3 Myths About Your Social Security Filing Age

When it comes to maximizing your Social Security benefits, the rules people tend to count on might not be as cut and dried as they seem.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Figuring out when to claim your Social Security benefits is a tricky question, and people wrestling with the decision often rely on several widely followed rules of thumb. Unfortunately, doing that can potentially lead you astray, because these are generalities, not rules, and they aren’t as clear-cut as you might think.

Let’s take a long, hard look at three “facts” about Social Security filing age and the real math behind them. All three are only true to a point — and as you’re planning your Social Security filing age, you should understand the truth behind these three principles.

First, let’s look at the concept of delaying benefits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. You Should Always Delay Your Social Security Filing Age to 70

This one is the easiest to understand why it’s wrong — but the component of truth in it can be important, because it could work in your favor to delay. Of course, an absolute like this is going to be proven incorrect in some circumstances.

Most people know that if you start taking benefits early — as young as age 62 — your Social Security check will be lower than if you had waited until your full retirement age (FRA). And once you pass your FRA, your benefit grows each year beyond that until age 70, when it tops out. So, if you happen to be able to delay your Social Security filing age and you live a long time after age 70, over your lifetime you may receive more from Social Security than if you filed early. However, if you need the cash flow earlier due to lack of other sources of income or expect a shortened life span, filing early may be your only choice.

Filing earlier can provide income earlier, but depending on your circumstances you may be short-changing your family. When you file early, you are permanently reducing the amount of benefit that can be paid based on your earnings record. Your surviving spouse’s benefits will be tied to the amount that you receive when you file, and so if you delay to maximize your own benefit and your spouse survives you, you’re also maximizing the benefit available to him or her. This is assuming that your surviving spouse’s own benefit is something less than your own.

To see how this all works, consider this example. John, who is 62, will have a benefit of $1,500 available to him if he files for Social Security at age 66, his full retirement age. His wife, Sadie, will have a benefit of $500 available at her FRA. If John files at age 62, his benefit would be reduced permanently to $1,125 per month. When John dies, assuming Sadie is at least at FRA at the time, Sadie’s benefit would be stepped up to $1,237 (the minimum survivor benefit is 82.5% of the decedent’s FRA benefit amount).

On the other hand, if John could delay his benefit to age 68, he would receive $1,740 per month, because he would have accrued delayed retirement credits of 16%. Upon John’s death, Sadie would receive $1,740 in survivor benefits. By delaying his benefit six years, John would have improved his surviving spouse’s lot in life by over $500 per month. Of course, this would require him to come up with the funds to get by in life in the meantime, and so if he did have the funds available this would make a lot of sense. If he didn’t have other funds available, one thing that can help matters is if Sadie filed for her own benefit at age 62 — that would provide them with $375 per month while John delayed his benefits.

What to remember: The key here is that it’s often wise for the member of a couple who has the larger benefit to delay benefits for the longest period of time that they can afford, in order to increase the survivor benefit available to the surviving spouse. But it’s also often necessary to file earlier due to household cash flow shortages. As we’ll see a bit later, only the question of surviving benefits makes the idea of delaying benefits to age 70 a truism. Otherwise, it could be more beneficial to file earlier.

2. Increase Your Benefits by 8% Every Year You Delay Filing

This one again comes from a partial truth: For every year after FRA that you delay your Social Security filing, you will add 8% to your benefit. But the year-over-year benefit differences are not always 8%, and often the difference is much less.

It is true that if you compare the benefit you’d receive at age 66 to the benefit you’d receive at age 67, it will have increased by 8%. However, if you compare your age 67 benefit to your age 68 benefit, it will have increased by 7.41%. This age 68 benefit is 16% more than the age 66 benefit, but only 7.41% more than the age 67 benefit. This is because the benefit increase is based on your FRA benefit amount (age 66 in this example), not the amount you could have received at age 67.

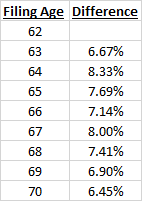

The table below shows the differences across the spectrum of filing ages when your FRA is age 66 (those born from 1943 to 1954). (Note: Annual Cost of Living Adjustments (COLAs) have not been factored in to these tables because COLAs can vary so much year to year and can even be zero.)

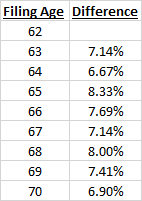

And this table shows what the differences are year-over-year if your FRA is age 67 (those born in 1960 or later):

So, as you can see, only from one specific year (your FRA) to the following year is the increase 8%. Otherwise, with only the exception of one filing age (the difference between three years before FRA and two years before), the year-over-year increase is less than 8%, and sometimes it’s less than 7%.

What to remember: Don’t be distracted by the differing percentage changes over the years. The bottom line is, Social Security benefit amounts themselves do increase by approximately 8% per year overall every year you wait – but often the year-over-year percentage increase is less. An increase of 8% is an approximation, but in reality, your increase will often be less.

3. The Break-Even Point is 80 Years of Age

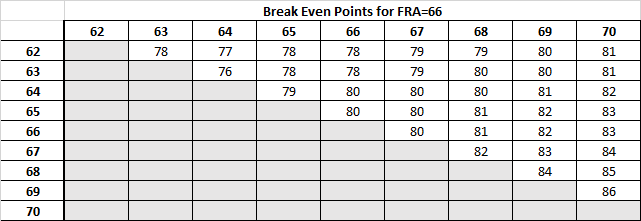

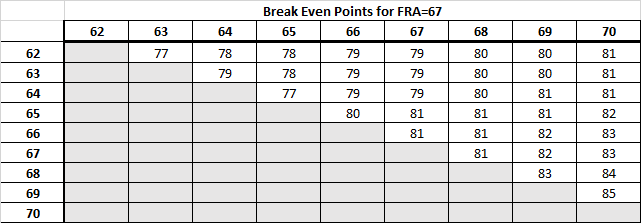

I’ve often quoted this as a generality — rarely pinning it down to a specific year but giving the range of around 80 years old. It’s not that simple, though, when you consider all the different ages that an individual can file. The break-even point is the age at which your lifetime payment amount would be equal, whether you claim Social Security early or late, and if you live beyond that, you would come out ahead by waiting. And if you don’t live to the break-even age, it’s better to claim earlier.

For example, when deciding between a Social Security filing age of 62 versus filing at age 63, your break-even point occurs at age 78 (when your FRA is age 66). But when deciding between age 63 and age 64 (with FRA at 66), the break-even occurs at age 76.

On the other end of the spectrum, when choosing between filing at age 69 versus filing at age 70 (FRA of 66), the break-even occurs at age 86 — considerably later than age 80. The break-even for the decision to file at age 68 versus age 69 occurs at age 84.

The two tables below illustrate the ages at which the break-even occurs between the various filing ages. This first table is when your FRA is 66:

And this table shows what the differences are year-over-year if your FRA is age 67:

What to remember: The year-over-year break-even point varies, depending on which Social Security filing age you’re considering. If the two options are earlier (before FRA) the break-even point occurs before age 80. If they are both at or around FRA, then the break-even occurs right around age 80. But if the Social Security filing age you're considering is near age 70, count on the break-even point being much later, as late as age 85.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jim Blankenship of www.BlankenshipFinancial.com is a practicing fee-only financial planner, author and speaker, in New Berlin, Illinois. He has written three books, including the popular "Social Security Owner's Manual." Jim focuses extensively on Social Security, retirement plans and income taxes in writings on the blog www.FinancialDucksInARow.com.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.