The Most Popular Apps for Retirement Planning in 2025

A J.D. Power survey ranks retirement planning apps based on customer service and satisfaction. Does your financial app make the cut?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Are you happy with your online tool or app for retirement planning? If you're like most people, the security of that app is as important as its navigation speed or visual appeal. That's the finding from a recent J.D. Power study on how consumers view the digital experience when using mobile or online tools for retirement planning.

Many of these tools act as "data aggregators," linking to your financial accounts at different institutions for the latest balance and investment information. The result is a helpful picture of your assets and portfolio construction in one place. Achieving that clarity, however, means that you need to trust the app with the log-in credentials of your other accounts — making those tools a tempting target for scammers and hackers.

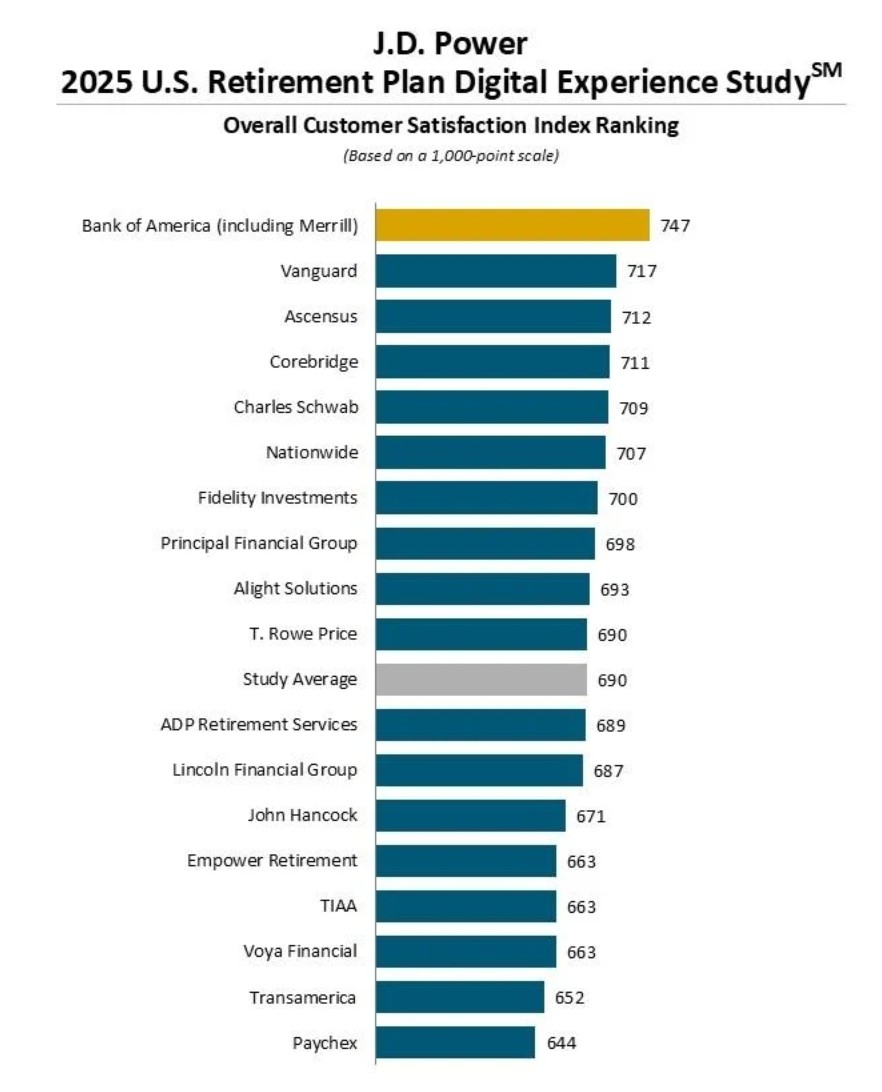

The J.D. Power's 2025 U.S. Retirement Plan Digital Experience Study benchmarked 18 major banks and financial institutions based on a large survey of U.S. consumers. So, did your retirement platform earn a high score?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Security is king when using retirement planning apps

Retirement plans are, obviously, valuable assets worth protecting, and it is clear that those turning to mobile planning apps want to ensure that the apps themselves are secure. As a result, there has been a shift in focus from app users prioritizing convenience to ensuring that these programs are as safe as possible.

"There was a time not long ago when multifactor authentication processes and other digital security measures were dismissed as an annoyance by website and mobile app users," a recent J.D. Power report said. "Now, enhanced security is one of the most critical pieces of the retirement plan digital experience."

Following recent high-profile data breaches, including the 2017 Equifax breach that exposed the data of 147 million Americans, it's not surprising that those who use mobile apps to monitor their retirement accounts would want to ensure that no unauthorized individuals can unlawfully access their plan.

The best (and worst) apps for retirement planning

J.D. Power asked retirement plan users about their attitudes towards digital apps in general and assessed which apps had the highest customer satisfaction. Scores were out of a total possible 1,000 points. Here's how the 18 financial institutions ranked, where a high score is best.

The study measured customer satisfaction across four areas: design, system performance, tools and capabilities and finally, the quality of information provided. The study is based on responses given by 7,151 plan participants in 2025.

For those stuck with a bad retirement planning tool, switching to a different institution's platform might make sense. Yes, it will be painful in the short-term to transfer all of those account credentials, but if you feel the security and user experience is better, you'll be more likely to actually use the app. Just be sure you know what happens to your data when you move it off a given system; you might call customer service to make sure your information has been deleted. Make sure you have opted out of data sharing and de-linked financial accounts where possible.

Remember that the J.D. Power study is just one measure of these tools' usefulness. You should also consider whether they require you to establish a retirement account (in which case, fees and terms are important). Working with a financial adviser with a retirement planning focus is another to set pick a platform. Note that advisers often use their own industry software, such as MoneyGuide and eMoney.

As sophisticated as these platforms are, AI will jump start new innovations in how you work with your financial data. AI is already helping companies protect against security breaches — and making companies and their customers more vulnerable at the same time.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.