The Future of Personal Finance

As the U.S. population ages and globalization creates more competition for money-management services, information technology will get smarter, too. But can tech help hedge your risks in investing and retirement planning?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Mention the word innovation in a conversation about the economy and the ears of most people -- investors and consumers alike -- will perk up. Think pharmaceuticals and anti-depressant drugs, IT and the iPhone, automobiles and hybrids. But you’re likely to get a dismissive sneer if you bring up the topic of financial innovation. Little wonder, considering the toxic fallout from collateralized debt obligations, credit default swaps, option ARMs and other so-called innovations.

The recent record is so dismaying that Paul Volcker, the legendary former head of the Federal Reserve Board, was driven to ask of financiers in 2009 how many innovations could they come up with that were “as important to the individual as the automatic teller machine, which in fact is more of a mechanical than a financial one?” Good question.

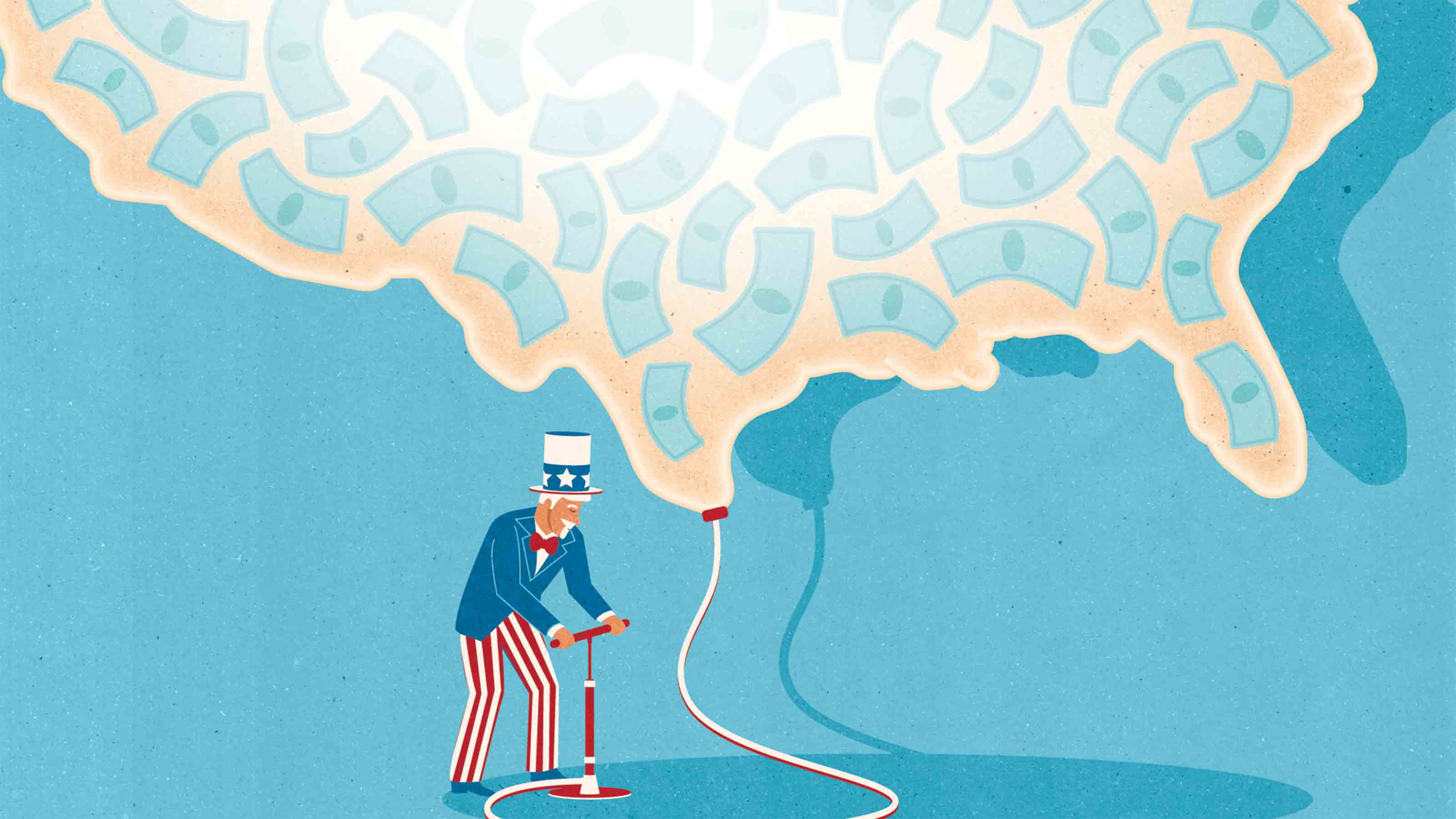

The answer is that much of what passes for financial innovation is little more than the clever relabeling of money so that corporations, government and financial institutions can evade regulatory restrictions. The mathematically sophisticated trading strategies dreamed up by Wall Street financial engineers are often fancy ways of making spectacular leveraged bets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What gains have we made?

Nevertheless, from the perspective of the past several decades, Volcker’s dismissive comment was too harsh. Financial innovations have improved everyday household finance. Among the more important innovations are credit cards and debit cards, money market mutual funds and equity index mutual funds, Treasury inflation-protected securities (TIPS) and exchange traded funds (ETFs), and Mint.com and other online financial services. Taken altogether, these products have made it easier to manage money and save smartly.

But when it comes to personal finance, well, you ain’t seen nothin’ yet. Thanks to the potent combination of an aging population, the competitive pressures of globalization and advances in IT, individuals have been forced to take greater responsibility for everything in recent decades -- from saving for retirement to paying for college.

The future will be all about simplification. The financial-services industry has created a dizzying set of products and services for dealing with household risk and responsibilities. From now on, the innovation mantra will be managing these risks comprehensively, from hedging against a drop in income to making sure you’ll never run out of money to monitoring household finances with a tap of a finger. The financial wizardry underlying these products lies on the frontiers of knowledge, but the products will be easy for ordinary people to use, with no hidden charges. Robert Shiller, economist at Yale University and an inventive architect for a new risk-management infrastructure, aptly calls the next phase of financial innovation “the democratization of risk management.”

Closing the retirement gap

Take retirement. We all know that Americans are getting older and living longer. There’s a growing concern that many people haven’t saved enough in recent decades, as employers have traded in traditional pensions for voluntary 401(k) plans with uncertain returns. The consultants at McKinsey & Co. estimate that the average couple will fall $250,000 short of what they need to live on after they retire. Worse yet, prospective retirees are finding it even more difficult to figure out how much they should withdraw from retirement savings accounts into their old age. Live too high on the hog at first and you could end up struggling later on. Hoard your cash and you won’t outlive your assets, but what kind of life is that?

The outline of a very difficult calculus is emerging. There’s a ferment of activity among Wall Street gurus, finance scholars, benefits consultants and others to create tailored retirement portfolios that offer savers a real long-term return based on their answers to a few questions -- on income and retirement age, for example. When it comes time to leave work behind, lifetime income annuities will provide a hedge not only against inflation, but also health care costs. You’ll get automatic updates on your inflation-adjusted portfolio and standard of living on your mobile phone. “We need straightforward financial markets that allow us to hedge all kinds of risk,” says Lawrence Kotlikoff, economist at Boston University and founder of ESPlanner, a software financial-planning firm.

There are tantalizing early-generation glimpses at what will become routine down the road. The three-decade-old investment firm Dimensional, built on cutting-edge academic finance theories on markets and investing, launched Dimensional Managed DC this year. It will design portfolios for employees to provide them with an inflation-protected income stream for life, after they answer a series of questions about their income and retirement goals. ESPlanner has developed a program that combines TIPS and equity index funds to put a floor on retiree living standards.

There are also proposals for the federal government to issue inflation-adjusted annuities to retirees, as well as annuities that hedge against health and long-term care spending risks. “If simple products for fully addressing longevity, credit, inflation, and other risks existed, you could spend less time worrying about retirement security and more time on such useful things as exercising, starting companies, and helping charities,” says Henry Hu, law professor at the University of Texas, Austin.

Information technologies will make it easier for households to monitor their savings, investments, loans, real estate, and life insurance on a real-time basis. Right now, most of us have such information scattered in different places, although the software-literate and financially organized can come pretty close to bringing it all together. But those people are the exception, not the rule. Putting all aspects of household finances in one place will improve everyday money management. “It isn’t about more choice,” says Paul Saffo, managing director of foresight at the Silicon Valley firm Discern Analytics. “It’s about greater insight.”

Another revolution is nigh

Personal finance is still in a state reminiscent of the personal computer in the late ’80s and early ’90s. Back then it took a deep knowledge of programming and software to tap into the PC’s potential. Now, with the iPad, even the technologically challenged can accomplish highly sophisticated tasks with the touch of a finger. A similar transformation -- call it iPad finance -- is happening in personal finance. It’s about time.

Contributing columnist Chris Farrell is economics editor for American Public Media’s weekly Marketplace Money show and author of The New Frugality.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Is a Recession Imminent?

Is a Recession Imminent?Economic Forecasts Shoppers will have to carry the load for now because weak business investment shows no sign of perking up anytime soon. Odds are, they’ll be able to.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

3 Factors That Could Drive the Next Recession

3 Factors That Could Drive the Next RecessionEconomic Forecasts The economy is humming along nicely, but how long can the good times continue?

-

Is Credit-Card Debt Out of Control?

Is Credit-Card Debt Out of Control?credit & debt Balances are on the rise, but defaults are still low.

-

Help Wanted in America: Skilled Workers

Help Wanted in America: Skilled WorkersTechnology In an ever-more-competitive job market, technology increases the need for skilled workers.