Why Investments Outperform Investors

Those in the market don't want to see their decisions as market timing. But too often they are.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I would like to think of myself as a boating enthusiast. Yet, if it were a crime to be a "boating enthusiast," the evidence to convict me would be weak and circumstantial at best. Boating enthusiasts are out on their vessels regularly. I, on the other hand, find reasons (read: excuses) to not go out on a particular day. For example, it may be too windy or not windy enough. Or it might rain. Yet, the reality is that most days would be just fine and present a wonderful opportunity to be on the water—and I'd wish I'd have gone out.

So what does this have to do with investing? Some investors find themselves in a similar pattern of behavior when it comes to making investment decisions. The conditions are seldom, if ever, perfect for investing. The stock markets are overvalued, the trend for the stock markets has been negative or too positive, interest rates are too high or too low, the Fed is tightening or is too loose: These are just some of the hurdles that people put in the way of making decisions to invest.

But wait a minute! Isn't not choosing to invest really an investment decision? In reality, it is. The funds are always somewhere, whether in cash, money market accounts or other investments. While an investor may protest and say their non-decision is only to protect capital, the reality is that the facts simply don't support that view.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

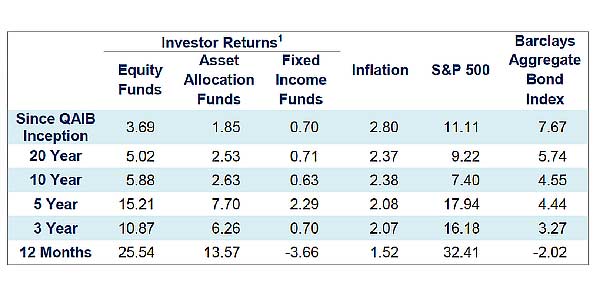

Dalbar, a leading research firm in financial services, has conducted an extensive study for the last 20 years, examining the impact of investor decisions on their results. In the table below, note the large discrepancy between investor results and investment results. The message is: Investments perform better than investors. Yes, investments perform better than investors! Why? When people only invest when they feel good about current market conditions, they endure a large negative impact on their results.

The evidence against market timing as a successful strategy is overwhelming. Investors often don't look at their decisions as market timing, but too often they are. Too often they become mono-focused on the stock market as if it were the only investment choice available when in fact contemporary portfolio design will incorporate in a portfolio several non-market selections that exhibit low to negative correlation with the market. Adding non-traditional investments, such as managed futures, absolute return strategies, etc., to reduce volatility and deliver reasonable returns helps your portfolio meet your goals and dreams.

In my professional tenure, I have had the opportunity to work with many clients and have seen the impact their financial decisions have had on meeting and achieving their needs, goals and dreams. Those who thought of their investment decisions through a matrix of risk and reward over the long term and acted on those decisions through a well thought out, intelligently diversified portfolio were able to get where they were headed with a high probability of success. Those who became frozen in place, also with a high probability, ended up disappointed and frustrated by not being able to meet the goals and dreams they envisioned.

Getting back to my boating analogy, I'm sure it occurred to many of you that there are times when weather conditions are so severe that taking the boat out would be silly. I agree! Yet, most of the time, when the potential for less-than-favorable conditions exists, it doesn't come to fruition. Even if it does, with the proper plan and equipment, the true boating enthusiast has nothing to fear.

When it comes to investing, market storms come and go, but with a well-designed strategy—using a broad base of asset classes and accounting for many likely yet unpredictable scenarios—you can weather them quite well.

Bob Klosterman, CFP, is the Chief Executive Officer and Chief Investment Officer of White Oaks Investment Management, Inc., and author of the book, The Four Horsemen of the Investor’s Apocalypse.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Robert Klosterman, CFP® is the CEO and Chief Investment Officer of White Oaks Investment Management, Inc., a fee-only investment management and wealth advisory firm. Bob is the author of the book, "The Four Horsemen of the Investor's Apocalypse. White Oaks has been recognized by CNBC.com as one of the "Top 100 Fee-Only Wealth Management firms in the country.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.