Physicians Face Unique Financial Challenges

A doctor's high income and demanding insurance needs may call for specialized financial assistance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Physicians face unique challenges when it comes to managing their finances. The importance of getting pertinent comprehensive advice to fit their specific situations can be a challenge that often goes unnoticed. Consider a sample doctor: Dr. Smith is 40 years old, married, has 2 kids and is making $250,000 in annual salary. We will compare her to household incomes in the U.S., and consider what information she needs to navigate her personal and business finances. The key question is, "Does she need the help of a specialist?"

General health advice such as "eat more vegetables" and "workout three times per week" is good information that everyone can benefit from. However, if someone has a rare neurological disorder or advanced cancer, is this general advice enough to cure them? Absolutely not! While the general advice still applies, it is time for that person to consult with a specialist. In the same way, for Dr. Smith, based on her income and the risks of her profession, general advice may not be enough. She may need a specialist to properly address her financial health.

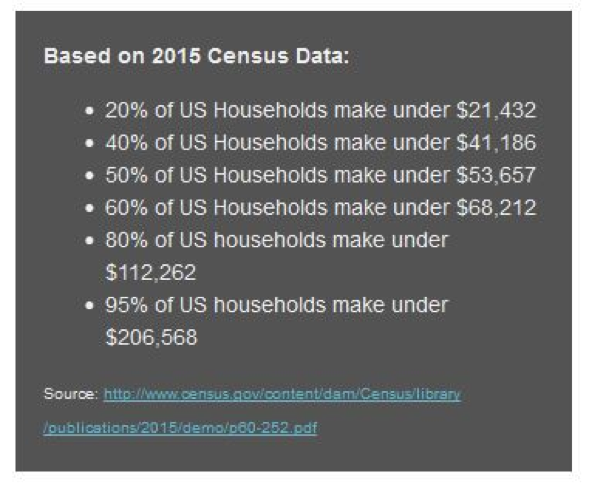

Consider data from the U.S. Census Bureau on U.S. household incomes (left). Comparatively, we can see that Dr. Smith's income clearly separates her from the crowd: In three months, Dr. Smith makes more than 50% of all U.S. households. In 12 months, she easily finds herself in the top 3% of U.S. households in terms of income. And remember, this is not including additional income from her spouse. Also, if Dr. Smith owns a private practice, her need for relevant customized advice is greatly magnified.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

To properly address her financial concerns, she will need to view her financial situation—both personal and business—very differently. Standing out from the crowd like this can be difficult. When working with a financial adviser to develop a specialized plan, Dr. Smith will likely implement strategies that do not apply for more than 95% of all U.S. households. Dr. Smith may find herself feeling very uncomfortable having to "think outside the box" and utilizing strategies that differ from popularized general information.

There are many interesting challenges she might face, and these challenges grow when considering the complexities of owning a private practice. How to take advantage of tax deferred retirement savings, what vehicles can provide tax-free retirement income, proper insurance coverage for both personal and business interests? One concern that deserves significant attention in this context is the need for Long Term Disability (LTD) benefits to protect financial interests if a doctor cannot work. The bottom line is that it will take a team of specialists to properly address the financial concerns of a well-compensated physician. There will need to be a financial adviser, an insurance specialist, an estate attorney, an asset protection attorney, as well as a CPA—all working in concert to develop and maintain a comprehensive plan.

Where does Dr. Smith find relevant financial information? Most major financial media outlets – whether websites, magazines, TV shows, book publishers or radio shows – offer advice that applies for the average person with a more typical income and net worth in order to appeal to the masses. The problem is that Dr. Smith has clearly separated herself from the masses, and the general information found in popular financial sources may not be enough to properly address all her financial concerns.

It is important that Dr. Smith finds the right financial specialists who can develop an appropriate finical plan for her and guide her through the process. The advisers will need to help her get comfortable with the reality that if she wants to safely reach her financial goals, while general advice may apply to some extent, she will need to embrace some specialized strategies that will separate her from the crowd. It may be a bit of a learning curve, but in the end, this is a good "problem" to have.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ian Maxwell is an independent fee-based fiduciary financial adviser and founder and CEO of Reviresco Wealth Advisory. He is passionate about improving quality of life for clients and developing innovative solutions that help people reconsider how to best achieve their financial goals. Maxwell is a graduate of Williams College, a former Officer in the USMC and holds his Series 6, Series 63, Series 65, and CA Life Insurance licenses.

Investment Advisory Services offered through Retirement Wealth Advisors, (RWA) a Registered Investment Advisor. Reviresco Wealth Advisory and RWA are not affiliated. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.