Dewey Will Do” issue in November 1948. Thanks to speedier production technology, we did much better in November 2016, when we were able to rewrite our entire January 2017 cover story to reflect Donald Trump’s surprise win.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Foreshadowing our Healthy Living section, we published stories about dealing with alcoholism. And in October 1950, we offered help for insomniacs (“Have Trouble Sleeping?”), just as we did last month in What’s Keeping You Up at Night?

Then as now, we were concerned with teaching kids about money (“Should Children Get an Allowance?”). But there has been a sea change in our coverage of women’s finances. Back then we wrote about women and money from the perspective of their husbands: “What Every Woman Should Know About Her Husband’s Finances”; “Money Quiz for Wives Only”; “Wife’s Guide to the Stock Market.” Today we address women directly in our Money Smart Women column.

Our passion. One thing that has remained constant over 70 years is our dedication to our readers. Our mission is to provide trustworthy advice that real people can act on to take control of their finances. And because we are a family-owned company, that mission is personal. “Providing useful advice to the American people for 70 years has been more than just a business for those of us in the Kiplinger family and to our colleagues here,” says editor in chief Knight Kiplinger. “It’s our calling, our passion. Nothing gives me more pleasure than hearing from longtime readers that our counsel has helped their families achieve real financial security. That’s what we’re all about.”

And hear from readers we do, such as this note from Matt Millard in Flower Mound, Texas: “We have had the magazine across multiple generations and it has had quite an impact on our family’s life. My Grandma Foster first gave Kiplinger’s to my late father in the early 1990s, and today we represent three generations of subscribers. Thanks for 25 years, Kiplinger’s, and here’s to many more!”

Our Greatest Economic Forecasts of the Last 90 Years

Our cover story this month is a reflection of the passion Knight referred to. It’s a collaboration among our entire staff, who at first suggested nearly 300 ideas. Senior editor Mark Solheim took the lead in culling and editing them to a manageable 70, and art director Stacie Harrison is responsible for the elegant cover and lush layout. We invite you to benefit from our 70 years of experience as we tell you the best ways to build, protect, preserve and enjoy your wealth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Janet Bodnar is editor-at-large of Kiplinger's Personal Finance, a position she assumed after retiring as editor of the magazine after eight years at the helm. She is a nationally recognized expert on the subjects of women and money, children's and family finances, and financial literacy. She is the author of two books, Money Smart Women and Raising Money Smart Kids. As editor-at-large, she writes two popular columns for Kiplinger, "Money Smart Women" and "Living in Retirement." Bodnar is a graduate of St. Bonaventure University and is a member of its Board of Trustees. She received her master's degree from Columbia University, where she was also a Knight-Bagehot Fellow in Business and Economics Journalism.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

QCD Limit, Rules and How to Lower Your 2026 Taxable Income

QCD Limit, Rules and How to Lower Your 2026 Taxable IncomeTax Breaks A QCD can reduce your tax bill in retirement while meeting charitable giving goals. Here’s how.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

How to Benefit From Rising Interest Rates

How to Benefit From Rising Interest RatesFinancial Planning Savers will get the best rates from top-yielding savings and money market deposit accounts at online banks.