Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Donor-advised funds (DAFs) are one of the fastest-growing forms of philanthropy in the United States, with over $52 billion granted to charities in 2023.

One of the many benefits of a DAF is the potential for charitable dollars to grow tax-free, which can have a tremendous impact. For example, Daffy members set aside over $105 million for charity last year, and since then, their accounts have grown by over $30 million — an incredible amount raised for charity.

Unfortunately, there is little guidance on developing an investment strategy for a DAF, which is distinctly different from selecting investments for a retirement account. In a retirement account, the primary factors driving investment decisions are typically time horizon and risk tolerance. There’s often a singular goal: building a large enough nest egg to last through retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In contrast, the goals for a DAF can vary widely. Some donors contribute regularly, matching their annual giving with weekly or monthly deposits. Others contribute opportunistically, overfunding their accounts in profitable years to support giving in leaner times. Additionally, some donors aim to create a long-term fund that supports annual donations to specific charities for decades, or even indefinitely, like an endowment.

As a result, designing the right portfolio for a DAF requires understanding the giving strategy of the donor.

How to match your investment strategy to your giving goals

Let’s explore a few scenarios to demonstrate different strategies donors might use when investing through their DAF.

A pay-as-you-go plan. Let’s imagine a client named Leah. Leah uses her DAF to donate about $5,000 annually to her child’s school, alongside a few other local and national charities. She contributed $2,000 up front to prepare for an upcoming school fundraiser and established recurring monthly contributions of $300 to support her ongoing giving.

Since Leah plans to distribute most of her contributions this year, she would likely benefit from a conservative portfolio allocated to short-term Treasury bills.

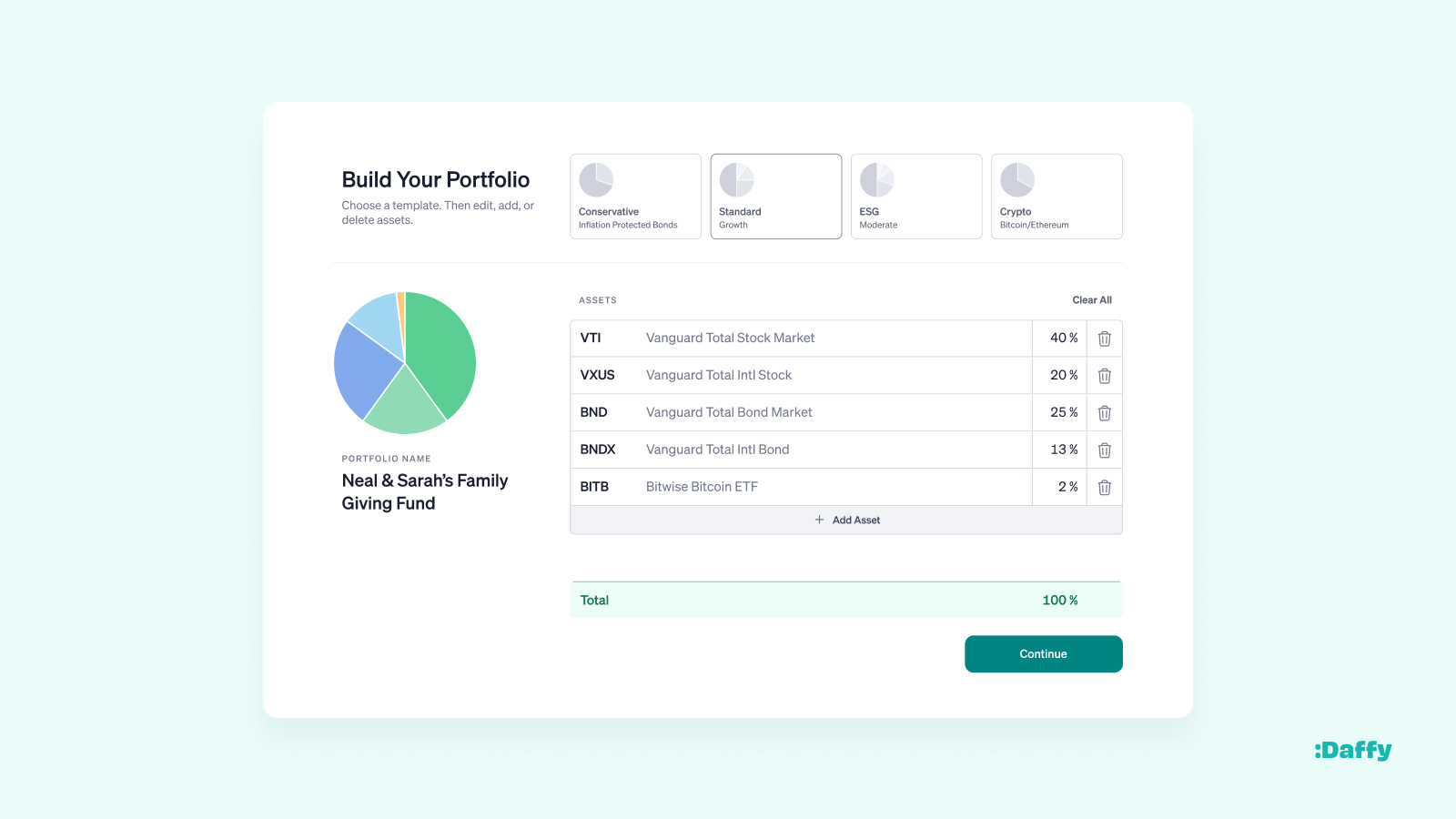

A growth plan. Now consider Neal and Sarah. The couple’s income is fairly stable most years, but Neal’s company went public this year, resulting in a substantial stock-based windfall. They usually donate around $10,000 a year, but they decided to contribute $100,000 this year to their DAF to help manage their increased tax burden from Neal’s stock sales. As a result, most of the funds in their portfolio will be invested for five years or more.

For this couple, a low-cost, globally diversified portfolio of stock and bond funds makes sense. They might even include a small allocation to bitcoin. With a tax-free, automatically rebalanced portfolio in a DAF, their portfolio runs little risk of becoming overweight with high-risk assets.

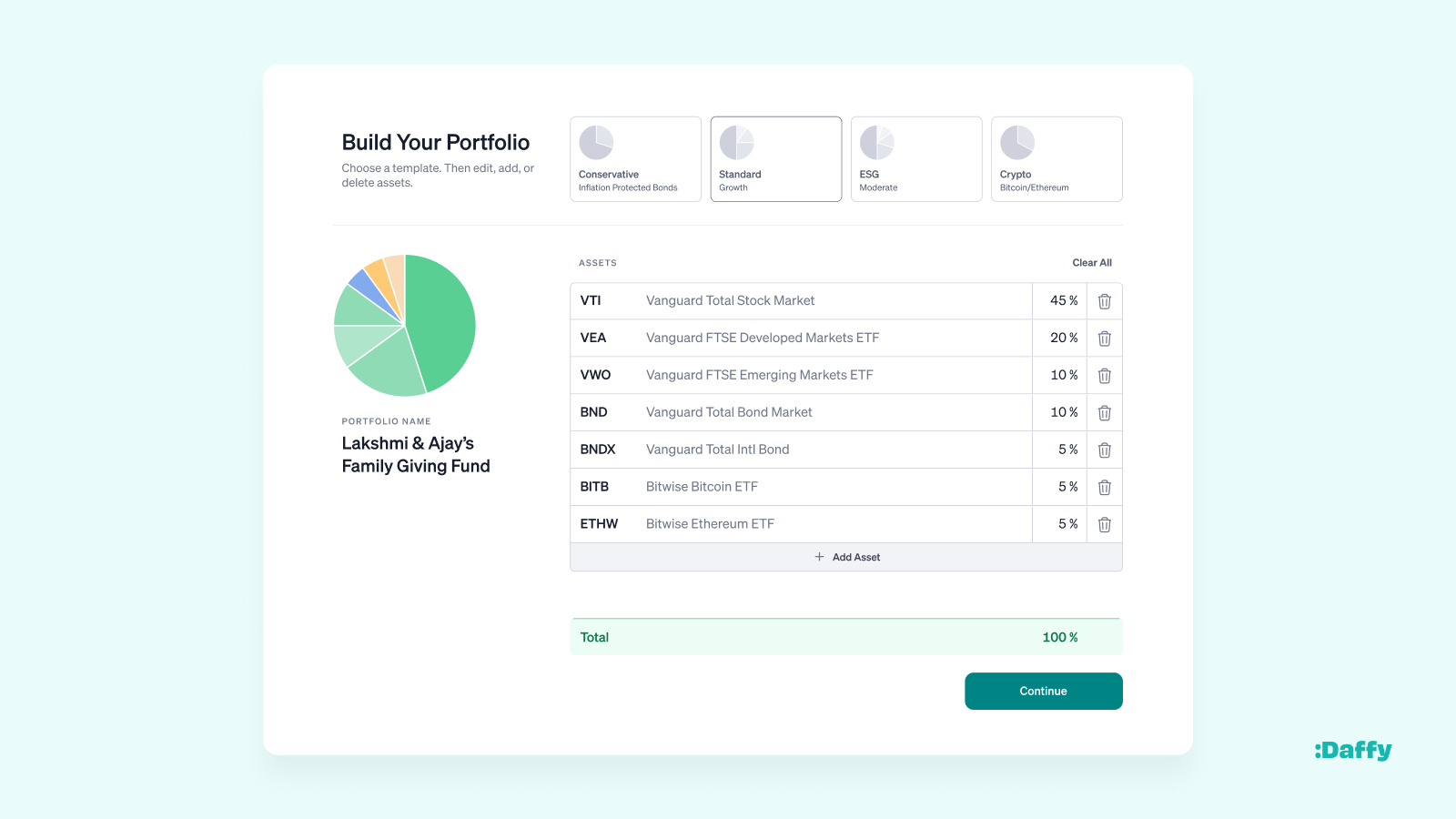

An endowment plan. Finally, meet Lakshmi and Ajay, who have both had successful careers and wish to create a lasting family legacy through their DAF. They have funded their DAF with over $750,000 in low-cost-basis mutual fund shares that they have held for over 20 years, avoiding any capital gains taxes on those investments. They plan to donate $25,000 annually for the next 20 years, with the intent that their children, Justine and Janan, will eventually succeed in managing the fund.

Given their long-term outlook, an aggressive diversified portfolio with growth-focused investments may be ideal, ensuring that their philanthropic efforts can endure for generations.

The impact of a thoughtful DAF investment strategy

The beauty of a DAF is that it offers the flexibility to adapt your investment strategy to your giving goals, no matter how short term or long term they may be. While not all donor-advised platforms in the U.S. offer clients and advisers the flexibility to customize their portfolio, some, like Daffy, give you the flexibility to select from hundreds of high-quality, low-cost ETFs to fit your giving strategy. (Full disclosure: I am a co-founder and the CEO of Daffy.)

For the 50 million to 60 million U.S. households that give to charity every year, giving is not just a one-off transaction. For many households, it is one of the most important financial goals for their family and their legacy.

So whether you’re looking to fund immediate charitable contributions, leverage market opportunities to maximize future donations or create a legacy that will benefit generations to come, matching your DAF portfolio to your giving strategy is key to making a lasting impact.

The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.

Related Content

- Donor-Advised Funds: A Tax-Savvy Way to Rebalance Your Portfolio

- If You Give to Charity, ‘Bunching’ Could Save You Thousands

- Which Type of Donor-Advised Fund Is Right for You?

- Should a Donor-Advised Fund Be Part of Your Estate Plan?

- A Donor-Advised Fund Can Give Your Charitable Giving a Boost

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Nash is the co-founder & CEO of Daffy.org, the Donor-Advised Fund for You™, an innovative, fast-growing platform for charitable giving. With no minimum to get started, industry-low fees and ground-breaking technology, Daffy brings the donor-advised fund back to its original goal of helping people be more generous, more often. Adam has served as an executive, angel investor and adviser to some of the most successful technology companies to come out of Silicon Valley. He is currently on the Board of Directors for Acorns, the country’s fastest-growing financial wellness system, and Shift Technologies.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.