$1 Billion in Health Insurance Rebates: Taxable or Tax-free?

Many Americans are about to get money back. We sort through how much they can keep.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

American health insurance companies are about to shower over $1 billion in rebates on policyholders -- refunding premiums paid in 2011 that fail to meet the so-called 80/20 rule imposed by the health care reform law. If you're among the lucky recipients, will the rebate be a double-edged sword? Will it be considered taxable income?

We'll get to that. But first a quick review of what's going on.

Under that 80/20 rule, health insurers are required to use no more than 20% of premiums for overhead and profit, with at least 80% going to cover the cost of health care and quality improvements. For large group plans -- those covering more than 50 employees -- a more stringent standard applies. They must spend at least 85% of premiums on health care and improvements. To the extent a company misses the mark, it must rebate sufficient premiums to bring it into line.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Based on data for 2011, the federal government says insurers will rebate about $1.1 billion to 12.8 million Americans. The average rebate for households that get one will be about $151. The rebates are to be made by August 1.

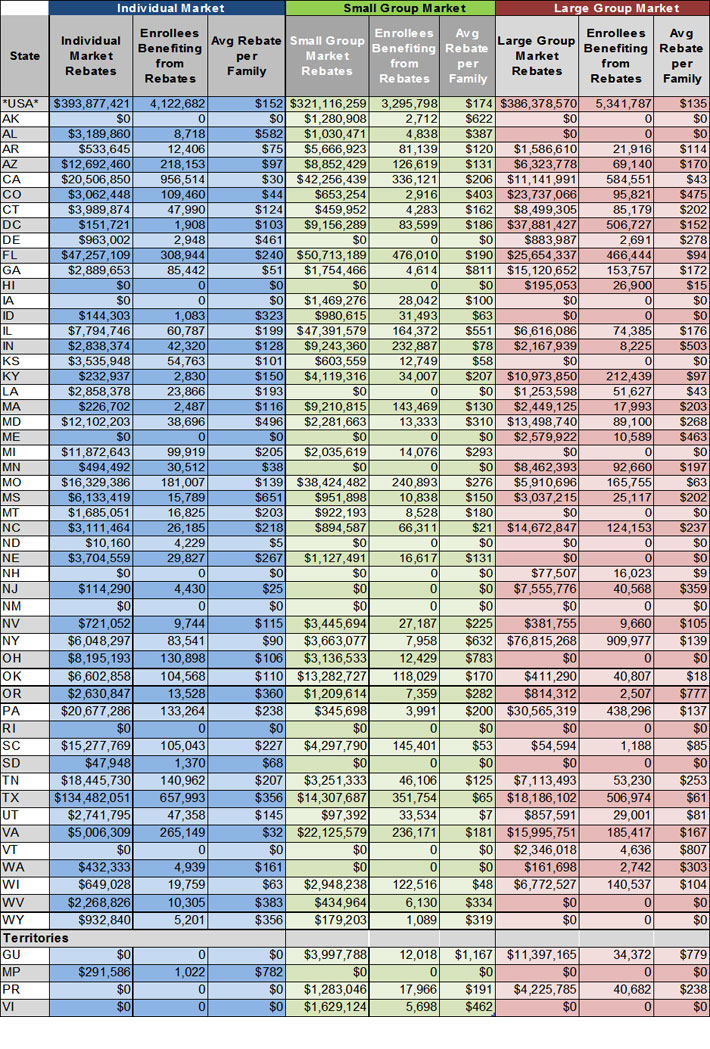

The table at the end of this story shows the average rebate by state for families who will be receiving one. A new tool, developed by the Department of Health and Human Services, will help you determine whether you'll get a rebate, based on your insurance company and whether you're covered by an individual policy or a small- or large-group employer plan. (Workers covered by an employer who is self-insured -- ask your human-resources department -- are not eligible for rebates.)

Taxable or tax-free?

As with most tax matters, the answer is: It depends. The principle here is easy to understand. If you got a tax break for money spent in 2011 and you get some of that money back in 2012, Uncle Sam wants to retrieve part of the tax break, too. Putting this principle into practice gets tricky, though.

Individual policies If you had an individual policy in 2011, the tax status of any rebate will turn on whether you deducted the premiums you paid. If you're among the two-thirds of all taxpayers who claimed the standard deduction rather than itemizing, you can be sure the rebate will be tax-free.

Even if you itemized, there's a good chance it will be tax-free because three-fourths of all itemizers do not deduct medical expenses. That's because you can do so only if your qualifying expenses (including health insurance premiums) exceed 7.5% of your adjusted gross income.

If you did deduct medical expenses, however, all or part of the rebate will be taxed. How much depends on how much your total itemized deductions exceeded the standard deduction for your filing status.

Group plans If you get your health insurance at work, the tax treatment of a rebate will depend on how you paid your share of the cost of health insurance and how the rebate is delivered.

If you paid the premium with after-tax dollars, the rebate will be tax-free.

If, as is common, your employer has a program to allow employees to pay their health care premiums with pretax dollars, then the rebate will be taxable.

If your employer gives you your share of the rebate as cash, that amount will be treated as extra 2012 compensation -- it will show up on your Form W-2 -- and both income tax and Social Security tax will be withheld. (This settles the score because in 2011, when the pretax money was used to pay the premium, that amount avoided income and Social Security taxes.)

Your employer might instead use the rebate to reduce your health premiums in 2012. That might sound like a way around the taxing issue, but it's not.

Let's say your rebate is $100 and that income and Social Security taxes take a total of 30% of your pay. If you get cash, $100 will be added to your compensation and that will cost you an extra $30 in tax. If the rebate is used to reduce your premiums, $100 less of your salary will be deducted before taxes to pay premiums this year ... and that means your taxable pay will be $100 higher than if the rebate hadn't applied. That, in turn, will increase your tax bill by $30.

In both cases, though, you'll be $70 ahead.

Source: U.S. Department of Health and Human Services.

Sneak preview: New tax benefits -- as well as burdens -- for 2012

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

End of Expanded Premium Tax Credit Would Drive Uninsured Rates Higher

End of Expanded Premium Tax Credit Would Drive Uninsured Rates HigherTax Credits Millions of people could become uninsured if Congress fails to extend the enhanced premium tax credit.

-

Over 162,000 Dreamers Cut Off From Affordable Care Act Insurance

Over 162,000 Dreamers Cut Off From Affordable Care Act InsuranceHealth Insurance A federal court in North Dakota has blocked ACA coverage for DACA recipients in 19 states. Here's what it means.

-

2025 Open Enrollment: Some DACA Recipients Can Purchase Affordable Care Act Health Insurance

2025 Open Enrollment: Some DACA Recipients Can Purchase Affordable Care Act Health InsuranceOpen Enrollment Your eligibility to purchase health insurance from the federal marketplace may have changed. Here's what you need to know.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Medicare, ACA Call Center Workers To Hold Another Protest: What To Know

Medicare, ACA Call Center Workers To Hold Another Protest: What To KnowMedicare and Obamacare call center employees plan another protest, this time in Washington, DC on December 12.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.