Investors Prospered by Staying the Course

The long bull market made it easier to avoid buying high and selling low.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

There may be no more common mantra in the investing world than “buy low, sell high.” But study after study shows that investors tend to do the opposite—piling into stocks when the market is up and selling when it plummets.

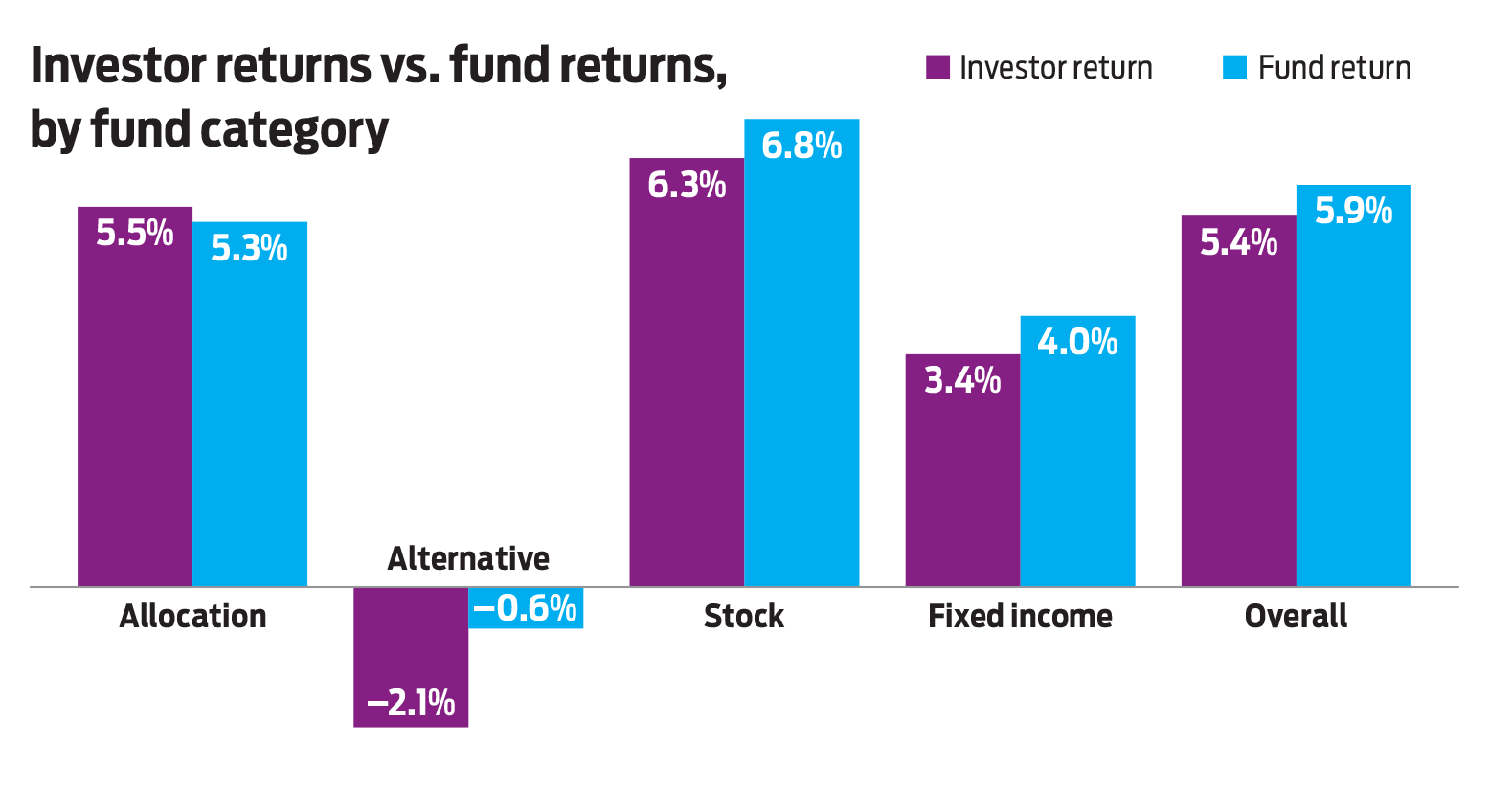

But a new report from investment research firm Morningstar indicates that investors may be improving. The study tracked average annualized returns for mutual funds and exchange-traded funds for 10-year periods that ended in 2014 through 2018. It then compared the results with “investor returns,” which take into account when investors put money in and pulled money out. U.S. investor returns trailed fund returns by an annualized 0.45 percentage point, on average—a marked improvement over the 0.57 percentage point gap the researchers found two years earlier.

Investors in “allocation” funds, which hold a mix of stocks and bonds, earned more than the funds themselves, indicating that the majority of investors put more money in the funds when prices were low than when prices were high. Target-date funds, which fall into this group, are likely the main reason for the category’s better performance. These funds, which invest in a mix of stocks and bonds that grows more conservative as investors near retirement, are predominantly held in workplace retirement plans, in which investors tend to hold for the long term and invest at regular intervals.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors showed the worst timing when they invested in alternative funds—investments designed to provide returns that aren’t correlated with stock or bond markets. Those funds didn’t benefit from a general upward trend, surrendering an average 0.61% annualized return over the 10-year rolling periods. But investors fared much worse, losing 2.05%.

Investors continue to pile into low-cost, passively managed funds, which should help them over the long term, says Sam Stovall, chief strategist at investment research firm CFRA. But the fact that investors saw worse results investing in volatile funds indicates that the shrinking “gap” could expand when markets overall get choppier. “There’s an old saying: Don’t confuse brains for a bull market,” Stovall says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.