Medicare Surcharge Thresholds to Drop

More beneficiaries who are considered high earners will be hit with steeper fees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

High-income retirees socked with premium surcharges for Medicare Part B and Part D may have to pony up even more in 2018. The income thresholds for the highest surcharge tiers drop next year, hitting more beneficiaries with higher premiums.

Resetting the trigger points was part of the Medicare Access and CHIP Reauthorization Act of 2015, known as the "doc fix" law. That law put an end to the annual battles over fee schedules for doctors' Medicare payments. To help pay for the permanent fix, lawmakers put high-income beneficiaries on the hook.

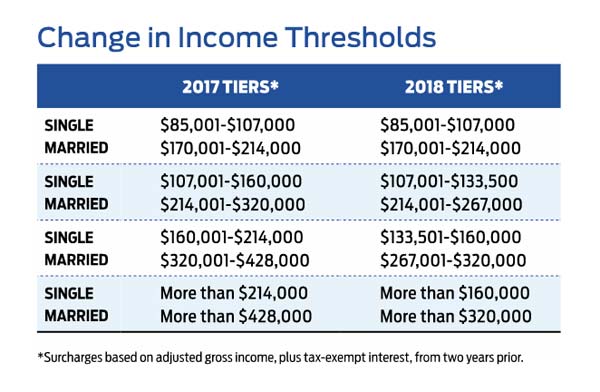

There will still be four surcharge tiers for 2018. There is no surcharge for beneficiaries whose modified adjusted gross income (AGI plus tax-exempt interest) is less than $85,000 for single filers or $170,000 for married taxpayers filing jointly. (See chart below.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But the tops of the other tiers are compressed so that some income levels that have been in tier two will be in tier three and some beneficaries previously in tier three will find themselves in the most expensive tier four. The highest surcharges used to kick in when MAGI passed $214,000 for singles and $428,000 for married couples. Those trigger points drop 25% in 2018, to $160,000 and $320,000 respectively. (The standard premium and surcharge amounts will be released later this year.)

Because 2016 tax returns are used to determine 2018 Medicare premiums, and those returns have already been filed, you could be stuck with higher premiums unless you qualify for a waiver because of a life-changing event, such as retirement or death of a spouse (see Medicare Surcharges Have Costly Effects).

But if your income is likely to be at similar levels in 2017, you still have time to try to lower your MAGI for this tax year with the aim of reining in your 2019 Medicare premiums. If you might cross a tier threshold, look to tap sources of income that are exempt from MAGI. That includes Roth account distributions, health savings account distributions, loans from cash-value life insurance, a portion of nonqualified immediate annuity payouts and reverse mortgage proceeds.

If you are subject to required minimum distributions from retirement accounts, consider making a direct charitable contribution from your IRA. Such qualified charitable distributions don't count toward your MAGI.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.