Managing Risk When Investing for Income

You might think bonds and real estate investments are always safer than stocks, but they come with their own set of risks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most people don't enjoy prolonging time spent in the car, so they search for shortcuts in an effort to arrive at their destination sooner. However, often those shortcuts can backfire—drivers can get lost, wait in traffic or run into a variety of other problems that make them wish they stuck with their original route.

This analogy relates to investors' search for income. In today's low interest rate environment, investors search far and wide for decent yields, trying to earn money faster and arrive at their financial goals sooner. However, investors should understand the risks associated with investing in bonds and high-yield investments.

Let's review some important considerations when deciding how bonds and high-yield investments fit into your overall investment strategy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Know What You Own

Investors should be properly rewarded through returns for the risks they assume. Skittish about stock market exposure but dissatisfied with investment-grade bond returns post-financial crisis, many investors have increasingly turned to high-yield bonds and real estate investment trusts (REITs). Investors rationalize that choice by falsely believing that while high-yield bonds and real estate are riskier than investment-grade corporate bonds and Treasuries, they are at least avoiding the higher risks associated with equities.

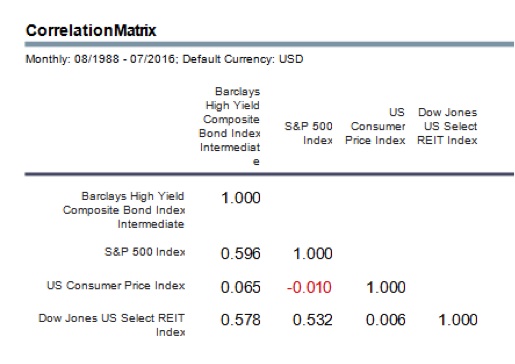

Unbeknownst to many people, high-yield bonds and REITs actually have volatility that mirrors that of the stock market at times. The movement of their prices in the same direction is called "correlation."

Re-visiting our driving theme, think of correlation like this: Imagine two delivery trucks traveling down the highway. If both trucks are moving in the same direction all of the time, their movements are 100% correlated. If the trucks are moving in the same direction only half of the time, their movements are 50% correlated.

High-yield bonds and REITS both have meaningful correlation with Standard & Poor's 500-stock index, as illustrated in the chart below. High-yield bond investment returns are correlated to S&P 500 returns about 60% of the time. REIT returns are correlated to the S&P 500 about 53% of the time. This means that high-yield bonds and REITs move up and down in tandem with the S&P 500 more than half of the time. That's no small amount of stock market risk for assets that historically return less than stocks on average.

Don't Overpay

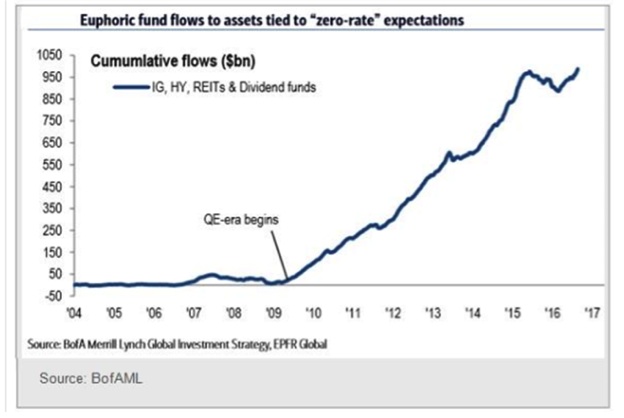

No one enjoys feeling like they overpaid for an asset. However, yield-focused investors are often overlooking high prices in their search for income. Since the financial crisis, cumulative flows to mutual funds invested in investment-grade bonds, high-yield bonds, REITs and dividend funds have soared, likely because investors have been assuming that low interest rates will continue. The chart below illustrates the amount of dollars these funds have attracted.

Don't forget that the prices of bonds and other investments that behave like bonds generally move in the opposite direction of interest rates. So when rates rise, as they have since this year's U.S. presidential election, yield-focused assets bought at record prices stand to see those prices drop in ways that may leave investors feeling burned.

Seek Real (After-Inflation) Returns

Yield-generating investments may fail to keep pace with inflation over time. Current levels of inflation remain low, about 2.20% as of October 2016, compared with historical inflation of about 3.71% from 1958 to October 2016, according to historical data from Dimensional Funds Advisors (DFA). However, if inflation begins to run higher than current interest rates, bond investors could be left in a lurch. Rising inflation and subsequent rising interest rates could produce negative real returns. This result is not unusual, as over thirty-year rolling periods, bonds of all stripes fail to keep pace with inflation about one-third of the time on average, according to DFA data. Keep inflation in mind and properly account for it so that your hard-earned returns do not become consumed.

No asset is risk-free. Every investment carries its own unique risks, and investors should account for those risks and manage them. Traveling too far down the road to avoid one risk (often stock market risk) can magnify other risks and mask where your actual risk exposure lies. Safe travels on the road to capturing real returns and achieving your financial goals!

A licensed attorney, Jared Snider serves as a senior wealth adviser at Exencial Wealth Advisors in Oklahoma City. He strives to help individuals and families attain their goals, manage risk and cultivate peace of mind.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jared Snider is a licensed attorney and serves as a senior wealth adviser at Exencial Wealth Advisors in Oklahoma City. He guides families, business owners and professionals in goal-based investing, planning and risk management. By creating solutions with clear action steps and follow-through, he strives to create peace of mind and confidence for his clients. Snider earned his Juris Doctor with highest honors from The University of Tulsa College of Law. Prior to joining Exencial, he practiced estate planning and real estate law. He is a member of Exencial's Investment Committee.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.