Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

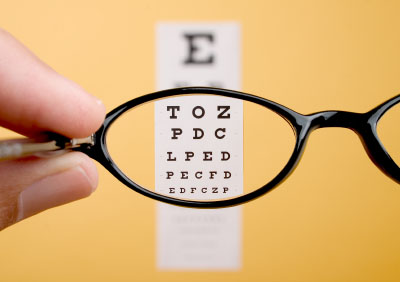

A flexible spending account offered through your employer is a great fringe benefit that lets you pay medical and child-care expenses with pre-tax dollars. Make sure you take full advantage of it when deciding how much to contribute -- because the amount you can set aside for health-care expenses is now limited to $2,500, a rule change from the health-care law that took effect in 2013. Another big change now permits some employers to allow employees to carry over $500 from one year to the next, although not all plans have made this change (see Big Changes to Flexible Spending Accounts).

We put together this slide show as a reminder of the kind of big-ticket expenses you can pay with medical flex-plan dollars and to encourage you to make the most of this benefit. If you’re unsure whether your employer’s plan covers a specific item, be sure to ask your plan administrator.

Weight-Loss Camp

The cost of a weight-loss program, if prescribed by your doctor to treat obesity, can qualify for reimbursement through a medical flex plan. You’ll need to submit evidence of medical necessity when you submit your bill for reimbursement. Summer camps for weight loss range from $600 to $1,000 a week.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

End of Expanded Premium Tax Credit Would Drive Uninsured Rates Higher

End of Expanded Premium Tax Credit Would Drive Uninsured Rates HigherTax Credits Millions of people could become uninsured if Congress fails to extend the enhanced premium tax credit.

-

Over 162,000 Dreamers Cut Off From Affordable Care Act Insurance

Over 162,000 Dreamers Cut Off From Affordable Care Act InsuranceHealth Insurance A federal court in North Dakota has blocked ACA coverage for DACA recipients in 19 states. Here's what it means.

-

2025 Open Enrollment: Some DACA Recipients Can Purchase Affordable Care Act Health Insurance

2025 Open Enrollment: Some DACA Recipients Can Purchase Affordable Care Act Health InsuranceOpen Enrollment Your eligibility to purchase health insurance from the federal marketplace may have changed. Here's what you need to know.

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.

-

Medicare, ACA Call Center Workers To Hold Another Protest: What To Know

Medicare, ACA Call Center Workers To Hold Another Protest: What To KnowMedicare and Obamacare call center employees plan another protest, this time in Washington, DC on December 12.