Stay the Course, Stay the Course, Stay the Course

Investors are being tested by the stock markets: Can they stay the course? Should they? Take a look at a few charts of market performance over the long term to see the case for sticking with a diversified portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With equity indices crossing into bear market territory, it's easy to get anxious seeing your account balance rise and fall several percentage points each day. Although the situation we face today is unique (coronavirus containment, oil price war, etc.), this type of market environment isn't. For well-prepared, long-term investors, now is a time to stay the course while evaluating potential opportunities as assets become oversold. Below we offer a series of charts detailing historical parallels and supporting the case for diversified portfolios.

The table below details the last several bear (or close to it) market drawdowns dating back to 1987. While you often hear about the magnitude of the drawdown (red numbers), what's less discussed is the performance of the next 12 months, or the green numbers. Many of the best all-time trading days come within a month of the worst trading days, and sitting out from these best days can have a material impact on long-term performance.

S&P 500 Biggest Declines and Following 12-Month Performance

To view chart at full size, click here

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It's tempting to try to time the market, but that requires two important timing decisions — when to sell and when to buy. A few small miscalculations of either move can have a significant impact on results. As seen below, missing out on just the market's top 10 performing days over the past 20 years would cut the gains on a $100,000 investment by about half.

Impact on a $100,000 Portfolio of Missing the Market’s Best Day

" target="_blank">To view chart at full size, click here

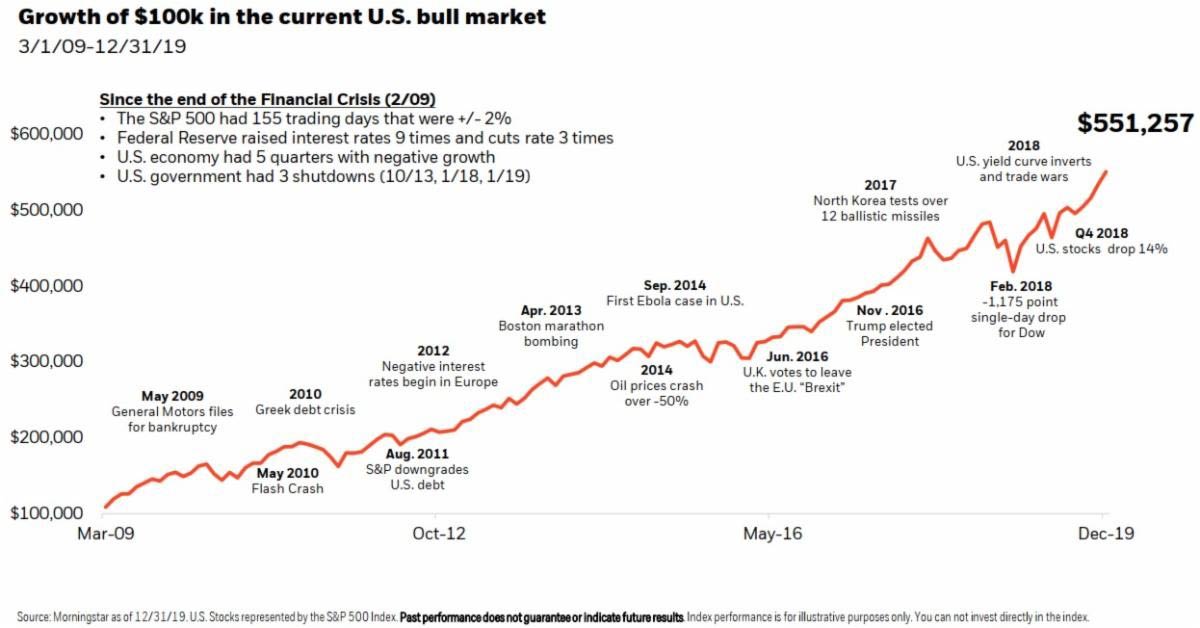

Looking back over the past decade, or century for that matter, there have been plenty of excuses to sell stocks. Just over the past bull market, we've had the Greek Debt Crisis, the introduction of negative interest rates, an Ebola outbreak, Brexit, and a global trade war, just to name a few. Amid all of this, stock markets have still managed to produce impressive gains.

" target="_blank">To view chart at full size, click here

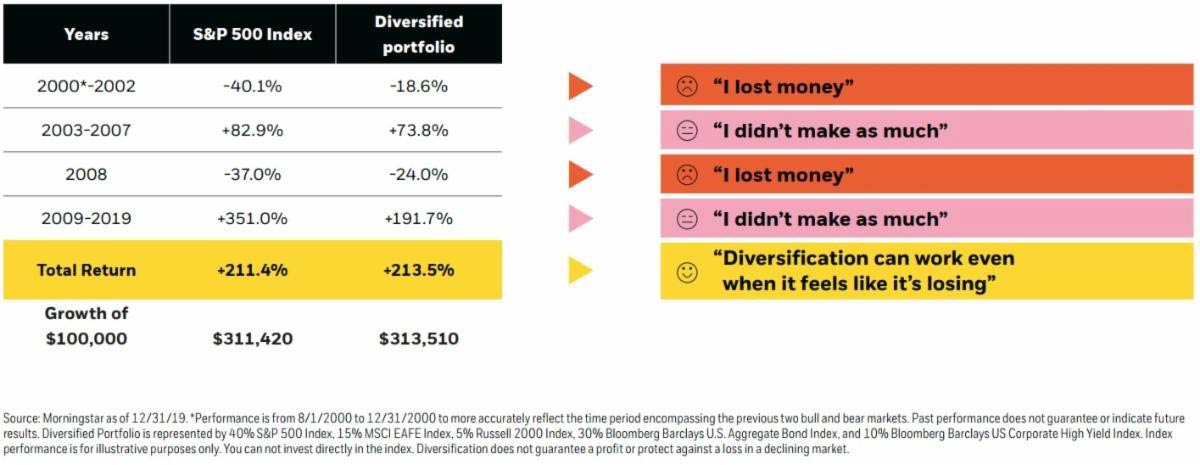

Many will offer opinions, but our view is that it's nearly impossible to predict how this crisis will unfold. What's perhaps more likely, is that volatility will remain elevated in the coming weeks and potentially months. Given this framework, our belief in diversified portfolios remain.

The Case for Diversification: S&P 500 Index vs. Diversified 60/40 Stock/Bond Portfolio

" target="_blank">To view chart at full size, click here

Conclusion: Living through these periods of market uncertainty is rarely a fun exercise, but these challenges will occur occasionally. It's important to remain calm and stay focused on the long term.

For more information or to discuss further, please email me

or call me at 203.409.1270.

Disclaimer: Summit Financial, LLC. is a SEC Registered Investment Adviser ("Summit"), headquartered at 4 Campus Drive, Parsippany, NJ 07054, Tel. 973-285-3600. It is provided for your information and guidance and is not intended as specific advice and does not constitute an offer to sell securities. Summit is an investment adviser and offers asset management and financial planning services. Indices are unmanaged and cannot be invested into directly. Data in this report is obtained from sources which we, and our suppliers, believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The Standard & Poor's 500 Index (S&P 500) is an unmanaged group of securities considered to be representative of the stock market; the MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index designed to measure the equity market performance of developed markets, excluding the U.S. and Canada; the Bloomberg Barclays U.S. Aggregate Bond Index is a market capitalization-weighted index comprising Treasury securities, Government agency bonds, mortgage backed bonds, corporate bonds, and some foreign bonds traded in the U.S.; The Russell 2000 Index is a market-cap weighted index comprised of the smallest 2,000 companies within the Russell 3000 Index. Consult your financial professional before making any investment decision. Past performance is no guarantee of future results. Diversification/asset allocation does not ensure a profit or guarantee against a loss.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.