Our Favorite Broker-Sold Funds

A dozen funds that would do any portfolio proud -- especially if you can get them without a sales fee.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twenty years ago, the distinction between load and no-load mutual funds was clear-cut. Do-it-yourselfers bought no-loads directly from the sponsors. Investors working with brokers, financial planners and even insurance agents invested in load funds, typically paying a front-end sales charge of 5% to 6% for stock funds and a little less for bond funds. Or they bought share classes with higher annual fees and stiff back-end sales charges.

In recent years, though, the distinction between load funds and no-load funds has blurred. Take the case of Thornburg Investment Management, which runs $48 billion of assets. Thornburg’s Leigh Moiola reports that 80% to 90% of the Santa Fe, N.M., firm’s funds are bought without a sales commission -- the inverse of the ratio 20 years ago.

Load funds without loads come in a variety of guises. They may be institutional-class shares, which investors typically buy through fee-based advisers. They could be Class A shares with their front-end loads waived. Or they could be Class R shares, which are used in 401(k) or similar retirement plans. “Load versus no-load is no longer correct terminology,” says Avi Nachmany, head of research at Strategic Insight. He estimates that the share of funds from traditional load families sold without sales fees today is 60% and rising. “Everyone is moving toward offering mutual funds through financial advisers,” Nachmany adds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

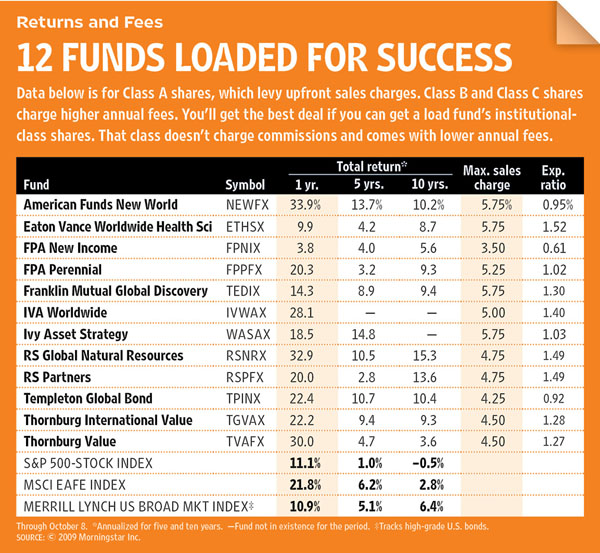

We don’t advise that you ever pay a front-end load or an ongoing sales charge (particularly for Class B fund shares). But we recognize that many outstanding load funds are now available without a fee through advisers, brokerage wrap accounts, 401(k)s and even 529 plans, so we decided to pick our dozen favorites. In compiling this list, we used the same strict criteria that we employ to compile the Kiplinger 25, the list of our favorite no-load funds. Among other considerations, we gave extra points to fund managers who are skilled risk managers and whose funds tend to hold up well in bear markets.

Domestic stock funds

Don’t let the name fool you. Thornburg Value (symbol TVAFX) isn't purely a bargain-hunting fund. Managers Connor Browne and Ed Maran divide their holdings into three buckets: basic value, consistent earners and “Remerging franchises,” companies with fast-growing products or services with strong competitive positions. This gives the fund, which invests mostly in large companies, a blend of growth and value attributes.

Basic value companies tend to be in industries, such as banking and oil, in which competition is fierce and firms don’t have much pricing flexibility. An example of such a holding is U.S. Bancorp, which remained profitable throughout one of the ugliest banking cycles in history.

Another holding, Gilead Sciences, the leader in HIV treatments, generates consistent (and rapid) earnings growth. Stocks such as this tend to hold up well in bear markets (see Stocks That Grow in Any Climate). Emerging franchises can be small or they can be large -- such as Apple, which Browne says has the potential to dominate the fast-growing smart-phone business.

The six managers at RS Partners (RSPFX), a small-company fund, think very much like private-equity investors when they spend hundreds of hours breaking down a business and analyzing each of its parts. Co-manager Joe Wolf says deep knowledge of a business is one of the best tools to mitigate risk. So he and his colleagues will buy a stock when they are satisfied that it has $3 to $5 per share of upside potential for each dollar of downside risk.

The RS team searches for businesses showing improved returns on invested capital. “When you purchase structurally improving businesses, time is your friend,” Wolf says. Holdings include NBTY -- owner of Nature’s Bounty, the leading vitamin wholesaler -- and ACI Worldwide, the dominant processor of debit-card transactions.

Eric Ende, of FPA Perennial (FPPFX), makes stock picking sound easy. You identify superior businesses that will increase their intrinsic value every year, buy them at a discount and hold on.

For Ende and co-manager Steven Geist, a superior business has a sturdy balance sheet, achieves a high return on capital and has abundant opportunities to reinvest in the business. And most important, the businesses are shielded by high barriers to entry, which means that returns will not be eroded by competitors.

Perennial, which focuses on small and midsize companies, has found several of these businesses in health-care niches. VCA Antech is a consolidator in the highly fragmented veterinary-hospital industry, and Charles River Laboratories dominates the market for providing laboratory rodents for pharmaceutical research.

Overseas stock funds

Thornburg International Value (TGVAX) is a close cousin of Thornburg Value. The managers (Bill Fries, Wendy Trevisani and Lei Wang) divide stocks into the same three buckets of basic value, consistent earners and emerging franchises.

During gloomy 2008, Trevisani notes, the fund had half of its assets in consistent growers. Such steady Eddies as Teva Pharmaceutical Industries, the Israel-based generic-drug giant, provided some ballast. This year, emerging-growth companies such as Baidu, a Chinese Internet play, are boosting performance.

In addition to holding 18% of its assets in emerging-markets stocks, International Value recently owned several European companies largely for their exposure to fast-growing developing countries. Trevisani says Louis Vuitton, the French luxury-fashion king, is selling more and more products in China, and Standard Chartered, a bank based in the U.K., generates 90% of its profits from emerging markets.

Over the long run, emerging markets deliver handsome returns. The problem is the rocky ride: Emerging-markets stocks tend to be nearly twice as volatile as U.S. stocks. American Funds New World (NEWFX) was designed to tamp down that risk. Along with developing-markets stocks, such as China Mobile, this fund invests in emerging-markets bonds (typically 10% of the portfolio). It also holds stocks of multinational corporations (currently one-fourth of assets), including Avon Products and Switzerland-based Nestle, that derive substantial revenues from emerging nations. As a result, investors enjoy most of the gains from emerging markets with about one-third less volatility than the typical emerging-markets stock fund.

Go-anywhere funds

As soon as you look at Ivy Asset Strategy’s record -- a 15% annualized return over the past five years -- you know that this is an unconventional fund. Co-managers Mike Avery and Ryan Caldwell begin their investing process by establishing a worldview and then investing with great freedom in stocks, bonds and precious metals.

After 9/11, Avery shifted Ivy’s focus from domestic to international, and he hasn’t looked back. The fund (WASAX) focuses on companies that benefit from rising prosperity and a burgeoning middle class in developing countries. When Ivy does hold U.S. stocks, such as Monsanto, it does so more for their emerging-markets exposure than for their U.S. operations.

Global stock funds are a dime a dozen, but Franklin Mutual Global Discovery (TEDIX) is a fund with a difference. Like all of the Mutual Series funds, which are owned by the Franklin Templeton family, Discovery buys only if its managers can get a security at a steep discount to their estimation of its true worth. “We’re risk-averse people. We hate losing money for our shareholders,” says Charles Lahr, who co-manages the fund with Anne Gudefin.

Sometimes Discovery takes preservation of capital to an extreme. Early this year, the fund held an extraordinary 60% of its assets in cash. That's now down to one-third of assets. But Discovery still has a relatively low weighting in U.S. stocks, which Lahr says he finds 25% to 30% more expensive than European shares. In Europe, Discovery has a healthy appetite for food and beverage stocks, such as Nestle and France’s Pernod Ricard.

You may think we’re going out on a limb to recommend IVA Worldwide (IVWAX), which is barely more than a year old and a member of a brand-new fund family. We’re not. Worldwide is managed by two Frenchmen, Charles de Vaulx and Chuck de Lardemelle, who were both trained at the feet of a master: Jean-Marie Eveillard, a fund-industry legend who compiled an astonishing record over 30 years at First Eagle Global before retiring last year.

De Vaulx, who managed or co-managed several First Eagle funds for seven years before decamping in 2007, absorbed value-investing lessons from Eveillard. His mentor, he says, “had no speculative juices flowing in his blood, no greed as an investor, but did have the intellectual fortitude to go against the crowd.”

Two keys to the approach, says de Vaulx, are to be as resilient as possible in down markets and to be eclectic enough to scour the world for opportunities in any asset class and location. Currently, Worldwide has 6% of its assets in gold bullion, 23% in high-yield bonds and 40% in stocks, most of them in Europe and Japan.

Single-industry funds

Who says that sector funds are inherently volatile and streaky? Eaton Vance Worldwide Health Sciences (ETHSX), piloted by the redoubtable Sam Isaly since August 1989, has exhibited less volatility than Standard & Poor’s 500-stock index. Performance? During Isaly’s first 20 years, this fund returned an annualized 14%, an average of six percentage points better than the S&P 500.

Isaly runs a fairly concentrated fund that holds 35 to 40 stocks. To reduce risk, he spreads his investments around the world and tends to take larger positions in big, steady growers, such as Johnson & Johnson. He takes smaller positions in high-growth, high-risk minnows, such as Allos Therapeutics, which in September won regulatory approval for a new lymphoma drug.

RS Global Natural Resources (RSNRX) is run along the same principles as RS Partners, with one important exception. In commodities, producers can’t set prices. So the managers (Andy Pilara, MacKenzie Davis and Ken Settles) look for companies with “advantaged assets,” by which they mean low-cost projects in commodities that are marked by a wide gap between low- and high-cost ventures.

This requires analyzing businesses project by project, which may call for climbing into the potash mines of Saskatchewan or descending into Australian coal mines. If companies get the projects right, says Davis, they can create value even when commodity prices are low and can generate handsome returns across market cycles.

Bond funds

We don’t intend to jinx Michael Hasenstab, but it’s hard to find fault with his stewardship of Templeton Global Bond (TPINX). Since Hasenstab assumed the reins in early 2001, the fund has ranked in the top half of the global-bond category each year (including so far in 2009). Over that period, Templeton has outpaced its peers by an average of five percentage points a year.

The fund’s name is a bit of a misnomer because such a high proportion of its returns (40% to 50% recently) have come from currency investing. In determining his strategy, Hasenstab, who holds a doctorate in economics and is aided by a team of 40 Templeton professionals around the globe, juggles three variables -- the financial health of nations, interest rates and currency trends -- with aplomb.

For example, in Europe he’s invested in the currencies and bonds of both Sweden and Poland, while in euroland he holds bonds but has made a large bet against the currency by selling the euro short. In fact, Hasenstab is bearish on all three major international currencies -- the dollar, euro and yen. He likes Asian currencies apart from the yen, however. So he holds bonds denominated in the local currencies of South Korea and Indonesia, and he’s taken long positions in the currencies of China and India (both countries offer foreigners limited access to bonds).

Value-investing principles, such as preserving capital and buying securities with a margin of safety, are embedded in the DNA of FPA New Income (FPINX) and other FPA funds run by Bob Rodriguez (see Racing Toward Disaster). FPA pretty much focuses on absolute returnQreturn of capital first, and only then on return on capital.

FPA New income, which Rodriguez co-manages with Tom Atteberry, takes these principles to an extreme. Since Rodriguez started running the fund in 1984, New Income has produced positive returns for 26 consecutive years. Atteberry, who came on board five years ago, will run the fund on his own when Rodriguez begins a yearlong sabbatical in January.

Because Rodriguez and Atteberry are scared of their own shadows when it comes to investing, it’s no surprise that they fret about the U.S. economy. They have positioned New Income extremely conservatively, with its effective duration (a measure of interest-rate sensitivity) a mere 1.1 years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Andrew Tanzer is an editorial consultant and investment writer. After working as a journalist for 25 years at magazines that included Forbes and Kiplinger’s Personal Finance, he served as a senior research analyst and investment writer at a leading New York-based financial advisor. Andrew currently writes for several large hedge and mutual funds, private wealth advisors, and a major bank. He earned a BA in East Asian Studies from Wesleyan University, an MS in Journalism from the Columbia Graduate School of Journalism, and holds both CFA and CFP® designations.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.