The Exciting Future of Federal Tax Credits

Sponsored content by Whittier Trust

If you read the title and question how anything tax-related could be exciting, consider that for the first time in federal tax history, hundreds of billions of dollars worth of federal tax credits will be eligible for direct refund by the government or eligible to be sold to unrelated taxpayers on an open market. From the passage of the Tax Cuts and Jobs Act (the “TCJA”) in 2017 to the recent passage of the Inflation Reduction Act (the “IRA”), the Internal Revenue Code, colloquially known as the Tax Code, has recently undergone more change than at any time in the last thirty years. In the past three years alone, Congress passed the CARES Act of 2020, the American Rescue Plan and the Infrastructure Investment and Jobs Act of 2021 and the CHIPS and Science Act of 2022. Each of these laws contained billions of dollars in additional tax credits and incentives. While none of the recent laws resulted in the complete overhaul of the Tax Code, such as occurred in 1939, 1954 and 1986, the Tax Code has nevertheless added many new ground-breaking provisions. Two of these new provisions, which were introduced by the IRA, are sections 6417 – Elective Payment of Applicable Credits and 6418 – Transfer of Certain Credits.

The IRA contained more than $200 billion of corporate tax incentives that qualify for treatment under sections 6417 and 6418. This includes manufacturing tax credits, transportation and fuel tax credits, hydrogen and carbon capture credits and clean energy production credits. The impact of sections 6417 and 6418 will be historic and will likely serve as the most effective tools at Congress’ disposal to encourage environmentally friendly behavior in the private sector.

Section 6417 allows applicable entities to make a direct pay election related to certain tax credits. This election will treat tax credits earned from eligible investments in renewable energy projects as tax already paid. In other words, taxpayers can request a cash refund from the IRS where the tax credit exceeds the entity’s tax liability or where the entity has no income tax liability at all. This creates a powerful incentive for applicable entities to invest in renewable energy projects, as the government is effectively writing a check reimbursing investment into the underlying credit activity.

One key definition in section 6417 is that of “applicable entities”, which includes “any tax-exempt organization”, but does not include individual and most corporate taxpayers. While most taxpayers do not fall into the definition of applicable entities, the direct pay election for tax-exempt organizations is a game-changer, allowing such entities to monetize their tax credits even though they would not normally incur income tax liability.

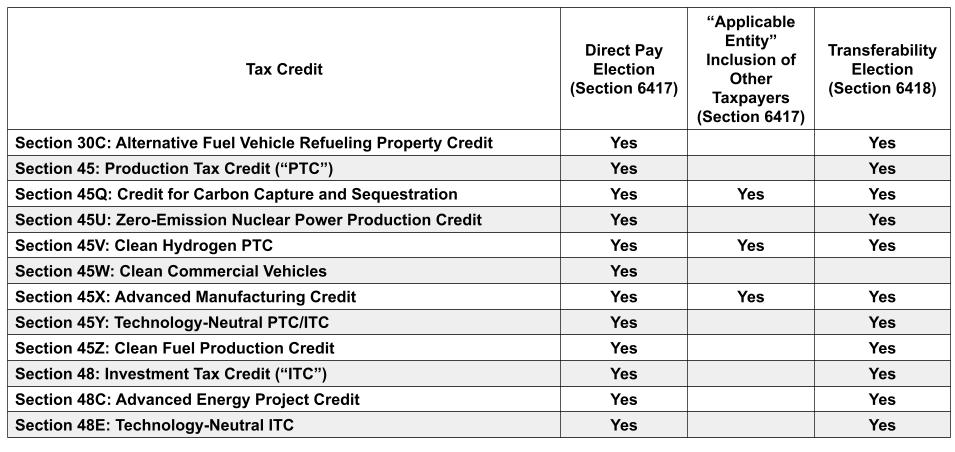

To further incentivize investment into three specific activities found in sections 45V: Clean Hydrogen Production Tax Credit, 45Q: Carbon Capture and Sequestration Credit, and 45X: Advanced Manufacturing Credit, Congress chose to include in the definition of applicable entities other taxpayers. This effectively creates three new refundable tax credits. Congress could easily choose to add new credits to this list in the future. A list of tax credits eligible for direct payment can be found in the table at the end of this article.

Section 6418 may become one of the most consequential tax provisions passed in decades and may pave the way for the creation of new and sophisticated markets specializing in the trading of billions of dollars in federal tax credits. Eligible taxpayers will make an irrevocable one-time election to transfer all or a portion of certain credits to an unrelated taxpayer. The transfer must be made in cash and can be elected no later than the due date of the tax return for the year in which the credit is to be claimed. Notably, the amount transferred is not includable in the transferee taxpayer's income nor deductible by the transferor taxpayer.

This new provision addresses a significant problem with most tax credits, which is that they lose their value for taxpayers with little or no income tax. Corporate taxpayers are especially confronted with this reality when they find they are unable to utilize tax credits within the statutory time requirement. For many years now, state governments have made certain tax credits “transferable” to unrelated parties in order to encourage the underlying credit activity. A whole cottage industry of what are effectively tax credit brokers match taxpayers engaged in the incentivized activity but who cannot use the credits with taxpayers who are willing to purchase the credits. Taxpayers pay for these third-party providers a fee, usually based on a percentage of the tax credit. At the federal level, however, taxpayers were forced to enter into complex tax credit finance structures in order to capitalize on the unusable credits. Section 6418 is the federal government finally allowing taxpayers to sell their credits, as has been done on the state level for many years now.

Section 6418 will benefit from its broader user base. The provision defines “eligible taxpayers” as all those who are not “applicable entities” under section 6417. In other words, section 6418 will include individuals and most corporations. Section 6418 will prove to be an attractive benefit for taxpayers wishing to sell their tax credits to unrelated third parties. Congress will no doubt add additional credits in the future to incentivize other activities.

One major restriction in section 6418 is that the tax credit transfer is limited to one transfer. The transferee in the exchange cannot resell the tax credit to another party. The purchase of the credit must be done in cash and receipt of the cash by the transferor is excluded from gross income. The expense of the cash payment is not deductible by the transferee as well. A list of tax credits eligible for transfer can be found on the table at the end of this article.

There remain several unknowns at this point, and the IRS is already in the process of collecting comments related to forthcoming guidance on these two tax provisions. Both provisions are effective starting in 2023. One area not yet addressed is how the states will address these two IRA provisions. States can generally be broken down into two broad categories when it comes to new federal tax provisions, conforming states and non-conforming states. Conforming states are those that either automatically or regularly adopt federal tax definitions and provisions into their own state tax code. For taxpayers doing business in these states, there are usually fewer tax adjustments that need to be made to their state returns since the states will adopt most federal tax treatments. Non-conforming states are those that generally do not conform or adopt new federal tax provisions, though many of these states still adopt certain federal tax definitions. For taxpayers doing business in these states, there may be legitimate concern related to the transfer of tax credits, whether these states will consider the receipt of cash taxable instead of not taxable. California is an example of a state that is notorious for being non-conforming. Taxpayers will also need to pay close attention to states in which they have nexus and how they address section 6417 direct pay election and the section 6418 credit transferability.

The direct pay and tax credit transfer options introduced by the IRA will create new opportunities in the tax industry for taxpayers and tax professionals alike. Tax professionals specializing in credits and incentives will have their hands full in the coming years. In 10 years’ time we may look back at the passage of the IRA and recognize it as the start of the period where tax planning was dominated by markets of transferable credits and incentives.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Paper Tax Filers Face Long Wait as IRS Digitization Effort Stalls

Paper Tax Filers Face Long Wait as IRS Digitization Effort StallsTax Filing Last April, the IRS launched its Zero Paper Initiative to speed up paper tax return processing. The project isn’t going well.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.