5 Ways to Slice the S&P 500

What started as a plain-vanilla fund concept now comes in many flavors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

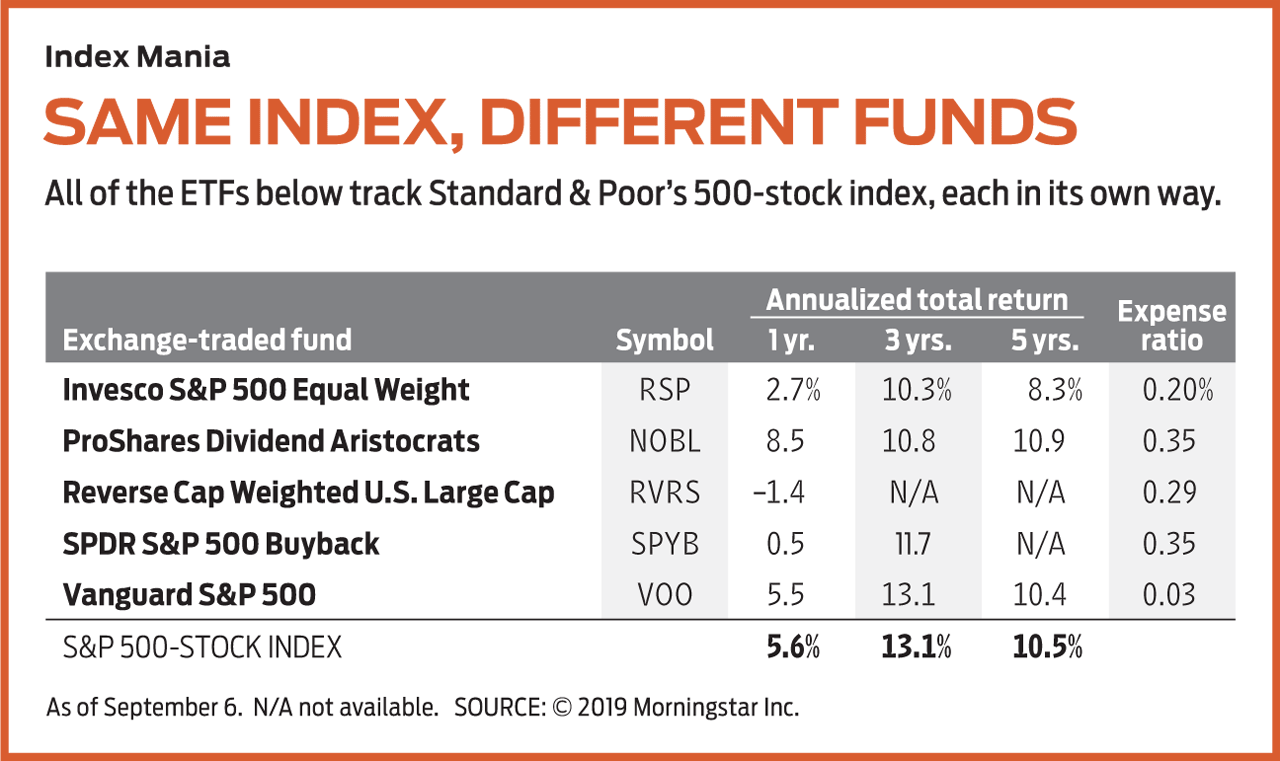

Not so long ago, S&P 500 index funds came in one flavor: They simply tracked Standard & Poor’s 500-stock index. Now, the fund industry offers almost as many types of S&P 500 index funds as Baskin Robbins does ice cream. You may be best off with the plain-vanilla version, but some other variations might be worth a taste test. Prices and returns are as of September 6.

Vanguard 500 Index (symbol VFIAX), the largest and oldest S&P 500 index fund, tracks the movement of the venerable stock index and weights each holding according to its market value, which is the number of shares outstanding multiplied by the share price. Using that methodology, the fund’s top holdings are Microsoft, Apple and Amazon.com. The 10 largest stocks in the fund account for 23% of the fund’s assets. The Vanguard fund simply weights its holdings the same way the index does. It follows the index’s returns closely, and for many people it’s a fine core holding. Exchange-traded-fund fans can consider the fund’s ETF clone (VOO, $274).

You can weight the S&P 500 index in different ways and get different returns as a result. Consider Invesco S&P 500 Equal Weight ETF (RSP, $108). As its name implies, this exchange-traded fund gives each stock in the index an equal weight, so that Nektar Therapeutics, with a market value of $3 billion, gets the same weight in the fund as $1.1 trillion Microsoft. The ETF is rebalanced every quarter.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What’s the advantage? Invesco S&P 500 Equal Weight ETF tends to beat the market-cap-weighted S&P 500 when small-company stocks are on a tear. In 2016, for example, the equal-weight ETF beat the S&P 500 by more than two percentage points. The past decade, however, has largely seen a large-company-stock rally, and the equal-weighted choice has lagged the S&P 500 by 0.16 percentage point annualized.

Investors who foresee a comeback for small- and mid-cap stocks can consider the Reverse Cap Weighted U.S. Large Cap ETF (RVRS, $16). The smallest stocks in the S&P 500 are the largest holdings in this fund, thereby turning the large-cap S&P 500 into a mid-cap index fund. The young fund, which has $9 million in assets, lagged the S&P 500 in 2018 and trails it so far this year. The fund has held up better against mid-cap yardsticks, losing 9.4% in 2018, compared with an 11.1% loss for the S&P MidCap 400, and essentially matching the mid-cap index’s return so far in 2019.

There are plenty of other ways to slice and dice the S&P 500. The ProShares Dividend Aristocrats ETF (NOBL, $71) uses only those S&P 500 companies that have raised their dividends every year for the past 25 years and weights each issue equally. The fund fares best in times when investors are worried about the stock market, because dividends can cushion downturns. The fund has lagged the S&P 500 by nearly two percentage points so far this year.

SPDR S&P 500 Buyback ETF (SPYB, $66) does for buybacks what the previous ETF does for dividends. It looks for companies that have actually reduced the number of shares available over the previous 12 months. All other things being equal, a lower number of shares should give a company’s stock a boost by dividing the corporate earnings pie among a smaller number of shares. The ETF has lagged the S&P 500 over the past year, but it has kept pace with an index tracking S&P 500 companies spending the most on buybacks in relation to their market value.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.