Does Your Financial Plan Fit on 1 Page? It Should. Here's How.

Software planning tools can be handy, but they can also be complex and end up steering you in the wrong direction. What may work better? A little face time with your planner, leading to a simple, easy-to-follow financial "map."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you found your financial plan has fallen short of providing you the clarity and confidence you were hoping for? If so, your feelings may be due in part to how your plan was built. Maybe the plan is too complex … or just too impersonal. There’s a solution for this, and it’s definitely not high-tech. It’s a good, old-fashioned conversation.

Many financial advisers use software tools to build their plans. The crux of a software-based financial plan is the information that has been input. Most financial planning programs typically offer a generous range for inflation, rate of return, mortality age, percentage of current income needed at retirement and the probability (%) of achieving your financial goals as some examples.

Once your financials are entered and these inputs are selected, the software generates a plethora of modules that can be included in your plan. You and your adviser will then typically meet and discuss your current situation in comparison to your ideal. As the client, you’re probably excited to see these projections — “Can I buy that dream house in five years?”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This is where the adviser-client conversation can become challenging. For example, if the plan “paints” an optimistic picture of your future, this could provide a false sense of security. If you request that your adviser lower the rate of return used, increase inflation and extend your mortality age by five years — wham — your plan now paints a totally different picture just by the click of a few buttons on a keyboard.

Sure, there will be those plans that still “paint” optimism even with very conservative inputs, but that’s not necessarily the norm.

A Nice, Long Talk Will Take You Far

As the co-founder of an advisory firm in Upstate New York, we feel planning is more art than science. We have found that intimate conversations centered around what is most important to clients about their money often yields invaluable answers that can serve as raw material for creating financial solutions for them.

Everyone has different plans or ideas for using their money. When you and your adviser are both clear as to yours, you can together begin building a “map” of sorts, which can provide clarity and direction for your financial life. Complexity isn’t a prerequisite for sound planning.

You can often share more about what you are trying to do or accomplish in 60 minutes of quality conversation with your adviser than through a 10-page data-intake form.

To this end, my business partner, Dennis Coughlin, and I have both have had experiences where our recommendations were vastly different for clients who had very similar personal and financial demographics. This happens as a result of knowing specifically what is trying to be accomplished.

2 Seemingly Similar Clients End Up with Very Different Plans

For example, I recently met with two couples who have very similar income levels and assets. They are also close in age. So the data entered into the typical software planning program would certainly look similar. The primary difference between them is something a software program would have a harder time picking up on: their lifestyle aspirations.

Couple No. 1 want to spend time with family, enjoy their home, travel twice per year and enjoy their community. Couple No. 2 want to spend eight months per year in Florida, gift annually to their kids and join the most expensive golf club in their hometown when home during the summer months.

As you may have guessed, Couple No. 1 can expect to retire earlier than Couple No. 2.

Anatomy of a Plan

So, while software has its place in financial planning, I prefer a more personal approach. After discussions with clients, my partner and I draw up a simplified financial planning map for them. It comes with plenty of room for notes, action items and tweaks over time. Here’s an example of what the basic framework of one client’s map might look like:

The map outlines some common areas we typically explore with clients. Depending on the scope of work, there might be five to 10 actionable items for each financial area. The lifestyle component is dynamic and typically includes many of the personal areas most important to each client (these often change from client to client).

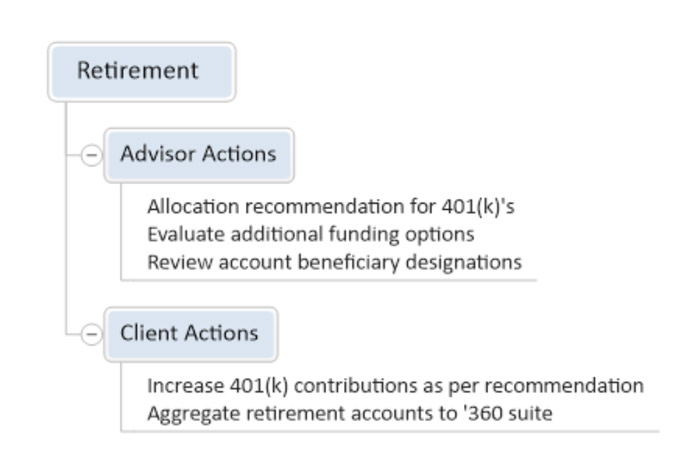

If I use the retirement branch of the map as an example, here is an abbreviated version of what it might look like:

As time passes, adjustments are made where necessary to assure the map continues to provide good coordinates as to their desired financial destination. The financial climate changes, their health can change, their intentions can change too. The map focuses on what we can control rather than what we cannot.

Take the Next Step

If you find yourself feeling confused and overwhelmed as to where your retirement plan is headed, have a sincere conversation with your adviser about those feelings. Ask him or her to provide you a helicopter view of all the moving parts of your plan. This may help you get a better sense of clarity while reducing financial stress.

We’re living in a world where information comes at us from various directions at warp speeds. The concept of less being more can be appealing … in many areas of life.

Branch address: 139 Genesee St., New Hartford, NY. Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Giambrone is a co-founder of CG Capital™, a boutique wealth management firm based in New Hartford, N.Y. He is a CERTIFIED FINANCIAL PLANNER™ and Accredited Investment Fiduciary® (AIF®). Chris has also earned a Certificate in Retirement Planning from the Wharton School of Finance at the University of Pennsylvania.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.