Do You Own ETFs? Heed the GICS Shakeup

Coming changes to how stocks are classified by industry and sector could have repercussions for investors in many exchange-traded funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you invest in exchange-traded funds, you’ll want to take a close look at the stocks and other securities held by your ETFs as 2018 progresses.

Two of the most prominent providers of indexes that determine what ETFs own are shaking up how they classify many popular stocks, including Facebook (FB) and Alphabet (GOOGL). Since the vast majority of ETFs are passively managed, the underlying index dictates what ETF managers buy and sell.

ETF investors received a heads-up that changes were coming, but the potential significance of the changes is becoming more apparent. Index providers S&P Dow Jones Indices and MSCI announced in November that they were looking to make changes to the structure of what’s called the Global Industry Classification Standard (GICS), which determines how stocks are sorted into sectors, industries and even sub-industries. The changes are slated to take effect at the end of September. On Thursday, S&P Dow Jones Indices and MSCI revealed the identities of 200 stocks (PDF) that would be affected by the changes.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

ETF investors would be wise to pay attention.

The most significant GICS overhaul is coming to the telecom sector. The previously named Telecommunication Services Sector that was mostly known for the likes of AT&T (T) and Verizon (VZ) will now be broadened and renamed Communication Services. The new Communication Services sector will include telecoms, but also draw new companies out of three other buckets:

- Media Industry: Includes companies such as Comcast (CMCSA), which provides cable and Internet service, operates broadcast and cable channels, and includes the film production studio Universal Pictures, among other business arms.

- Internet & Direct Marketing Retail Sub-Industry: Includes companies such as TripAdvisor (TRIP), which provides travel reviews and booking services.

- Information Technology Sector: Includes companies such as Facebook, the ubiquitous social media site that connects people from around the world.

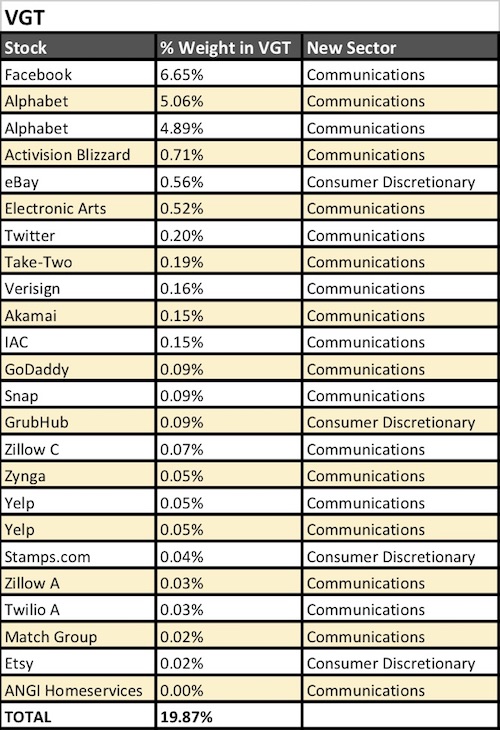

Yes, these changes are complicated, but that’s all the more reason for ETF investors to pay close attention. To help, here’s a simplified example of how GICS changes could affect your portfolio. Let’s look at the changes we theoretically could see in the Vanguard Information Technology ETF (VGT) – a popular tech ETF that holds more than $18 billion in assets.

Based on the chart above that shows the stocks held by the ETF that could be reclassified by the GICS changes, nearly 20% of VGT’s portfolio could change over, including prominent names such as Facebook and both share classes of Google parent Alphabet. The resulting classification shifts could mean that those stocks would end up moving into the Vanguard Telecom Services ETF (VOX), which also would bring in a few consumer discretionary stocks, including Walt Disney (DIS) and Dish Network (DISH). This could drastically alter the dynamics of both funds.

The VGT has averaged 13.4% annual gains over the past decade, versus just 5.9% annual returns for the VOX and its motley crew of sleepy telecom companies. The flipside? Those telecoms power a 4%-plus yield in VOX, versus just 1% for the VGT. So both income and growth potential alike could be in flux.

Some popular funds might be affected differently. For instance, the $400 billion Technology Select Sector SPDR Fund (XLK) already meshes tech companies such as Facebook and Alphabet with telecoms such as AT&T. However, it likely will be impacted by the influx of a few large consumer discretionary stocks migrating into telecommunications. Meanwhile, holdings such as eBay (EBAY) could move out of XLK and into the Consumer Discretionary Select Sector SPDR Fund (XLY).

The takeaway here? If you own any sector or industry ETFs, in particular, it’s time to pay close attention to the “Press Releases” or “Literature” section of your fund provider’s website. Over the next few months, many ETF providers are sure to release updates on what the new GICS classifications mean. Take them seriously: They could drastically alter the risk, growth potential and income generation profiles of some of your most important holdings.

EDITOR'S NOTE: This story has been updated to reflect potential changes to the XLK.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.