Retirement Requires a Shift in Thinking

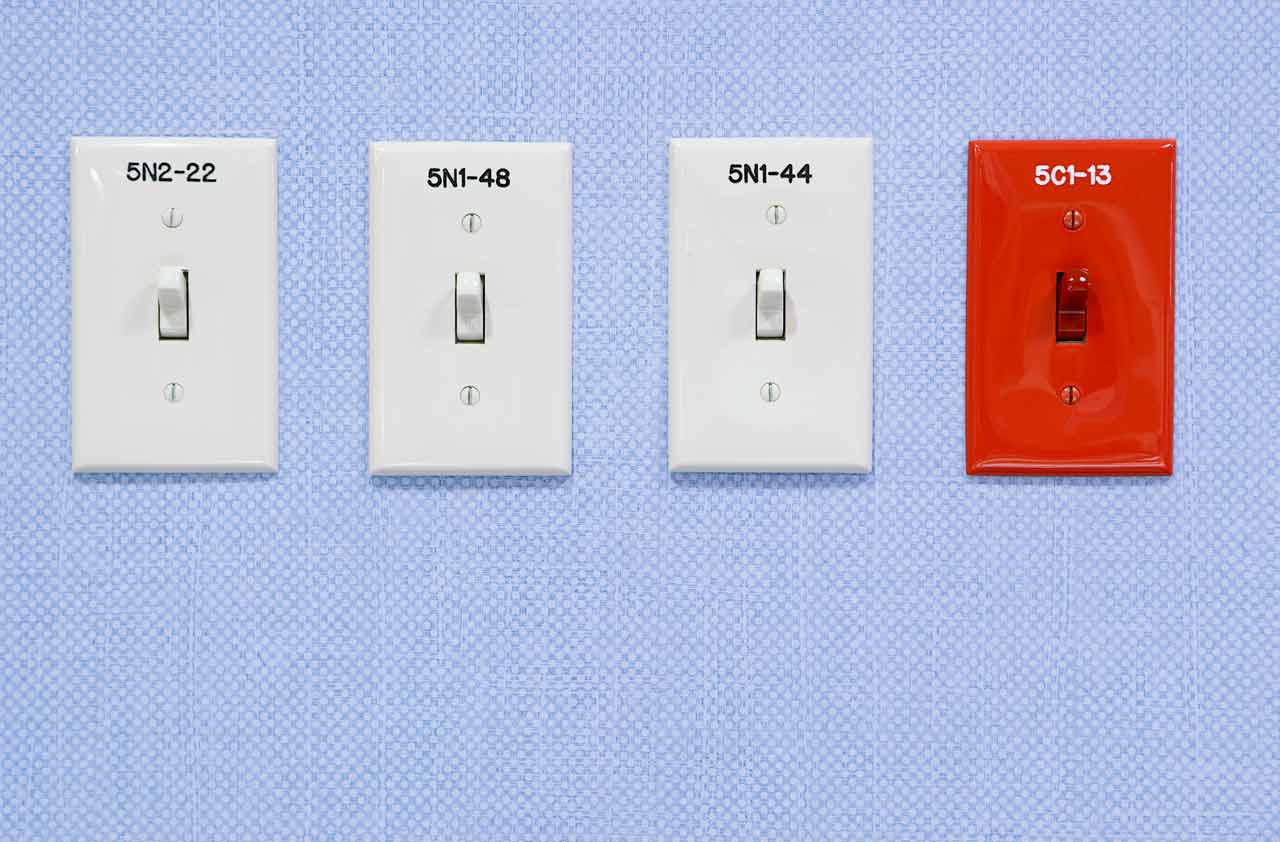

The risk-reward equation changes when you retire. It's no longer about growing your wealth: It's about protecting what you've got. So get ready to flip your mental switch from accumulation mode to preservation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For most of your investing life, you’ve probably been encouraged to build a portfolio that balances risk and return — achieving the highest returns possible based on your personal tolerance for risk.

For most people, that means living with a certain amount of volatility in exchange for growing a comfortable nest egg for their retirement years. You can lose money taking on too much risk, of course, but you won't gain much ground being too risk-averse. So, a larger investment in the stock market (60%, 70% or more) would be a must for those looking to help grow their wealth over the long term.

In retirement, though, things are different, and a shift in thinking is required.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The goal for most people should change as retirement nears — from growing their nest egg to helping to protect their savings and ensuring the money they’ve accumulated can provide them with enough income to last 20 to 30 years or more.

That means a shift in mindset and a transition in strategies.

The problem is, the financial industry has done such a good job of pushing accumulation at (almost) any cost, it can be tough for some to switch their focus to the next stages of investing: preservation and distribution.

Recently, for example, we put together a retirement plan for a potential client who had saved a hefty chunk of money — more than $3 million. We included an income plan — using a bucketing strategy — that laid out where he would get his money in retirement.

With bucketing, we typically look at three time frames, which could be labeled “now,” “soon” and “later.”

The “now” bucket is designed to cover living expenses and larger emergency expenses in the first years of retirement. The “soon” bucket holds money you may need to access a few years down the road. And both buckets are built to withstand a market downturn early in retirement — a time when “sequence of returns risk” can devastate a portfolio.

In this case, the first bucket, the “now” bucket, was set up with cash equivalents and fixed-income investments. The second, “soon,” bucket included equities (about 50%). The third, “later,” bucket had a higher percentage of equities, designed for long-term growth and legacy planning.

When presented with the potential plan, the client felt that we had put too much into fixed income, especially at the beginning of the plan. The client thought more growth opportunity was needed and wanted to take more risk. So, rather than focusing on how to generate income from the portfolio, the client was still focusing on trying to achieve potential higher rates of return.

We had covered the biggest concerns the client had come to us with: How long the money would last, and where exactly to pull income from. But in the end, the client focused more on maximizing the rate of return.

Those are two different goals.

I can’t blame the investor, who had been trained for 30 years to think about risk and reward, account values and returns.

But I do hope, as an industry, we can help people understand that:

- Cash and fixed-income investments can play a critical role in weathering economic storms and can help protect what individuals have in retirement.

- Each investment has valuable features people can use to their advantage. But needs are different in retirement, and a person’s plan should reflect that.

- Even if they can handle a more aggressive investing strategy, why risk it if they don’t have to?

In retirement, it’s important to think of your savings as income rather than a lump sum. It’s not all about achieving maximum return on investment anymore; it’s about how you can get the maximum return from your portfolio and into your pocket.

Instead of sticking with a collection of random investments or going with a cookie-cutter asset allocation, talk with your adviser about ways to help build a strategic plan for how you’re going to distribute your assets to yourself.

Kim Franke-Folstad contributed to this article.

Fee-based financial planning and investment advisory services are offered by Imber Financial Group LLC, a Registered Investment Advisory Firm, and Capital Asset Advisory Services LLC, an SEC-Registered Investment Adviser (Registration does not imply a certain level of skill or training). Insurance products and services are offered through Imber Wealth Advisors Inc. Imber Financial Group LLC and Imber Wealth Advisors Inc. are affiliated companies. Investing involves risk, including the potential loss of principal.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jon Imber is the president and owner of Imber Wealth Advisors. A fiduciary adviser, he has passed the Series 65 exam and holds a life insurance license in Michigan. He's a member of the Financial Planning Association and a Registered Financial Consultant (RFC®). He earned his bachelor's degree in marketing and business administration from Northwood University.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.