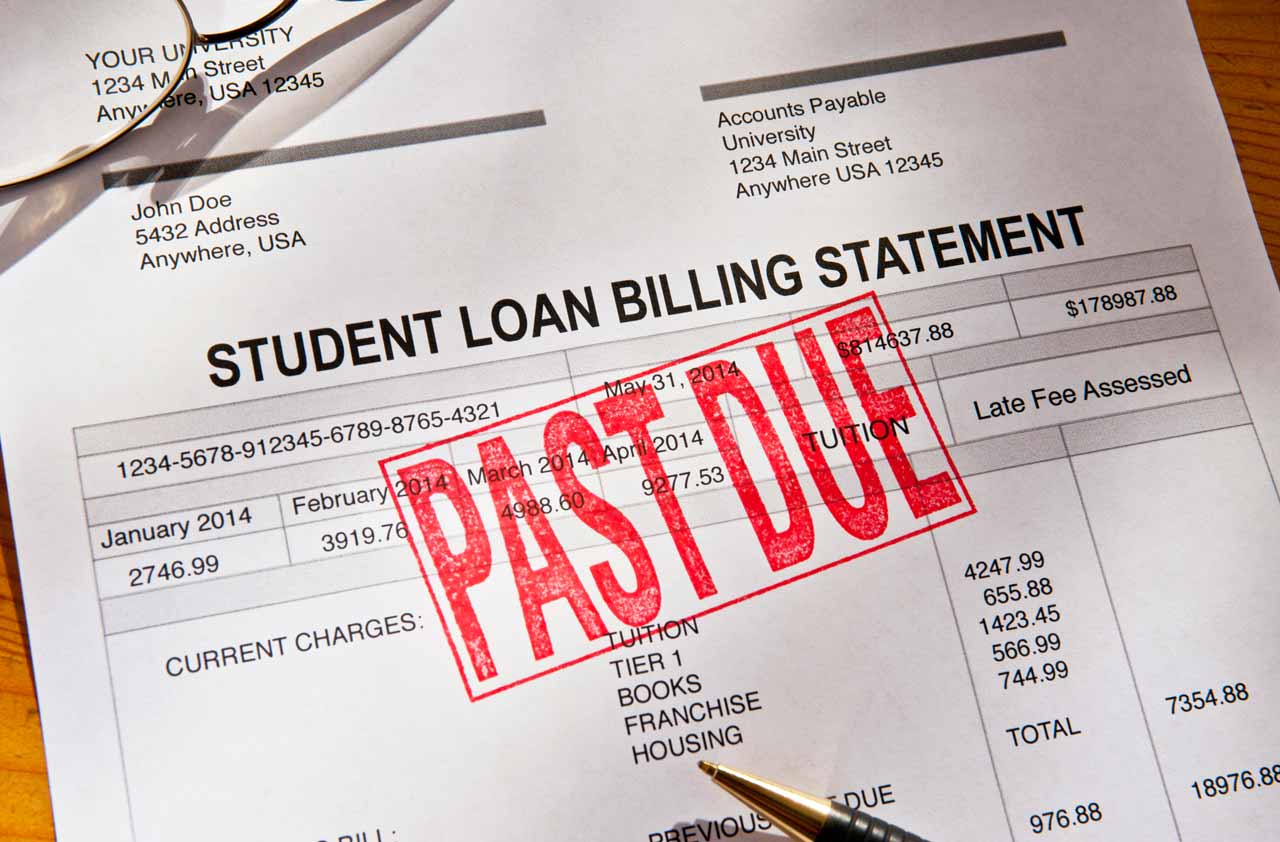

Keep Student Loans From Strangling Your Retirement Plans

Understand your options for handling student debt.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

More and more people are staggering into retirement carrying a heavy burden: student loan debt. Borrowers age 60 and older had $66.7 billion in student loan debt in 2015, up more than 700% from 2005, according to the Federal Reserve Bank of New York. And they are struggling to pay back that debt: Nearly 40% of federal student loan borrowers age 65 and older are in default, according to the U.S. Government Accountability Office, compared with 17% of those age 49 and younger.

While student debt weighs heavily on borrowers of all ages, it presents particular challenges for seniors. Older people with student loans have less saved for retirement than those without such debt, and they’re more likely to skimp on necessary doctor visits and prescription drugs, according to the Consumer Financial Protection Bureau.

If you fall behind on a federal student loan, the government can garnish your wages or Social Security benefits, or take a portion of your tax refunds. And unlike most other kinds of debt, there’s no statute of limitations on federal student loans. “This debt really does follow you until you die,” says Persis Yu, director of the National Consumer Law Center’s Student Loan Borrowers Assistance Project.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Whether you have just co-signed a student loan with a grandchild entering college or are already struggling with loan payments that you can’t afford, it’s important to understand your options for handling student debt. Under certain conditions, for example, lenders will release a co-signer from responsibility for a loan after the primary borrower has made a series of timely payments. And federal loan borrowers may have access to various income-based repayment plans that can make payments more affordable.

People age 60 and older are the fastest-growing segment of student loan borrowers, according to the CFPB. Most of these older borrowers have debt that was used to help pay for their children’s or grandchildren’s education—either loans they took directly or co-signed with the student. Roughly one out of four older borrowers have loans that helped pay for their own or their spouse’s education.

If you haven’t yet taken out any loans—but a child or grandchild is begging for help with college bills—keep your borrowing in check. College financing expert Mark Kantrowitz offers this rule of thumb: Borrow no more than your annual income. That way, you should be able to pay back the loans in 10 years or less. And “if retirement is just five years away, borrow half as much,” he says, to enter retirement debt-free. If you’re asked to co-sign a loan, recognize the risks: You and the student are equally obligated to repay the debt, and if the student defaults, it could wreck your credit.

Getting Out of Debt

Once you’re in repayment mode, consider paying more than the required monthly installment whenever you have extra cash. If you have multiple loans, direct extra payments to the one with the highest interest rate. Send a cover letter specifying that you want the extra payments applied to the loan principal, which will reduce the balance you’re paying interest on and help you pay down the loan faster. Otherwise, most lenders will treat the extra cash as an early payment of the next installment due. Include the loan ID number on your check and in your cover letter. Some older co-signers have complained that loan servicers allocate their payments to other loans held by the student—not the loans they co-signed, according to the CFPB.

Borrowers struggling to repay federal loans may have several options for reducing monthly payments. Some income-driven repayment programs available for federal loans limit your monthly payment to 10% of your “discretionary income”—typically calculated as the difference between your adjusted gross income and 150% of the poverty level for your family size. (For a two-person household, the poverty level is $16,240 in 2017.) Perhaps you’ve retired and your AGI has dropped below 150% of the poverty level. In that case, “your monthly payment will be zero, so that’s something definitely worth looking into,” Kantrowitz says.

For Parent PLUS loans—federal loans available to the parents of dependent students—lowering the monthly payment is “trickier, but there are still options,” Yu says. Parent PLUS borrowers who consolidate their loans can qualify for an “income contingent” repayment plan that can limit payments to 20% of their discretionary income—which in this case is the difference between their annual income and 100% of the poverty level. “It’s the most limiting of the repayment plans,” says Dave Evans, president of 401k Sleuth, a financial education firm in Stamford, Conn. Check your repayment options at www.studentaid.ed.gov.

If you work in the public or nonprofit sector and make 10 years’ worth of payments on a federal loan, you may qualify to have your remaining debt forgiven. Let’s say you earned your nursing degree in your fifties. You could work at a public hospital for 10 years while repaying your loan, then have the remaining debt wiped out. What’s more, you can delay required minimum distributions from your employer retirement plan if you’re still working in your seventies—leaving your nest egg to grow tax-deferred for a longer period.

If you’ve co-signed on a private loan, ask about the requirements for obtaining a “co-signer release,” which removes your responsibility for the loan. Generally, the primary borrower must have a strong track record of making on-time payments and good credit. Encourage the primary borrower to have payments automatically deducted from his bank account. Being just a few days late with payments may be “all it takes to lose eligibility for co-signer release,” Kantrowitz says.

If you’re having trouble repaying a private loan, contact the loan servicer directly to ask about your options. The company may offer an extended repayment plan, which reduces your monthly payment but extends the loan over a longer period. It may also offer forbearance, which temporarily suspends your obligation to pay the loan. But forbearance may “just make the problem worse,” Kantrowitz says, as interest continues to accrue. As an alternative, he says, ask for a partial forbearance, in which you suspend principal payments but continue paying interest.

For complex student loan issues, there are legal resources and student loan ombudsman programs that may help. Go to www.studentloanborrowerassistance.org and click on “resources.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.