A Better Way to Tell a Correction from a Bear Market?

You could go by the usual definition, but dive a little deeper into the market and you might get a better indication of what's going on before making any stock moves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The standard definition of a correction is a 10% market decline, while a bear market is a 20% decline. These are simple definitions … I take a different view.

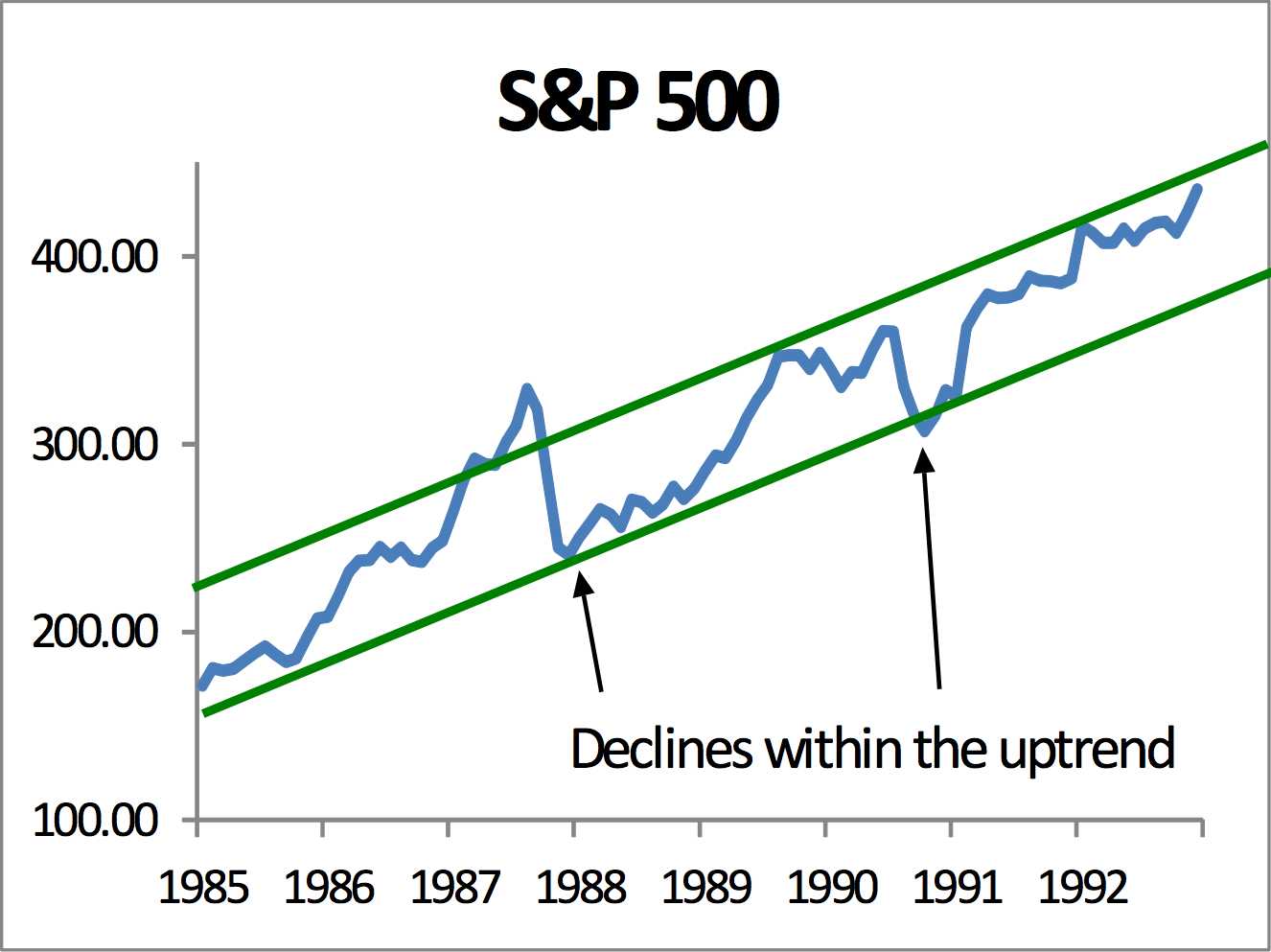

At Cornerstone, we view a correction as a significant decline within an up trend. The key here is that the up trend continues after the correction is over. Two examples are the crash in 1987 and the correction of 1990. In both cases, the market fell 20% or more, yet they recovered quickly and the up trend continued.

As you can see in the chart below, the up trend (green lines) continued upward, but the market, (blue line) vacillated between the two green up trend lines. Since the declines did not reverse the trend, they were only corrections, however, since they were declines of over 20%, by the standard definition, they were called bear markets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why is that significant? Buying the dip has been a successful strategy for investors over the past nine years. Corrections can be a buying opportunity, since the market is still in an up trend. Current positions do not need to be sold, again since the market is still in an up trend.

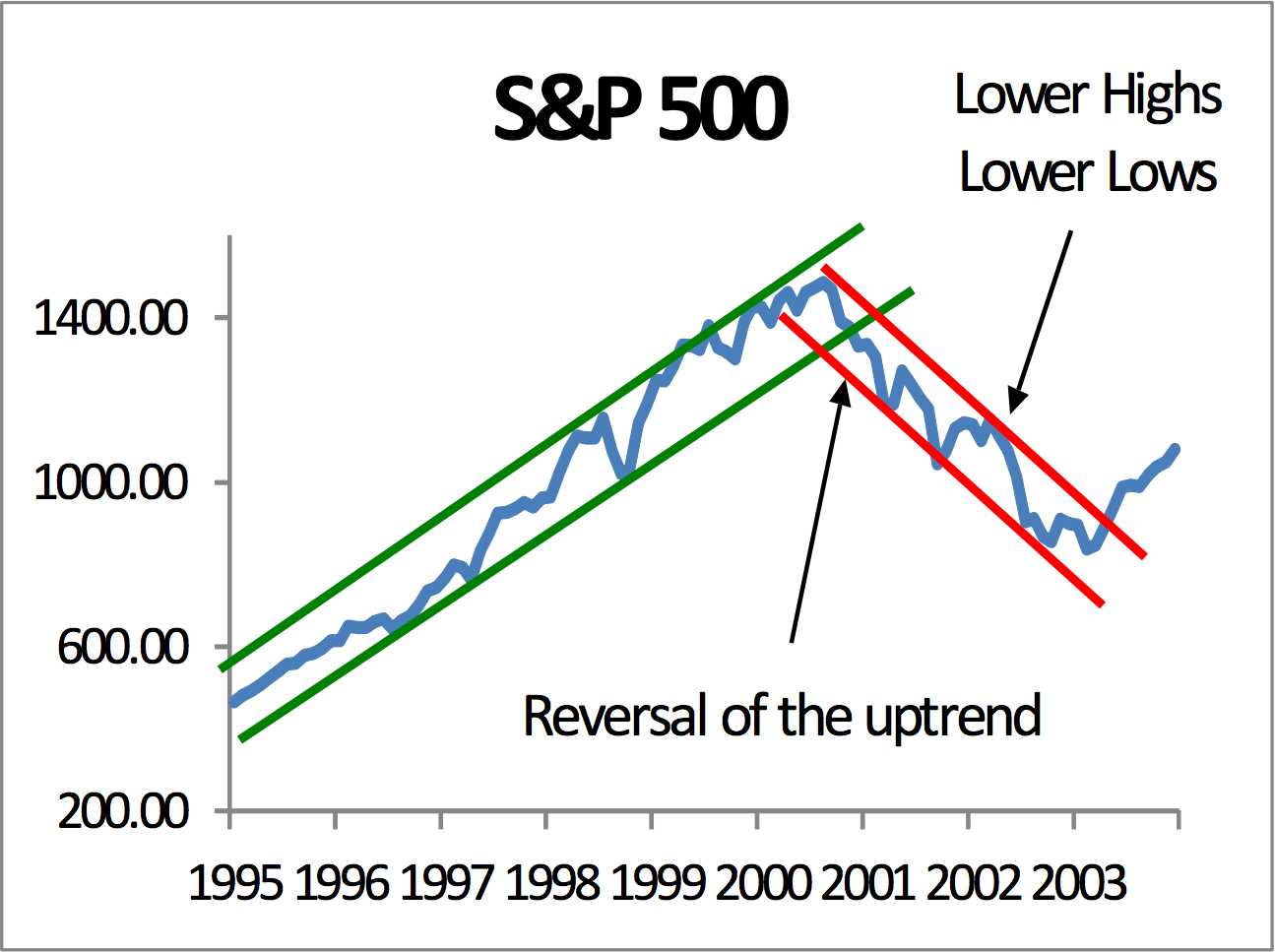

At Cornerstone, we define a bear market as the reversal of an up trend. This can be seen in 2000 and 2007. A reversal of an up trend is usually characterized by a chart with lower lows and lower highs. Since the lows keep going lower, the chart reverses trend, and an up trend starts to head down (red lines).

For investors, what that means is with a bear market, rallies are to be sold, and dips are not bought. As you can see from the chart, buying the dips only leads to lower lows. Selling rallies is the wise move in a bear market.

Once a chart breaks above the down trend and the lows start getting higher and the highs start getting higher, the bear market is over and the market has reversed into a bull market.

Why do markets peak, and how far can a bear market go? Overvaluation makes markets fragile. So the more overvalued, the more vulnerable it is to a correction or a bear market. Historically, bear markets (as defined by Cornerstone) did not bottom until valuations were extremely low. The price-to-earnings ratio of the market has hit single digits in the past at bear market bottoms. Today’s Shiller P/E is over 30.

How can you tell if a correction is on its way to becoming a bear market? You don’t know until the chart tells you. If after a decline, the market fails to return to its up trend, that is a sign that a bear market has begun.

Where are we today? As you can see in the chart below, the market has not made lower lows, which means the first step in a bear market hasn’t happened yet. So, for now, the market is in a correction.

The green lines indicate the long-term up trend. The thin orange line indicates what some call the “Trump rally.” This refers to the market’s rise since President Trump was elected. On the Dow Jones, this Trump rally trend could be broken, and the market could drop a bit further, but it still has a ways to go before it even falls to the level of the top green line that marks the upper limits of the up trend. As long as it holds that trend line, and follows it up, the market would not have fallen into a bear.

The S&P chart above is a little different. The upper end of the up trend channel and the Trump rally are hitting the same spot right now. So a failure of one means the failure of the other. As you can see by the chart, the S&P is currently slightly below each trend line.

Does this mean it’s the start of a bear market? Not yet. The first indicator would be if the low fell below the previous low from the 1st quarter of 2018. And then the subsequent rally would have to fail to make new highs, at least above the upper trendline. Then time will tell.

Watching if the lows go lower and the highs go lower are good signs the market is rolling into a bear. And especially if the market drops below the lower green up trend line.

In the meantime, it’s only a correction within an up trend, and should be treated as such, by holding onto quality investments and adding investments that have become oversold. Will it turn into a bear market? Only time will tell, so we are watching things closely and have strategies — such as selling into rallies, reducing equity exposure, and raising cash among others — for various outcomes.

Third-party posts do not reflect the views of Cantella & Co Inc. or Cornerstone Investment Services, LLC. Any links to third-party sites are believed to be reliable but have not been independently reviewed by Cantella & Co. Inc. or Cornerstone Investment Services, LLC. Securities offered through Cantella & Co., Inc., Member FINRA/SIPC. Advisory Services offered through Cornerstone Investment Services, LLC's RIA.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.