How to Calculate Your Retirement Wealth Gap

Another version of your “retirement number,” a simple wealth gap calculation could be eye-opening for retirement savers – especially business owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Whether they admit it or not, many business owners wrestle with anxiety surrounding their financial futures. Maybe you’ve dealt with this yourself. But you don’t have to be fearful about your retirement savings if you plan properly.

I’d like to share a quick calculation with you to help put your fears into perspective and even create plans to put them behind you. What calculation could help to ease your fear? The wealth gap calculation! Basically, it’s the difference between where you currently sit, financially, and where you need to be to live the lifestyle that you want to live during your retirement.

What Is a Wealth Gap?

Imagine you’re standing on a riverbank. The side you’re standing on represents your current financial picture. This is made up of your income and all your current assets. On the opposite riverbank is your retirement. The river in between is the distance between your current situation and your retirement goals. That gap is what you must plan for.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Without planning, that gap might as well be an impassable torrent. As a business owner, you spend all your time and resources working in your business. It’s easy to lose focus on anything other than what is directly in front of you. As a result, you could easily go through a decade or two in your business only to find out that the thing you’ve poured all your blood, sweat and tears into for most of your life isn’t worth nearly as much as you thought it was.

Sadly, this is the reality for many business owners. They come to the end of their careers thinking they will sell their business and live on the proceeds for the rest of their lives. However, only around 4% of businesses actually sell for what the owner believes they’re worth. With numbers like that, it becomes clear that planning for your retirement, outside of your business is a necessity.

Finding How Wide Your Wealth Gap Is

To know how far you are from where you want to be, first, you must know where you are. Therefore, to measure your wealth gap, you must begin with a full assessment of your current income-producing assets, excluding your business and your home. But why should you exclude your business and your home?

I don’t think of a home as an asset because it doesn’t produce an income. Of course, you could sell your home and downsize, yielding a profit, but you would still need to live somewhere, and there will be some cost associated with that whether you rent or own.

Similarly, you can’t include your business in this valuation because you won’t be drawing an income from your business once you’ve retired from it. Once again, I realize that it can be sold, BUT statistically speaking, only about fewer than 20% of businesses are able to be sold. So, you must consider the very real possibility that you will never sell your business when measuring your wealth gap. Therefore, the first step in determining your wealth gap is finding where you currently are.

For a simple illustration, let’s say that you have $1 million, producing an annual income of $40,000 for you (based on the 4% rule).

Where Are You Going?

Just as important, when measuring your wealth gap, is knowing what your retirement goals are. You must have answers to questions like, when do you want to retire? Will you stay in your current home, or will you downsize? Will you be traveling? What sort of lifestyle do you want? The answers determine what your specific retirement number will be. You can’t know which way to go if you don’t know where you’re going, which brings me to my next point.

Oftentimes, business owners live in and through their businesses. What does that mean? Consider this… many business owners list their cellphones as a business expense. The ability to pay for their cellphone through their business disappears when they sell their businesses. Does that mean that when they sell the business, they will no longer have a cellphone? Of course not! It just means that once they are no longer in business, they will have to cover the cost of their cellphone with their personal finances. The same goes for vehicles, Wi-Fi, etc. Once you’ve retired, it’s highly unlikely that you’re going to want to give up the lifestyle that you’ve grown accustomed to.

Therefore, you will need to account for these expenses when calculating how much your lifestyle will cost when you retire. Once again, for illustrative purposes, we will say that your current lifestyle costs around $150,000 per year, or $12,500 each month. But you’re still going to pay taxes. With that in mind, you would need a gross income of around $190,000 (this figure may vary depending on your state’s tax requirements) to meet your retirement needs.

What Is the Wealth Gap Formula?

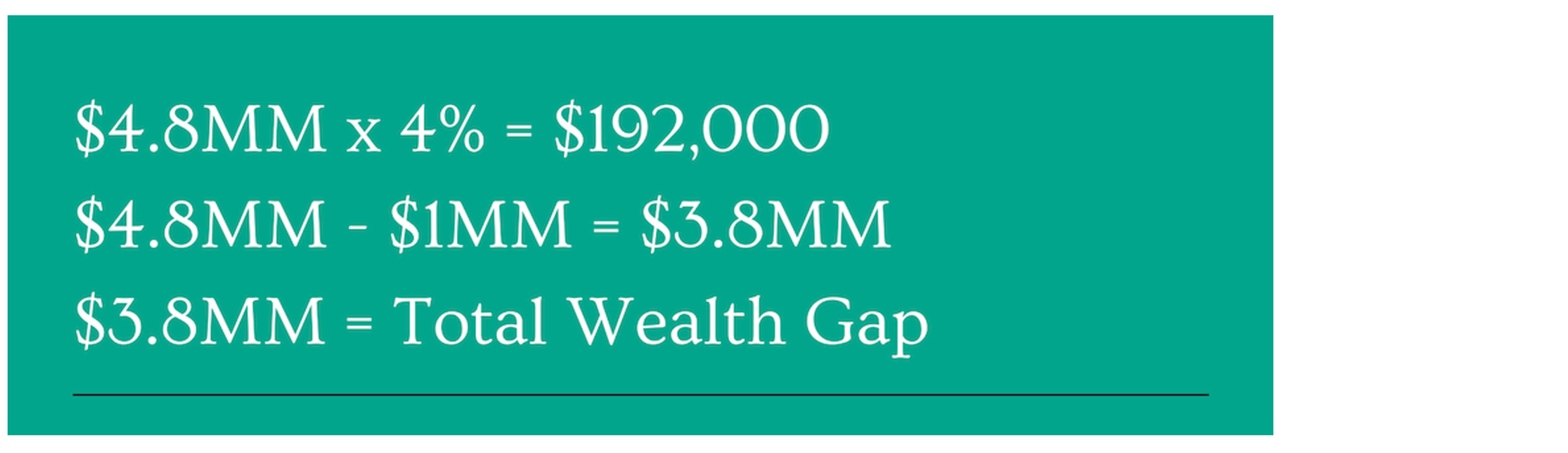

According to our earlier illustration, assume that you have $1 million in assets with a 4% distribution rate. And, once you’ve reached retirement, you will need roughly $190,000 per year before taxes to have an annual income of $150,000 post-tax. So how much do you need to close the wealth gap? Roughly $3.8 million. But how did I come to this number?

First, you must determine where you are currently. Then, find the pre-tax income you will need to continue your current lifestyle throughout retirement. Next, identify the lump sum needed to sustain that income using the 4% rule. Finally, subtract your current assets to find your wealth gap.

In our illustration, you would need $4.8 million to earn the required $190,000 gross annual income from the 4% distribution rate (a figure we got by dividing $190,000 by 4%, or 0.04). And $4.8 million minus your $1 million in assets results in a wealth gap of $3.8 million.

While the formula seems complicated, when explained as a word problem, it is pretty simple:

What about Social Security?

Once again, keeping things as simple as possible, let’s stick with our previous calculation and add an extra $40,000 per year in Social Security benefits. In this illustration, Social Security is extremely valuable because the $40,000 in benefits, added to the $40,000 from your 4% distribution rate, cuts your wealth gap to $2.8 million.

The additional $40,000 per year lowered your wealth gap by $1 million. But you’re still facing a $2.8 million wealth gap. Even if you’re 45 years old, you’d still need to save $8,833 per month with a hypothetical 7% rate of return in order to make up the difference by age 60. If that doesn’t worry you, I don’t know what will. But this is not a hopeless situation.

So, how will you bridge your wealth gap? Your business! But if fewer than 20% of businesses are able to sell and just 4% of those are sold for what the owner thinks they’re worth, how can your business bridge the gap? You must stop working in your business and begin working on it. I work with business owners every day who are proactively working on their businesses to make them more attractive to prospective buyers. They are doing things like decentralizing themselves from their businesses and reviewing and updating their contracts and agreements to mitigate their company-specific risk.

Your business is your No. 1 asset. Although you want to diversify outside of your business, you must do all you can to increase its value and prepare it for an eventual transfer. If you aren’t working every day to make your business more transferable than it was yesterday, you will never close your wealth gap. If you’re not doing that, you could find yourself working in your business well into your 60s, 70s or even your 80s.

In Conclusion…

This information isn’t meant to discourage or frighten you. Instead, I’m showing you how to take action, so you no longer fear for your retirement. The wealth gap calculation that I’ve just shared is only the first step. By using this calculation, you can quantify your goals. You know exactly where you are and just how far away your retirement goals are on the opposite side of the river.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Justin A. Goodbread is a CERTIFIED FINANCIAL PLANNER™ practitioner and an adviser with WealthSource® Knoxville. After years of working in a large firm, he ventured out on his own in 2009, starting Heritage Investors, and eventually joining WealthSource® Partners LLC in 2022. As a serial small-business owner, Goodbread has bought and sold multiple businesses. He uses this experience, along with his continuing education, to help business owners grow and sell what is often their largest asset.