163 Large-Cap Stocks Still Are 50%+ Off Their Highs

The 50% Club is littered with many battered companies ... a few of which may be worth buying

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

People are fond of quoting Berkshire Hathaway (BRK.B) CEO Warren Buffett, and rightly so: He’s one of the world’s most successful investors. A favorite Buffett quote, from the 1988 Berkshire shareholder’s letter, is “Our favorite holding period is forever.”

Many people have used this quote to support a long-term buy-and-hold strategy, but, like many of Buffett’s observations, it’s much more nuanced than that – as it should be. A look at the stocks in the Russell 1000 Index, which measures large-company stock performance, shows that some stocks really shouldn’t be held forever.

Of those 1,000 stocks, 163 remain 50% or more below their all-time highs. The Russell 1000 has fallen 5.93% since its Sept. 20 all-time high, according to Morningstar.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

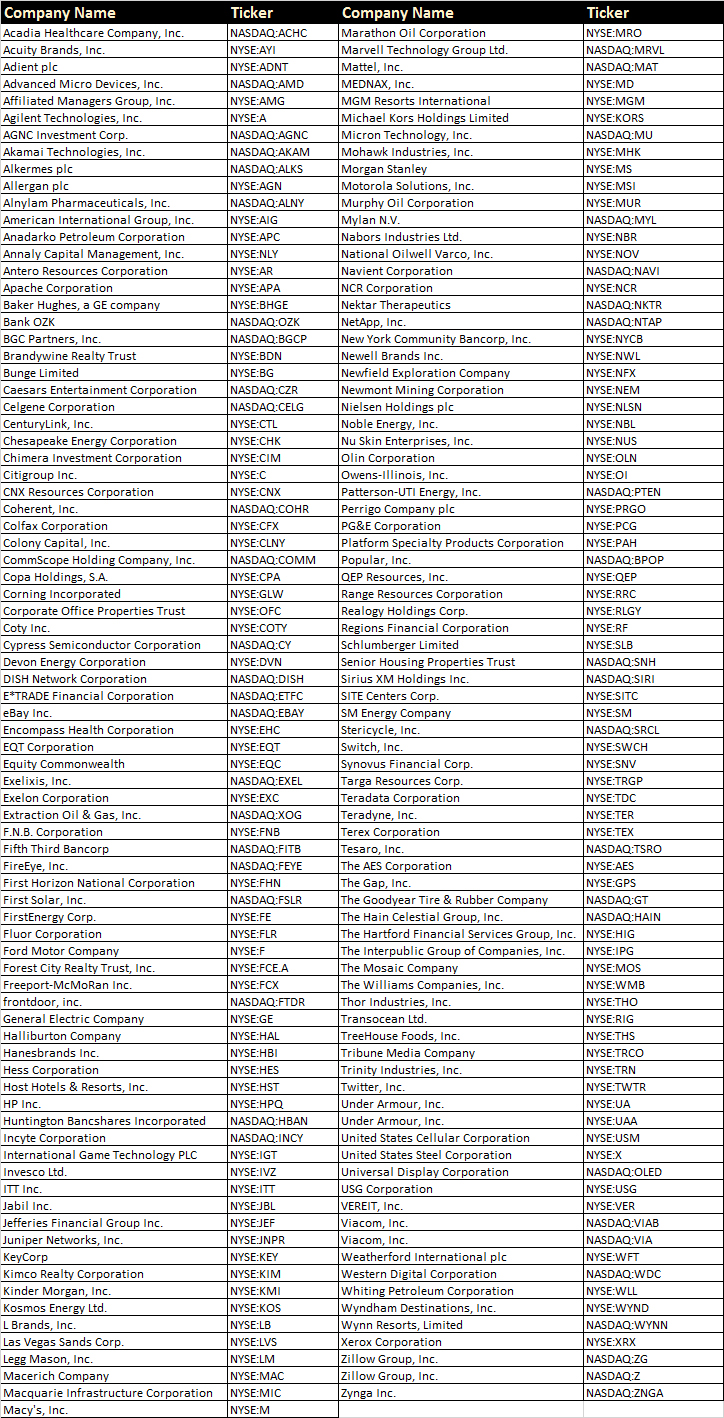

The 50% Club

This group of beaten-up stocks includes some well-known members.

Citigroup (C), for example, is worth just 10.9% of its all-time high, set in August 2000. Morgan Stanley (MS), hit an all-time high of $110 in September 2000. It closed Friday at $44.13. And snakebit General Electric (GE), whose high-water mark was $60.50 in August 2000, traded hands at $8.02 on Friday. (This data, from S&P Global Market Intelligence, is adjusted for stock splits).

If you were unfortunate enough to buy any of these 163 stocks at their all-time highs, you’re more likely to get a pot of gold from the wee leprechauns in your back yard than to break even. A 50% decline requires a 100% gain to recoup your loss. And while dividends can ease the pain of losses, it can take a long time for dividends to get you back to even. Morgan Stanley, for example, is down 35.2% from its all-time high if you include reinvested dividends; General Electric is down 76.01%, according to Morningstar.

Many of the stocks in the 50% club are highly cyclical. For example, chip-maker Micron (MU), oil exploration company Apache (APA) and precious metals miner Newmont Mining (NEM) are good stocks to leave while laughing. While they have regular times in the sun, their big downturns often overwhelm their big gains.

Similarly, many of the bank stocks on the list were casualties of the most recent financial crisis. Banks suffer disproportionately in financial downturns, because banks are often at the heart of most financial downturns. It shouldn’t be surprising to see that KeyCorp (KEY) and Huntington Bancshares (HBAN) are among those that remain 50% or more below their all-time highs. Mutual fund companies Invesco (IVZ) and Legg Mason (LM) also are on that list.

So what did Buffett mean when he said, “Our favorite holding period is forever?” When you think about it, the statement alone doesn’t say much: Most people would like to have a stock that does well forever. What’s more, the Buffett quote is really half a quote. Here it is in its entirety (emphasis mine):

“In 1988 we made major purchases of Federal Home Loan Mortgage Pfd. (“Freddie Mac”) and Coca Cola. We expect to hold these securities for a long time. In fact, when we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint. Peter Lynch aptly likens such behavior to cutting the flowers and watering the weeds. Our holdings of Freddie Mac are the maximum allowed by law, and are extensively described by Charlie in his letter.”

Overlooking the first clause of the sentence – “In fact, when we own portions of outstanding businesses with outstanding managements” – is overlooking an awful lot. Buffett is not saying that all stocks should be held forever: Just the ones with outstanding businesses and managements. Does he sell companies that disappoint? Absolutely. It should be noted that Freddie Mac is no longer one of Berkshire’s holdings, while Coca-Cola (KO) is.

Currently, Standard & Poor’s ranks 10 of the stocks now selling at 50% below their all-time highs as a strong buy:

- Celgene (CELG)

- Exelon (EXC)

- First Horizon National (FHN)

- FirstEnergy (FE)

- FreeportMcMoRan (FCX)

- Marathon Oil (MRO)

- Morgan Stanley

- Mosaic (MOS)

- Olin Corp (OLN)

- United States Steel (X)

If you’re looking for flowers to water, these might be worth a look. The full list of 50% Club stocks is below:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.