Don't Quit Your Day Job Just Yet

An aspiring filmmaker's dreams collide with financial realities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

OUR READER

Who: Todd Thompson, 37

What: Creative developer

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Where: Orlando

Marital status: Married

Symptom: Wants to be financially secure so he can eventually go out on his own. Ultimately hopes to be a movie mogul.

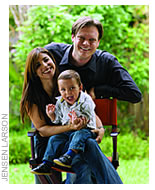

Olga and Todd Thompson are blessed with a beautiful 1-year-old son, Ethan, a lakefront home in Orlando and a concentration of artistic talent. Todd, an actor, filmmaker and screenwriter, works as a creative developer for Disney theme parks. Olga, 33, is a freelance graphic artist and commercial photographer.

This sweet life has only one complication: money. Earnings from Todd's job and Olga's photo business pay the bills. But although Todd enjoys his work, he aspires to make it as a full-time filmmaker someday. He's a partner in an indie production company, where he works nights and weekends. The company has released several acclaimed short films and is seeking investors to develop full-length features.

Making movies "is definitely a life passion of mine, a career I could pursue to my last days," Todd says. But before Todd can pursue his ambition, he needs to attend to his son's needs and his and Olga's retirement.

Todd and Olga are starting out well, with $135,000 in retirement funds, an ample savings account and little debt. Their mutual funds are mainly growth-oriented. Their house is worth as much as they owe. The wild card is investment real estate. A few years ago, Todd bought three condominiums and a townhouse in the Orlando area. He has kept them occupied and says he's breaking even on cash flow. Todd acknowledges that half his paper profits disappeared in the real estate downturn, but he retains about $200,000 in equity.

What to do

Advisers cringe when they see clients with more assets in rental real estate than in stocks and bonds. But even with capital-gains tax rates as low as they are, Todd should hold for now, says Roger Wohlner, of Asset Strategy Consultants in Arlington Heights, Ill. "Set up a stress test. I'd build in a 20% vacancy rate and see if he could handle it." If not, Wohlner says, Todd should "get out and diversify" once buyers re-emerge and property values stabilize.

Todd's film company represents a second enterprise. Yet, for a new parent, the best security is a full-time job with a strong employer that offers a steady paycheck, health benefits and a 401(k) with a match, says Sheryl Garrett, founder of the Garrett Planning Network. She applauds Todd's ambition, but in this situation, she says, "you have to have a paycheck coming in." Garrett says that for Todd and Olga to be able to retire comfortably, they need to amass a savings kitty that can generate enough investment income to cover 100% of their yearly fixed living expenses.

That's a tall order, but it shouldn't stop Todd from putting his heart into his filmmaking. Who knows? Maybe he'll produce a movie that mints money. Or maybe Disney will find a role or two for a young man who's been in The Green Mile, The Waterboy, several science-fiction flicks and a few TV series.

Stumped by your investments? Write to us at portfoliodoc@ kiplinger.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kosnett is the editor of Kiplinger Investing for Income and writes the "Cash in Hand" column for Kiplinger Personal Finance. He is an income-investing expert who covers bonds, real estate investment trusts, oil and gas income deals, dividend stocks and anything else that pays interest and dividends. He joined Kiplinger in 1981 after six years in newspapers, including the Baltimore Sun. He is a 1976 journalism graduate from the Medill School at Northwestern University and completed an executive program at the Carnegie-Mellon University business school in 1978.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and More

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and MoreAmazon Prime The Amazon Prime Big Deal Days sale ends soon. Here are the key details you need to know, plus some of our favorite deals members can shop before it's over.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.