How—and Why—to Invest in the Dow

The Dow seems to prove that a reasonably diversified portfolio of 30 stocks will perform close to the broad market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After 123 years, has the Dow Jones industrial average finally become obsolete? It pains me to think so. My fondness for the index can be traced to a book I coauthored 20 years ago called Dow 36,000, but today’s Dow is not the same as the Dow of 1999. [Editor’s Note: Read Knight Kiplinger’s 2011 take—Dow 36,000 Revisited —on James Glassman’s book, more than a decade after it was published.] More than half of the stocks have been replaced. Even so, the adjustments fail to reflect a U.S. economy dramatically changed by the internet. Where is Amazon.com (symbol AMZN, $1,870)? Where is Facebook (FB, $181)? Where is Alphabet (GOOGL, $1,086), alias Google? Not in the Dow. (Stocks I like are in bold; prices are as of June 14.)

Let’s face it: The Dow has always been weird. Unlike the Nasdaq, Standard & Poor’s 500-stock index and nearly all other indexes, the Dow weights its component stocks by price rather than by market capitalization, which is share price times shares outstanding. A stock’s price is almost completely arbitrary. If I start a company and want to raise $100 million in equity, I can issue 1 million shares and price each at $100, or I can issue 10 million shares and price each at $10.

Basing an index on share prices can produce serious distortions. Of the 30 stocks that make up the Dow, Boeing (BA) has by far the most influence on the value of the index because its stock costs by far the most: $347 per share. Verizon Communications (VZ) has a market cap that is 23% greater than Boeing’s, but Verizon’s share price is $58, so it has about one-sixth of Boeing’s impact on the overall value of the Dow. If Boeing rises 10%, the Dow goes up more than 200 points; if Verizon rises 10%, the index goes up less than 40. Between March 1 and June 3 of this year, the Dow dropped 700 points. The decline in Boeing’s stock over the period essentially accounted for the entire decline in the index. The other 29 stocks were, on average, flat.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Which Stocks Are in the Dow?

The Dow’s membership criteria are, to say the least, vague. S&P Dow Jones Indices, which owns and manages the index, says: “A stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors.... Changes to the indices are made on an as-needed basis.” Decisions are made by a committee of three representatives from S&P and two from the Wall Street Journal, which is owned by Dow Jones (Charles Dow, who invented the index, was the first editor of the Journal).

Terms such as “excellent reputation” and “as needed” sound quaint, and, indeed, the Dow has the air of a wood-paneled gentleman's club, admitting new members with proper social standing while showing the door to those who haven’t measured up. The last company to be expelled was General Electric (GE), a year ago; it was replaced by Walgreens Boots Alliance (WBA), the drugstore chain. GE was the only firm left from the 12 in Charles Dow's original index. Changes to the DJIA come in spurts—four firms on one day in 1997, four in 1999, three in 2004 and three in 2013. We may be due for another upheaval.

If Amazon were in the Dow, it would account for about half the movement of the index.

The current list of 30 stocks is distinguished as much by who isn’t on it as by who is. Of the seven largest companies by market cap listed on U.S. exchanges, only two—Apple (AAPL) and Microsoft (MSFT)—are in the Dow.

The membership committee, like that for any tony club, does not explain its decisions. But it’s clear that as long as it is price-weighted, the Dow will not admit Amazon, which goes for $1,870 a share. If Amazon were in the Dow, it would account for about half the movement of the index. Nor will Berkshire Hathaway (BRK.B) make the list, even with its less-pricey B shares trading at $205 each. Berkshire pays no dividends, and although the Dow has no official dividend rule, all 30 of its components make regular payouts.

The Dow includes no utilities or transportation shares (they are in separate Dow indices), and no real estate stocks. The index is overweighted—compared with the market as a whole—in industrials and consumer cyclical companies, which provide nonessential goods or services.

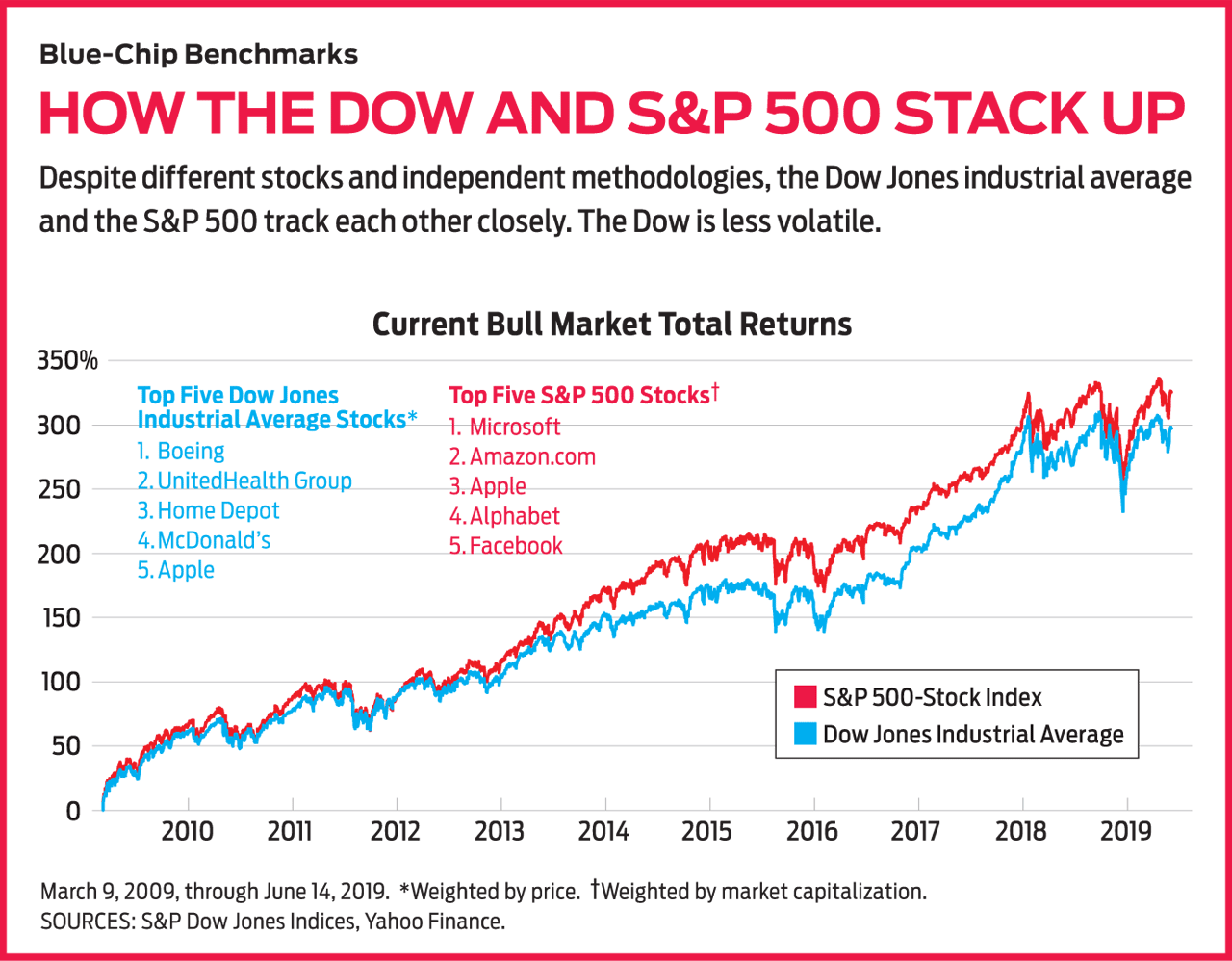

Despite all that, the Dow’s performance has closely tracked that of the S&P 500, a market-cap-weighted index of roughly the 500 largest U.S. stocks (see the chart below). Over the past 10 years, the annual average return of the Dow has been 14.1%; the return of the S&P, 13.9%. Still, there are striking year-to-year differences. In 2012, the Dow returned 10% and the S&P, 15%. But in 2017, the Dow beat the S&P by more than six percentage points.

Over time, the main difference between the Dow and the S&P is risk, expressed as volatility—that is, the extremes of the ups and downs of the two indexes. Over the past 10 years, the Dow has an average standard deviation, a common measure of price variation, of 11.9%, compared with 12.6% for the S&P. Consider that in 2008, the year the market collapsed, the Dow lost 31.9% (taking into account dividends, as all of these return calculations do), while the S&P 500 lost 37%. Then in 2009, the rebound year, the Dow gained 22.7%, and the S&P gained 26.5%.

How to Invest in the Dow

The Dow seems to prove that a reasonably diversified portfolio of 30 stocks will perform close to the same as the broad market. That doesn’t mean the Dow membership committee should be less diligent, but it also doesn’t mean that major changes are needed in the selection process. Perhaps the committee could be more up-to-date. It did not add Apple, for instance, until 2015. But overall, the brilliant idea of Charles Dow—to pull together a group of stocks that represent U.S. industrial shares as a whole—has withstood the test of time.

The easiest way to invest in the Dow is to buy an exchange-traded fund called SPDR Dow Jones Industrial Average (DIA, $262), nicknamed Diamonds. The ETF reflects the movements of the Dow, carries an expense ratio of 0.17% and has a dividend yield of 2.1%. Or you could try variations on the theme. One is First Trust Dow 30 Equal Weight (EDOW), an ETF whose portfolio is adjusted from Charles Dow’s original price-weighted formula to give each stock the same influence—that is, 3.3%, compared with Boeing’s current 9.2% and Verizon’s 1.5%. The fund is less than two years old, and although it beat Diamonds in 2018 and is leading in 2019, I can’t recommend it until it has built a longer track record.

Another popular play on the Dow is to buy the highest-yielding stocks in the index, a strategy called Dogs of the Dow. Lofty yields can indicate firms that are shunned and, therefore, bargains. Put equal amounts of cash into the 10 Dow stocks with the highest yields at the start of the year, then rebalance with the new Dogs the next year. Analyst James O’Shaughnessy tracked the system from 1951 to 1996 in his book How to Retire Rich, finding that the Dogs whipped the full Dow by a wide margin. In recent years, however, there has not been much difference between the two approaches, and I am not a fan. If you must go canine, I recommend just scanning the list for attractive stocks to buy. Among the current Dogs, I am especially fond of International Business Machines (IBM, $135), yielding 4.8%; Cisco Systems (CSCO, $55), 2.6%; Coca-Cola (KO, $51), 3.1%; and Chevron (CVX, $121), 3.9%.

The Dow, despite its quirks, is still far from obsolete. I like Diamonds better than the S&P 500 index funds because of its lower volatility. And don’t forget that the index has to rise only another 40% or so to reach 36,000.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of stocks mentioned here, he owns Amazon.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.