The High Cost of Emotion in Personal Finance

Our rational side knows market timing is a fool’s game. Yet, short-term trends sometimes drive our decisions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Humans are hard-wired in ways that helped our ancestors survive over thousands of years. Investing in markets is a recent concept – the New York Stock Exchange (NYSE) was founded in 1817. Unfortunately, the cognitive processes that aided our ancestors may undermine our success in modern markets. Behavioral finance is an emerging field that examines how people use the tools of finance, rather than studying the tools themselves.

One common behavioral mistake is known as “myopic loss aversion.” Behavioralists have estimated that people hate losses roughly two-and-a-half times as much as they like gains. We exert more effort to avoid losses than to achieve gain. Suppose an investor’s portfolio rose 40% and then dropped 20%. He/she would feel the loss about 2.5 times as much as the gain. The drop causes heightened loss aversion, potentially leading the investor to panic and act against what he/she knows is rational.

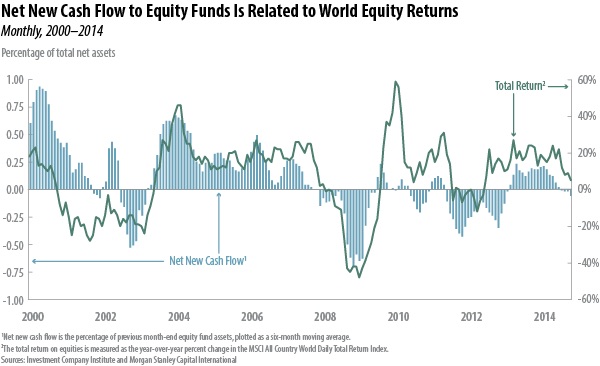

Researchers measured the cost of this approach by comparing the performance of return chasing with a buy-and-hold strategy. The research reveals return chasing leaves nearly 2% on the table annually. Rather than earning 10% annually over the long term, those impaired by the recency bias took a 20% haircut and ended up with 8% annualized returns.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Understanding the lessons of behavioral finance can greatly increase your odds of achieving financial freedom. Realizing that these tendencies exist is the first step in making better decisions. Remember, we hate losses roughly two-and-a-half times as much as we like gains. Fight the urge to panic over investment losses, and realize our tendency to overreact to recent history. Working with a financial adviser can help you stay on track. It’s easy to get emotional when managing your own money. An objective partner can help you overcome harmful behavior biases and remain focused on long-term goals.

Sources: Bloomberg, CFA Institute, Wall Street Journal, About Archeology, Federal Reserve Bank of St. Louis, Investment Company Institute, Morgan Stanley International

David has served as CEO of Mercer Advisors since 2008. He is responsible for the firm’s strategic vision, business plan execution, and organizational structure.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.