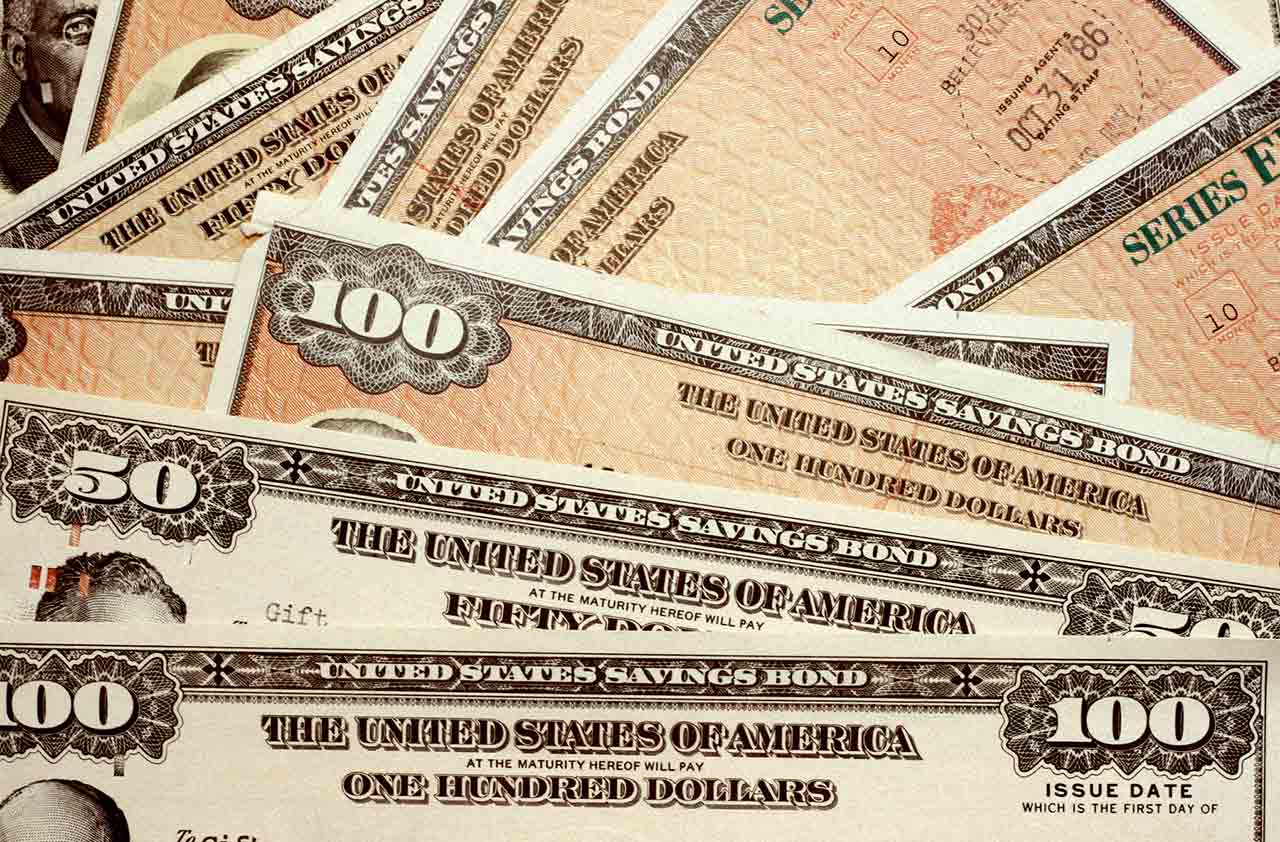

When Savings Bonds Make Sense

Series I savings bonds are safe options, but don’t go all in.

As you survey safe options to eke out interest on your savings, one that may catch your eye is the Series I savings bond. I bonds are issued by the U.S. Treasury Department (buy them at treasurydirect.gov) and backed by the full faith and credit of the government. Such a low-risk investment has appeal for savers, “particularly when there’s so much turmoil and uncertainty in the economy,” says Greg McBride, chief financial analyst for Bankrate.com. But I bonds are likely suitable for only a portion of your savings.

An inflation hedge. An I bond’s interest rate has two parts. Each year at the beginning of May and November, the Treasury announces the fixed rate that will apply to bonds issued during the following six months. The fixed rate is 0% for bonds issued between May 1 and October 31 this year (that rate remains the same for the life of the bond). The inflation rate, however, resets every six months and is based on changes in the consumer price index. The fixed and inflation rates are combined to form a composite yield, which is 1.06% for bonds being issued now.

Where I bonds fit. The top-yielding online savings accounts offer better rates than new I bonds. And if you’re looking for a place to put your emergency fund, a savings account is the better choice because you can access the money quickly; you can’t redeem an I bond for the first 12 months. By holding an I bond to its maturity of 30 years, you’ll get maximum interest from it. But if you cash it out before five years have passed, you lose three months of interest.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

I bonds may be worthwhile for a portion of your long-term savings. Historically, “the average composite rate has generally been higher than the average rate for online savings accounts,” says Ken Tumin of DepositAccounts.com. Plus, an I bond’s interest is exempt from state and local income tax, and you can defer federal income tax until you redeem the bond or it reaches maturity.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Higher Summer Costs: Tariffs Fuel Inflation in June

Higher Summer Costs: Tariffs Fuel Inflation in JuneTariffs Your summer holiday just got more expensive, and tariffs are partially to blame, economists say.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2025

Roth IRA Contribution Limits for 2025Roth IRAs Roth IRA contribution limits have gone up. Here's what you need to know.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Is Amazon Prime Day? Everything We Know, Plus the Best Deals on Apple, Samsung and More

When Is Amazon Prime Day? Everything We Know, Plus the Best Deals on Apple, Samsung and MoreAmazon Prime Amazon Prime Day is four days this year. Here are the key details you need to know, plus some of our favorite deals to shop during the sale.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.

-

Five Ways to Shop for a Low Mortgage Rate

Five Ways to Shop for a Low Mortgage RateBecoming a Homeowner Mortgage rates are high this year, but you can still find an affordable loan with these tips.