Put a Student on the Path to Retirement Without Hurting Financial Aid

Contributing to a young worker's Roth IRA can help a student start saving for retirement, although the timing of this gift could affect financial aid for college.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Question: My grandson had a job last summer, and I think it would be a good idea for him to open up a Roth IRA. Can I give him the money to contribute, and how will it affect his chances for financial aid for college?

Answer: Children of any age can contribute to a Roth IRA as long as they earned income from a job. (If your grandson is a minor—under age 18 or 21, depending on the state—he may need a custodial Roth IRA opened for him by an adult.) Because your grandson worked last summer, he has until April 17, 2018, to contribute to a Roth for 2017. He can contribute up to the amount of money he earned last year or $5,500, whichever is less. As long as he had eligible income, you can give him the money to contribute.

This is a great way to give him a head start on retirement savings, and he can withdraw the contributions without penalties or taxes at any time. You need to time your gift carefully to minimize the impact on financial aid. Money you give him to contribute to an IRA is considered to be student income in the year it’s received, and student income is hit hard by the federal financial aid calculations. Students are allowed to earn about $6,570 a year without it counting in aid calculations. But for every $1 students earn above that limit, they are expected to contribute 50 cents toward college costs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Free Application for Federal Student Aid (FAFSA), which families must fill out to receive aid, now looks back at earlier tax returns to report income and assets. For example, the FAFSA for the 2018-19 academic year uses 2016 tax figures. That means money you give your grandson before January 1 of his sophomore year of high school won’t be included as income on the financial aid application.

Retirement accounts are sheltered assets on the FAFSA, so once the money is in his Roth IRA, it won’t affect his aid eligibility as long as he doesn’t make any withdrawals. If he does take money out of the Roth during the tax years under review by the aid formula, however, it’s considered to be student income in aid calculations—even if some of the withdrawal is from contributions and isn’t taxable. So he’ll want to wait until after the last tax year that counts for financial aid before withdrawing any money from the Roth.

For more information about the benefits of opening a Roth IRA for a kid, and a few IRA administrators that make it easy for minors to open an account and charge low or no fees to get started, see Roth IRAs Are for Kids, Too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

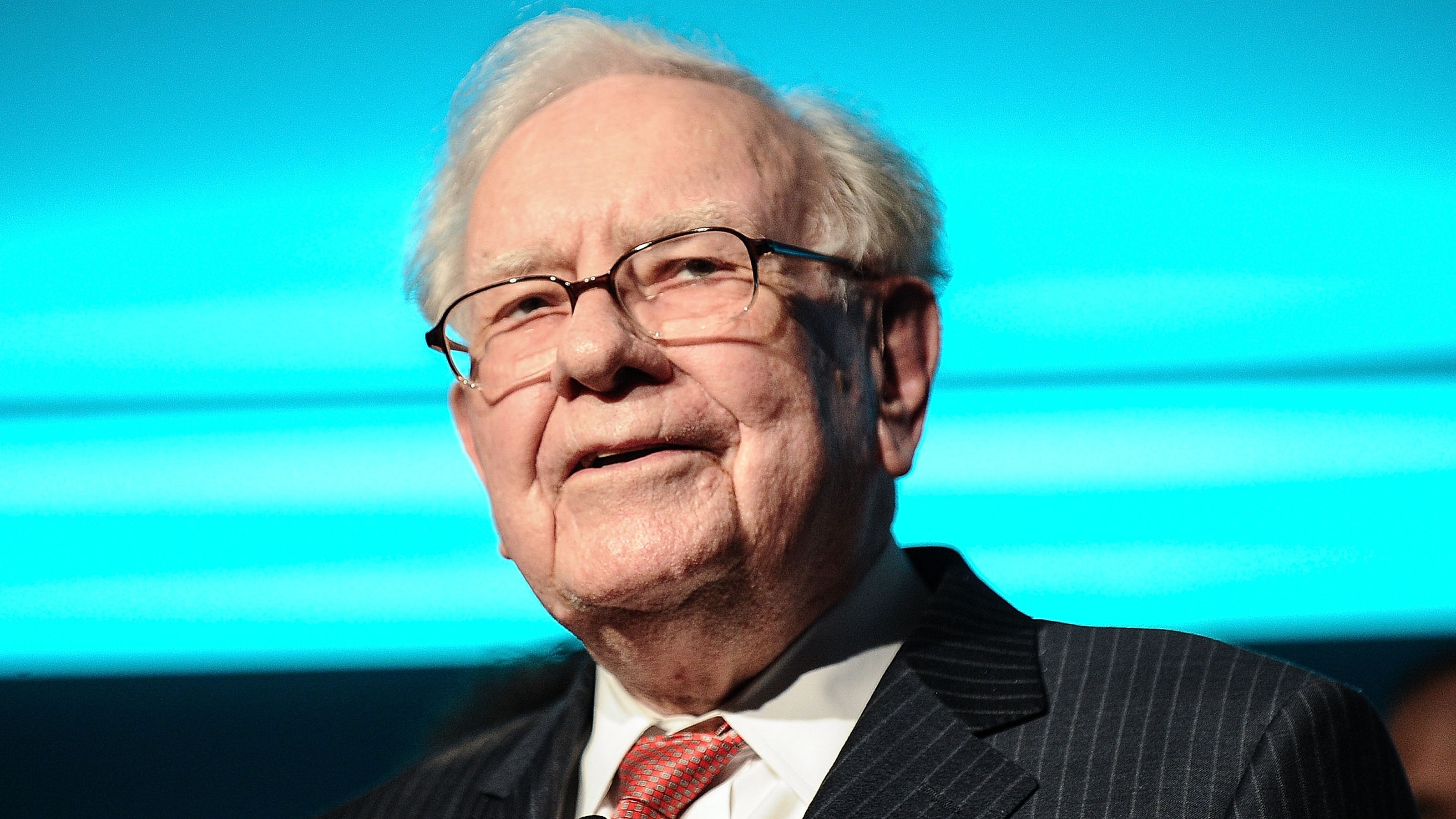

I'm an Investing Expert: This Is How You Can Invest Like Warren Buffett

I'm an Investing Expert: This Is How You Can Invest Like Warren BuffettBuffett just invested $15 billion in oil and gas, and you can leverage the same strategy in your IRA to potentially generate 8% to 12% quarterly cash flow while taking advantage of tax benefits that are unavailable in any other investment class.

-

For a Concentrated Stock Position, Ask Your Adviser This

For a Concentrated Stock Position, Ask Your Adviser ThisThere can be advantages to having a lot of stock in one company, but ‘de-risking’ can help avoid some significant disadvantages.

-

8 Times You Should Contact Your Financial Adviser

8 Times You Should Contact Your Financial AdviserWhether you experience a job change or begin caring for aging parents, your financial adviser can help manage the impact on your financial plan.

-

Give Cash Now, Cut Your Estate Tax Later

Give Cash Now, Cut Your Estate Tax Latertaxes During this season of giving, take advantage of the annual gift tax exclusion before the year ends.

-

10 Timeless Investing Principles

10 Timeless Investing Principlesretirement Investors and retirees looking for reassurance during challenging stock market times can take heart in these time-tested investing principles.

-

How to Help Grandchildren Pay for College

How to Help Grandchildren Pay for CollegePaying for College Follow these tax-saving strategies while gifting money to help fund their education.

-

Getting Out of an RMD Penalty

Getting Out of an RMD Penaltyretirement When your brokerage firm miscalculates your required minimum distributions, you have recourse.

-

Borrowers Get More Time to Repay 401(k) Loans

Borrowers Get More Time to Repay 401(k) Loansretirement If you leave your job while you have an outstanding 401(k) loan, Uncle Sam now gives you extra time to repay it -- thanks to the new tax law.