What You Need to Know About Making IRA and 401(k) Contributions in 2017

Contribution limits won't change, but income limits will increase slightly.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

How much can I contribute to my IRA and 401(k) in 2017?

The contribution limits aren't changing in 2017. You'll still be able to contribute up to $18,000 to a 401(k), 403(b), 457 or Thrift Savings Plan. If you're 50 or older anytime in 2017, you can also make a catch-up contribution of up to $6,000, bringing your total to $24,000.

The income limits to qualify for the retirement savers’ tax credit are also rising by a very small amount. To be eligible for the credit, income must be less than $31,000 for single filers, $46,500 for heads of household or $62,000 for married couples filing jointly in 2017. The credit can be worth up to $1,000 per person, or up to $2,000 for married couples, with the size of the credit based on income and the amount of money contributed to a retirement-savings plan, such as a 401(k) or IRA. The lower your income, the larger the credit. If your income is just below the cutoff, the credit is worth up to $200 per person or $400 for a married couple. For more information about the savers' credit, see Who Qualifies for the Retirement Savers' Tax Credit?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

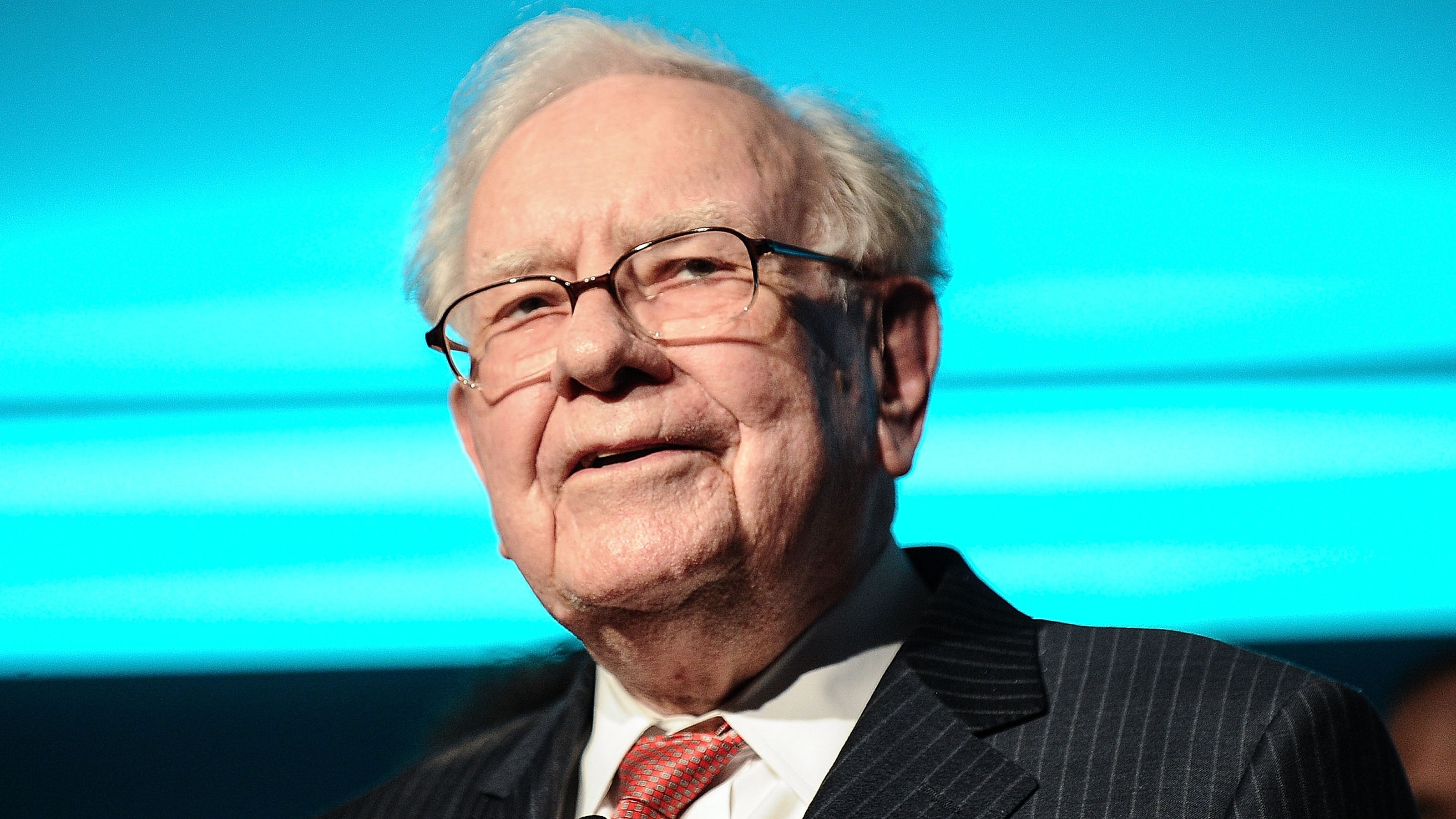

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

For a Concentrated Stock Position, Ask Your Adviser This

For a Concentrated Stock Position, Ask Your Adviser ThisThere can be advantages to having a lot of stock in one company, but ‘de-risking’ can help avoid some significant disadvantages.

-

Catch-Up Contributions to Retirement Accounts Boosted By SECURE Act 2.0

Catch-Up Contributions to Retirement Accounts Boosted By SECURE Act 2.0Americans approaching retirement age can now squirrel away more money in IRAs, 401(k)s, and other retirement accounts.

-

When RMDs Loom Large, QCDs Offer a Gratifying Tax Break

When RMDs Loom Large, QCDs Offer a Gratifying Tax BreakSend money directly to charity from your traditional IRA, and you won’t owe taxes on the amount you donate. It’s a win-win!

-

Save More for Retirement in 2023 Thanks to Higher IRA and 401(k) Contribution Limits

Save More for Retirement in 2023 Thanks to Higher IRA and 401(k) Contribution LimitsIf you're saving for retirement, you can contribute a lot more to an IRA, 401(k), or other retirement account in 2023.

-

Traditional IRA Contribution Limits for 2022

Traditional IRA Contribution Limits for 2022traditional IRA Once again, retirement savers won’t be able to contribute more to traditional IRAs this year, but changes to how they work may be coming.

-

Give Cash Now, Cut Your Estate Tax Later

Give Cash Now, Cut Your Estate Tax Latertaxes During this season of giving, take advantage of the annual gift tax exclusion before the year ends.

-

Trading Options for Your 401(k)

Trading Options for Your 401(k)Employee Benefits About 40% of companies offer self-directed brokerage accounts in their 401(k) plans, giving participants more investing options.