How to Age Gracefully: Learn from Bill Gates, the Who and David Attenborough

Getting old isn’t nearly as bad as many people think it will be. Nor is it quite as good. Maybe it’s somewhere in between.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Aging. Arthritis, heart disease and dementia. That doesn’t exactly sound like hopeful aspirations for a future you. But here’s the thing. Aging isn’t all bad, and much of how you view growing old has to do with your mental makeup. The fact is, not everyone gets to be 40 and have wrinkles. Or, like Bill Gates, Pete Townshend of the Who and David Attenborough, not everyone gets to live out their lifelong dreams as an OG.

Thanks to advancements in healthcare, education, and frankly, forming better habits, life spans have increased dramatically. In 1900, the average life expectancy for men and women in the U.S. was 47 years. By 2019, that number had risen to nearly 79 years, according to the Centers for Disease Control and Prevention. And according to forecasts by the U.S. Census Bureau, the number of Americans living to 100 and beyond is expected to quadruple by 2054.

So, what does it mean to age gracefully? And what can we learn from these resilient seniors?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bill Gates

Bill Gates

Bill and Melinda French Gates created the Gates Foundation in 2000. At that time, they planned for the organization to continue its work for several decades after they died. But last week, the billionaire Microsoft founder announced his plans to distribute “virtually all” of his wealth (an estimated $200 billion) within the next 20 years, before winding down the foundation in 2045. In the first 25 years, the Gates Foundation gave away more than $100 billion to develop new vaccines, diagnostic tools and treatment delivery mechanisms to fight disease around the world.

“People will say a lot of things about me when I die, but I am determined that ‘he died rich’ will not be one of them,” Gates, who turns 70 later this year, wrote in his blog. “There are too many urgent problems to solve for me to hold onto resources that could be used to help people. That is why I have decided to give my money back to society much faster than I had originally planned."

The announcement comes weeks after Microsoft, now worth more than $3 trillion, marked 50 years since it was founded by Gates. “It feels right that I celebrate the milestone by committing to give away the resources I earned through the company,” he wrote.

Gates may or may not age gracefully, as no one sees him slowing down anytime soon, but his legacy will clearly go on for decades.

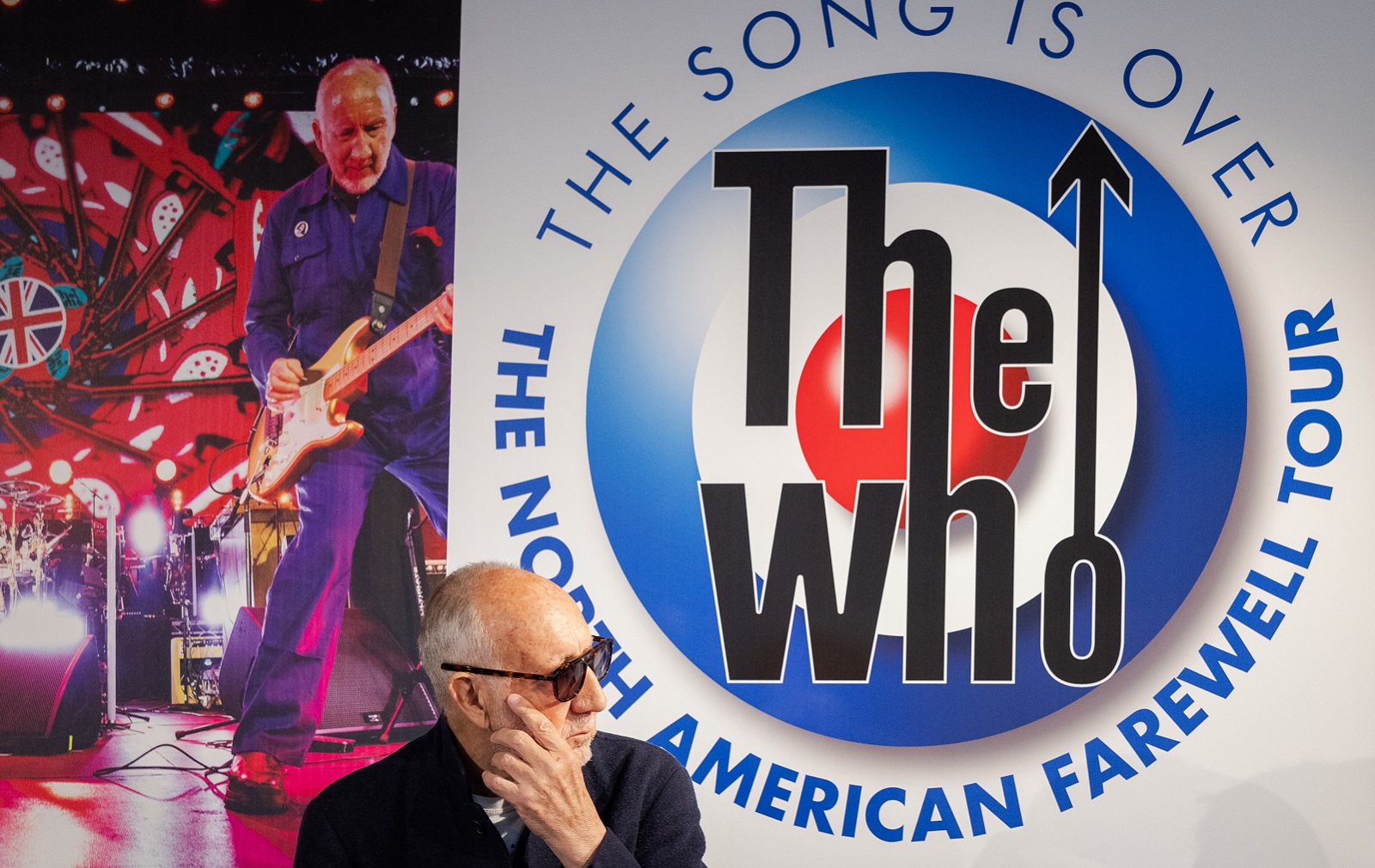

Pete Townshend and The Who

Pete Townshend of the Who

Fifty-five years after co-founding the rock band The Who, Pete Townshend, who turns 80 in May, is still going strong. The Who will kick off the aptly named The Song is Over North American Farewell Tour – billed as a “truly grand finale” – on August 16 just outside of Fort Lauderdale, Florida, and wrap in Las Vegas on September 28. They've had a few other alleged farewell tours over the years; therefore, the "truly grand finale" reference.

The Who is still regarded as one of the most influential rock bands of the 20th century, earning a reputation as one of the greatest live rock acts, for their performances at Monterey and Woodstock.

In 1965, Townshend thought time was against him. He, like most of his contemporaries, believed that a rock ‘n’ roller couldn’t maintain credibility much beyond age 25 because rock music belonged to young people. But something changed. “I’m doing all kinds of interesting things, theatrical projects, art projects, book projects, working. I’ve done four record productions in the past couple of years,” Townshend said in an interview with Rolling Stone. “I’m really active on music and doing stuff and trying to keep myself fueled up.”

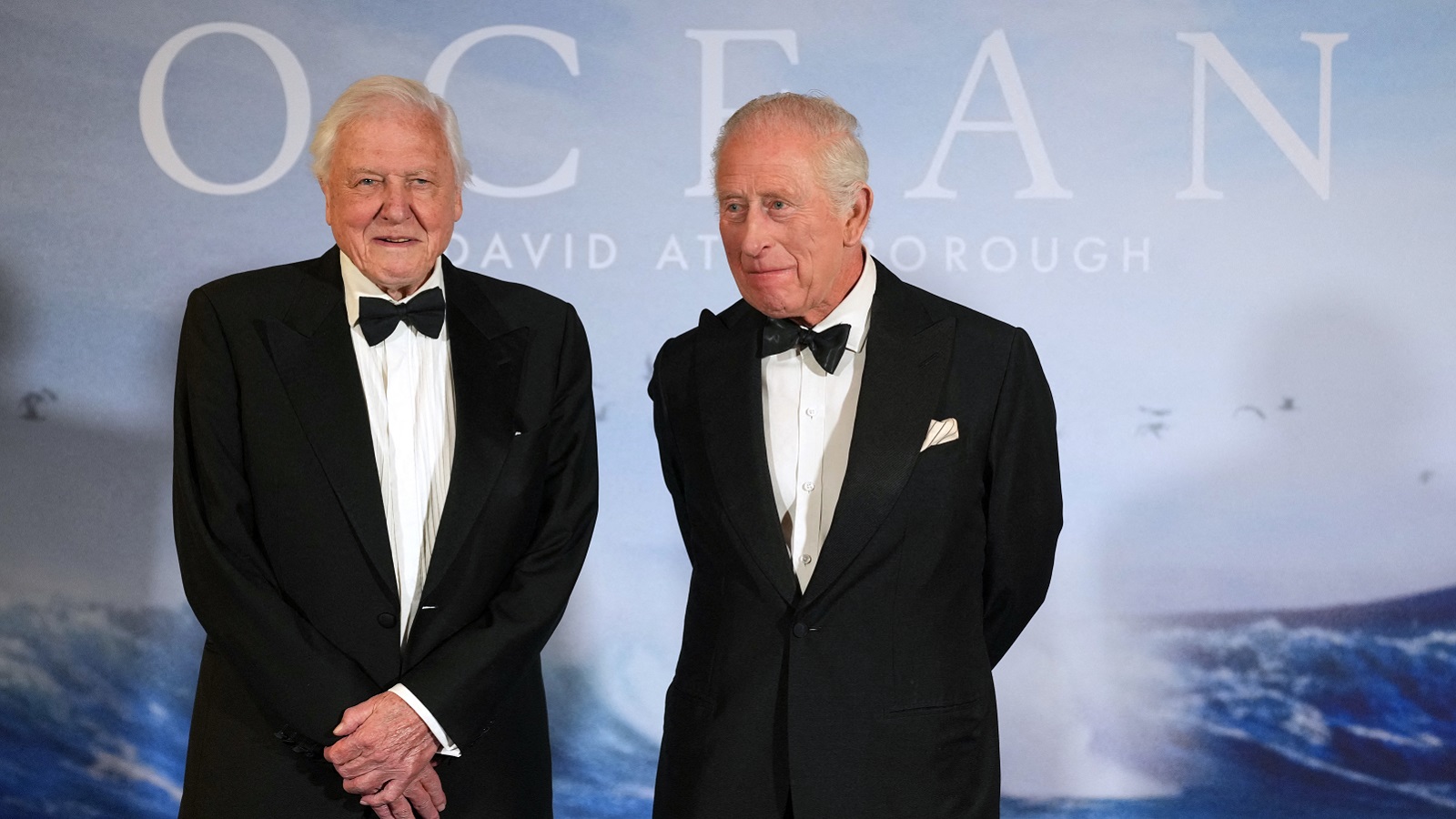

Sir David Attenborough

Sir David Attenborough and King Charles 3

David Attenborough, best known for his work primarily focused on the wonders of the natural world and his support of environmental causes, turned 99 in May. His filmography as writer and narrator has spanned eight decades, and includes Natural World, Wildlife on One, the Planet Earth franchise, The Blue Planet, and its sequel.

Over the years, Attenborough has advocated for restoring planetary biodiversity, switching to renewable energy, mitigating climate change, and more. Now, Ocean with David Attenborough has made its way onto the cinema screen. So much for slowing down.

Final word

There’s something circumspect about aging gracefully, as if the careful reflection of years past brings clarity to the present. In a survey by Pew Research Center, respondents aged 18 to 29 believe that the average person becomes old at age 60. Middle-aged respondents put the threshold closer to 70, and respondents aged 65 and above say that the average person does not become old until turning 74.

But aging isn’t just about counting the candles on your birthday cake. It’s so much more. Just ask Morgan Freeman, Harrison Ford, Betty White, Colonel Sanders, or Albert Einstein. It’s never too late to switch gears in life and retire on your terms — mentally, physically, and financially.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

For the past 18+ years, Kathryn has highlighted the humanity in personal finance by shaping stories that identify the opportunities and obstacles in managing a person's finances. All the same, she’ll jump on other equally important topics if needed. Kathryn graduated with a degree in Journalism and lives in Duluth, Minnesota. She joined Kiplinger in 2023 as a contributor.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.