Run, Don’t Walk, From Leveraged ETFs

Leveraged ETFs may make exciting moves, but these trading instruments are perilous for most portfolios.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The competition for investor dollars is fierce, and Wall Street is rife with financial geniuses figuring out new products designed to profit from even the most esoteric of trends. Some of them are good. Others could eat you alive.

One truly great idea was the exchange-traded fund (ETF), which allows investors to own a piece of an entire sector of the market, such as banking, the latest hot trend or even the entire market, with one instrument that trades just like a common stock.

Unfortunately, they just cannot leave well enough alone. They have to supercharge it with leverage, which seems to be a way for individual investors to profit with the professionals.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But just because one of their newfangled trading products is exciting does not mean it is right for most investors. Indeed, investors often fail to understand that leveraged ETFs cut both ways. Leverage can rev up your profit potential, but at the same time increase your risk of incurring losses.

Again, that is not necessarily bad. Investors already choose their risk/reward preferences in the types of stocks they buy now. There is a difference between the stock of a staid food company, which makes steady but small profits year after year, and a Silicon Valley company that is working on self-driving cars, cloud computing and blockchain technology. The latter has much higher risk but promises the possibility of a huge reward.

However, leveraged ETFs make big promises they cannot keep simply because of the way they are designed.

Through some financial engineering not relevant here, leveraged ETFs deliver a multiple of the underlying index’s or basket’s returns each day. For example, the ProShares Ultra S&P500 (SSO) “seeks daily investment results, before fees and expenses, which correspond to twice the daily performance of the Standard & Poor’s 500 Index.”

In other words, if the S&P 500 moves higher by 0.50% one day, the Ultra ETF moves higher by 1.00%.

So far, not so bad. If the investor believes that the stock market is going to keep going up then this could be a good vehicle to own. Of course, any day that the market goes down, the Ultra ETF will go down by twice the percentage. That’s the tradeoff for the higher profit potential.

But here is the problem, and it is a big one.

Here Comes the Math

The value of a leveraged ETF is recalculated every day. Let’s say a regular, non-leveraged ETF currently trades at $50.00 per share and a two-times (or 2x) leveraged ETF, based on the same underlying basket, coincidently also trades at $50.00 per share. The next day, the regular ETF falls by one point to $49.00 per share. That’s a 2% loss.

The 2x leveraged ETF falls by 4% to a price of $48.00 per share. No surprise here.

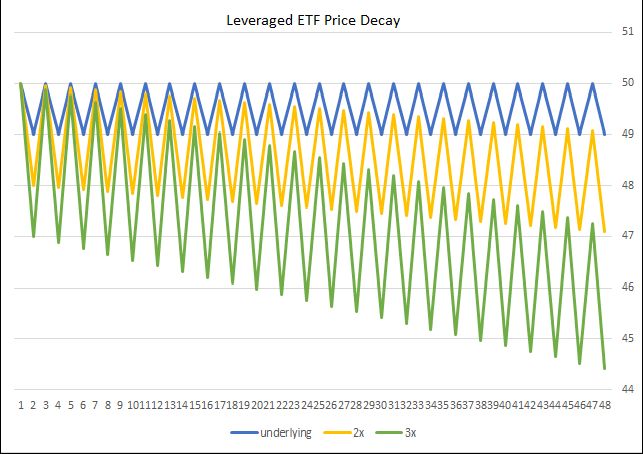

On the second day, the regular ETF rallies back one point to $50.00. Does the 2x leveraged ETF rally back two points? No, it does not. The math says that the regular ETF gained 2.04%. Therefore, the 2x ETF gained 4.08%. Again, that looks good until you realize that a 4.08% gain on an ETF trading at $48.00 results in a price of $49.96. It does not rally back to $50.00, as the regular ETF did.

Why? Because what matters are percentages, not points. To recoup a loss in the stock market, the percentage required to gain is higher than the original percentage lost.

Here is the simplest example. If the S&P 500 loses 50% in a bear market, it must double to get back to breakeven. That is a needed gain of 100%. If it only gains back 50% – the same percentage it lost – it still will be in bear-market territory.

Over time, even if the underlying fund stays in a flat trading range, leveraged ETFs can lose money. That is why they are only for short-term strategies for traders.

The chart below shows idealized paths for a regular ETF, a 2x ETF and a 3x ETF when the underlying simply moves down by one point and then up by one point day after day.

And the same is true for inverse leveraged ETFs, which are designed to move two or three times the daily change in the underlying but in the opposite direction.

Making them even less attractive, the higher the volatility of the underlying market, the worse the capital decay becomes.

To be sure, if you pick a leveraged ETF and the underlying market moves strongly in the direction you wanted then you can indeed make a beefy profit. But even in this scenario, high volatility can still be a huge drag on profitability.

The No-Risk Profit?

There is no such thing as a no-risk profit, but given the natural value decay of leveraged ETFs, selling them short is a good plan, right? If it were that easy, of course, Wall Street would have already figured that out; sell both the leveraged long and inverse versions of an ETF, kick back and watch the profits roll in. That’s the dream anyway and it works sometimes.

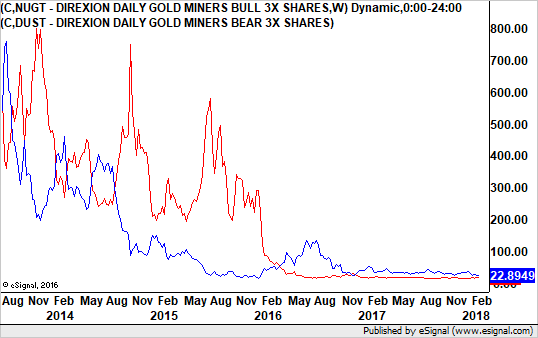

A chart of the Direxion Daily Gold Miners Bull 3x Shares ETF (NUGT) and the Direxion Daily Gold Miners Bear 3x ETF (DUST) shows that both ETFs lost plenty of their value over time.

Gold mining stocks saw many short-term up and down cycles over the past few years. Both ETFs lost money.

Now let’s look at an underlying market that was in full rally mode with low volatility. It is no surprise that the Proshares Ultrashort S&P 500 ETF (SDS), a 2x leveraged inverse ETF, plunged in 2017, losing 32.08% of its value. However, the SSO gained 43.72%, which was better than twice the performance of the S&P 500 and its 19.42% gain.

Had you been short each S&P 500 leveraged ETF, you would have gained only 11.68% before commissions. And that does not take into account margin fees and possibly even margin calls.

Before calling your broker to capture what appears to be a risk-free, albeit a relatively modest gain, consider that the 2017 stock market was extraordinarily good to investors, and extraordinarily calm. It was an exception, not the norm.

In most markets, over time, they will decay in value. So even if you feel you missed out on the great rally of 2017, or if you think a bear market is imminent, leveraged ETFs are very likely to burn a hole in your portfolio.

They can be appropriate for experienced traders who already understand the power of leverage and the time-decay factors involved. If you time them right, a quick trade can be lucrative. But most of us should leave them alone. They are not worth the risk.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.