States Eye Higher Taxes for Top Earners

The tax revenue could close budget gaps, but the measures could drive away mobile workers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Talk of tax hikes isn’t limited to Washington, D.C. Several states are also considering boosting taxes on their most prosperous residents.

Jay Inslee, the governor of Washington state, has proposed a 9% capital gains rate on gains of more than $25,000 ($50,000 for married couples). New York Governor Andrew Cuomo has proposed five new, higher tax rates for individuals who earn $5 million or more, with a top rate of 10.82%. Minnesota Governor Tim Walz has proposed a new top tax rate of 10.85% for couples with income of more than $1 million and singles with income of more than $500,000. Walz also wants to impose a capital gains tax of between 1.5% and 4% on profits that exceed $500,000, as well as reduce the state’s exemption from estate taxes.

Pennsylvania Governor Tom Wolf’s plan to raise revenue is broader, in that it would increase the state’s flat income tax from 3.07% to 4.49%. But Wolf also wants to expand the amount of income that low- and middle-income residents can exclude from state taxes, which would end up reducing taxes for those families.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Proponents of the tax hikes say they would help close budget gaps exacerbated by the pandemic, which has forced some states to lay off employees and cut services. But critics say the increases could compel high earners to depart for friendlier jurisdictions.

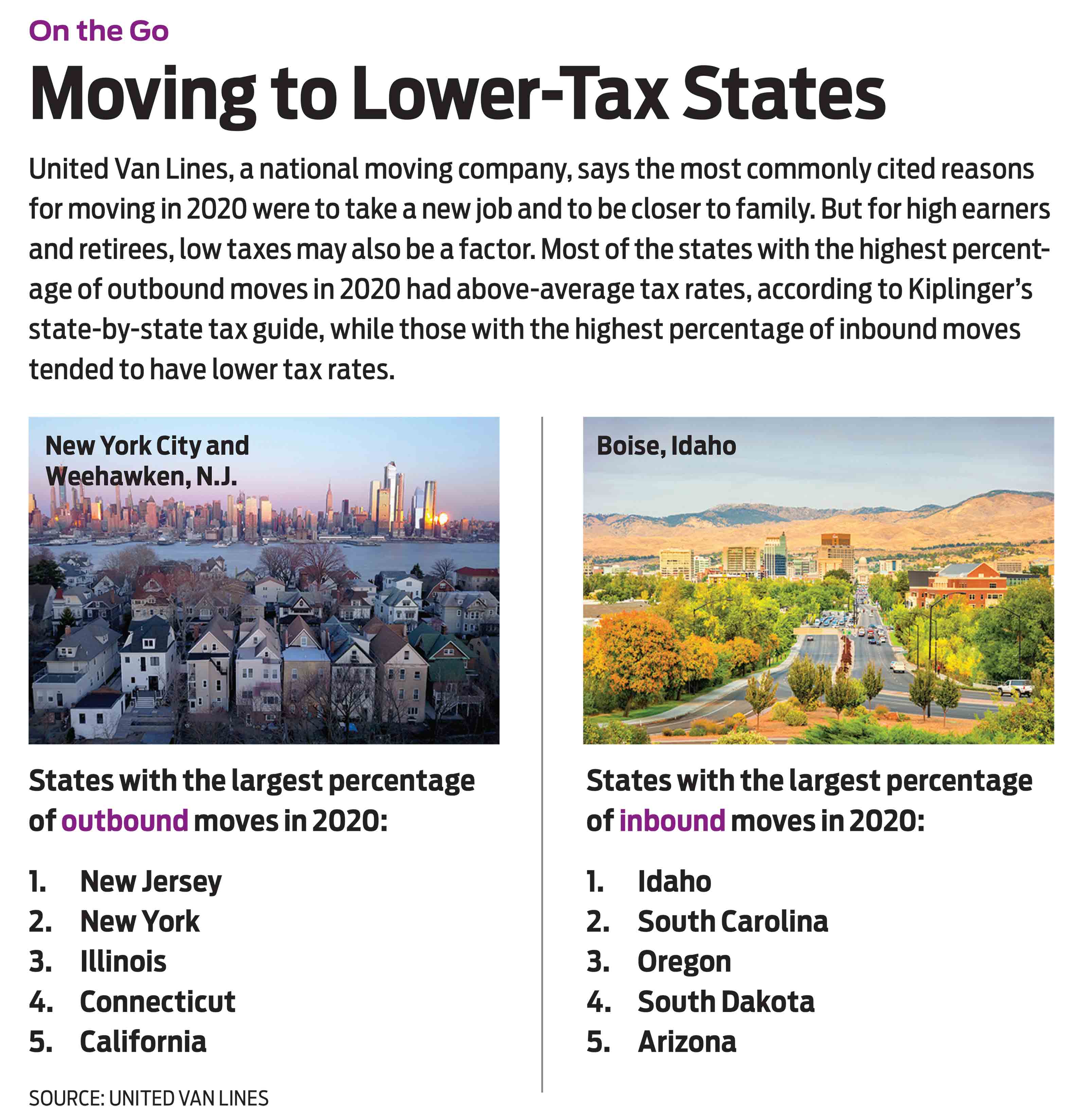

“States like New York and Illinois are already suffering in terms of outmigration, and taxes have something to do with that,” says Katherine Loughead, senior policy analyst for the Tax Foundation (see below). And as more employers allow their workers to do their job remotely, that trend could accelerate, Loughead adds.

Luring a mobile workforce. With that in mind, some states, eager to attract a newly mobile workforce, are proposing significant tax cuts. Mississippi Governor Tate Reeves, for instance, wants to phase out his state’s income tax by 2030; similarly, West Virginia Governor Jim Justice wants to phase out the Mountain State’s income tax in the next few years.

While scrapping income taxes could make a state more attractive to mobile workers and retirees, states still need to pay for roads, law enforcement and other essential services. Justice has proposed a 1.5 percentage point increase in his state’s sales tax to make up for lost income tax revenue. That would put West Virginia in line with other no-income-tax states, such as Tennessee, which rely heavily on sales taxes to pay the bills. (Tennessee’s average state and local sales taxes total 9.55%—the highest in the U.S.)

Critics of a Tennessee-style tax regime say sales taxes are regressive because everyone pays the same rate and low-income residents spend a higher percentage of their income on goods and services than high earners do. “If you eliminate income taxes and increase the sales tax, you’re increasing the burden on low-income residents,” says Richard Auxier, senior policy associate with the Tax Policy Center. “During the pandemic, these are the people that were hit the hardest.”

Auxier also argues that families usually consider a number of factors when considering where they’ll live, including the quality of schools, availability of broadband and updated infrastructure.

Critics of the race to lower taxes point to Kansas, which slashed its taxes in 2012. The governor at the time, Sam Brownback, said the cuts would be offset by a boom in business development. But when the expected revenue failed to materialize, the state was forced to make deep cuts in spending on education and services. Five years after the experiment was launched, the tax cuts were repealed.

If you’re thinking of relocating to another state—or just want to know how your current state stacks up—check out Kiplinger’s State-by-State Guide to Taxes on Middle-Class Families at kiplinger.com/kpf/taxmap and Kiplinger’s Guide to Taxes on Retirees at kiplinger.com/links/retireetaxmap.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?

-

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?Quiz How well do you know the new 2026 IRS rules for wealth transfer and the specific tax brackets that affect your heirs? Let's find out!

-

5 Types of Gifts the IRS Won’t Tax: Even If They’re Big

5 Types of Gifts the IRS Won’t Tax: Even If They’re BigGift Tax Several categories of gifts don’t count toward annual gift tax limits. Here's what you need to know.

-

The 'Scrooge' Strategy: How to Turn Your Old Junk Into a Tax Deduction

The 'Scrooge' Strategy: How to Turn Your Old Junk Into a Tax DeductionTax Deductions We break down the IRS rules for non-cash charitable contributions. Plus, here's a handy checklist before you donate to charity this year.