How Index-Linked Annuities Buffer Against Market Shocks Like the Coronacrash

This relatively new type of annuity protects investors from any market losses … up to a certain point. That protection could give you the courage to stay in the ring when others leave the fight.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"Risk is an arbitrary concept until you experience it. Talking about being punched in the face is different from...actually being punched in the face." – Carl Richards, Certified Financial Planner™ and creator of the Sketch Guy column

Markets shed 40% back in March as efforts to slow the spread of coronavirus drove the economy to a near halt. Though they bounced back remarkably fast, the economic outlook is uncertain, unemployment is high, and volatility is expected to remain until COVID-19 vaccines are widely distributed and are finally bringing the panemic under control.

We're in uncharted waters, and our life rafts may not work the way they used to. After six years of quantitative easing and the hangover from it, bond yields remain paltry. De-risking via higher allocations to fixed income appears to no longer be as effective as it once was.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

New Problems, New Solution

In March, the Life Insurance Marketing and Research Association (LIMRA) reported that 2019 sales of a relatively new kind of annuity called an index-linked annuity (ILA) grew 55% from 2018. This growth may have been inspired by the late 2018 correction when markets shed $2 trillion. But it may also hint at a broader appetite due to the secular trend of exceptionally low interest rates, the looming specter of tail risk (rare and terrible market events), and a swell of baby boomer retirees.

Research from annuity data gurus at WINK reports that the average issue age for all ILAs is 62. This suggests that folks are employing these protections to buffer against portfolio losses in the "fragile decade." The fragile decade is the period of time from the last five working years through the first five years of retirement when sequence-of-returns risk may threaten a retiree's ability to outlive their savings.

Developed over a decade ago, the index-linked annuity allows investors to benefit from market participation, while buffering against losses through a limit of, say 10% — meaning that the first 10% loss is covered by the insurer, and any losses beyond that are on you. Because they buffer against losses, index-linked annuities are also known as buffer annuities. Another name they go by is registered index-linked annuities (RILA).

The protections an index-linked annuity offers come with a tradeoff. Folks seeking more protection via a higher buffer may sacrifice growth potential relative to the amount of risk they transfer to the company issuing the ILA.

For example, choosing a 10% buffer could allow for uncapped participation on the upside, while choosing a 20% buffer may limit upside via the cap to 20% in the chosen crediting method.

Does an ILA Sound Familiar?

If you are acquainted with fixed indexed annuities (FIA), then index-linked annuities may seem familiar. Both are touted for their ability to protect portfolios against market losses with upside potential, but unlike fixed indexed annuities — which protect against any losses in a given period — index-linked annuities offer variable returns that may include losses.

So, though both are relatively conservative plays, index-linked annuities can be a little bit riskier to own than fixed indexed annuities. But they, in turn, offer greater upside potential as well. Indexed-linked annuities are registered with the SEC, which means they are sold with a prospectus. This is unlike a FIA and makes ILAs more tightly regulated and under stricter disclosure rules.

ILA Results In the Real World

How effective can index-linked annuities be in real-world investing situations? Or, said differently, what happens when we get punched in the proverbial face, by the coronavirus or some other disaster? The five-year period beginning March 1, 2015, offers at least a few harrowing declines against which to measure.

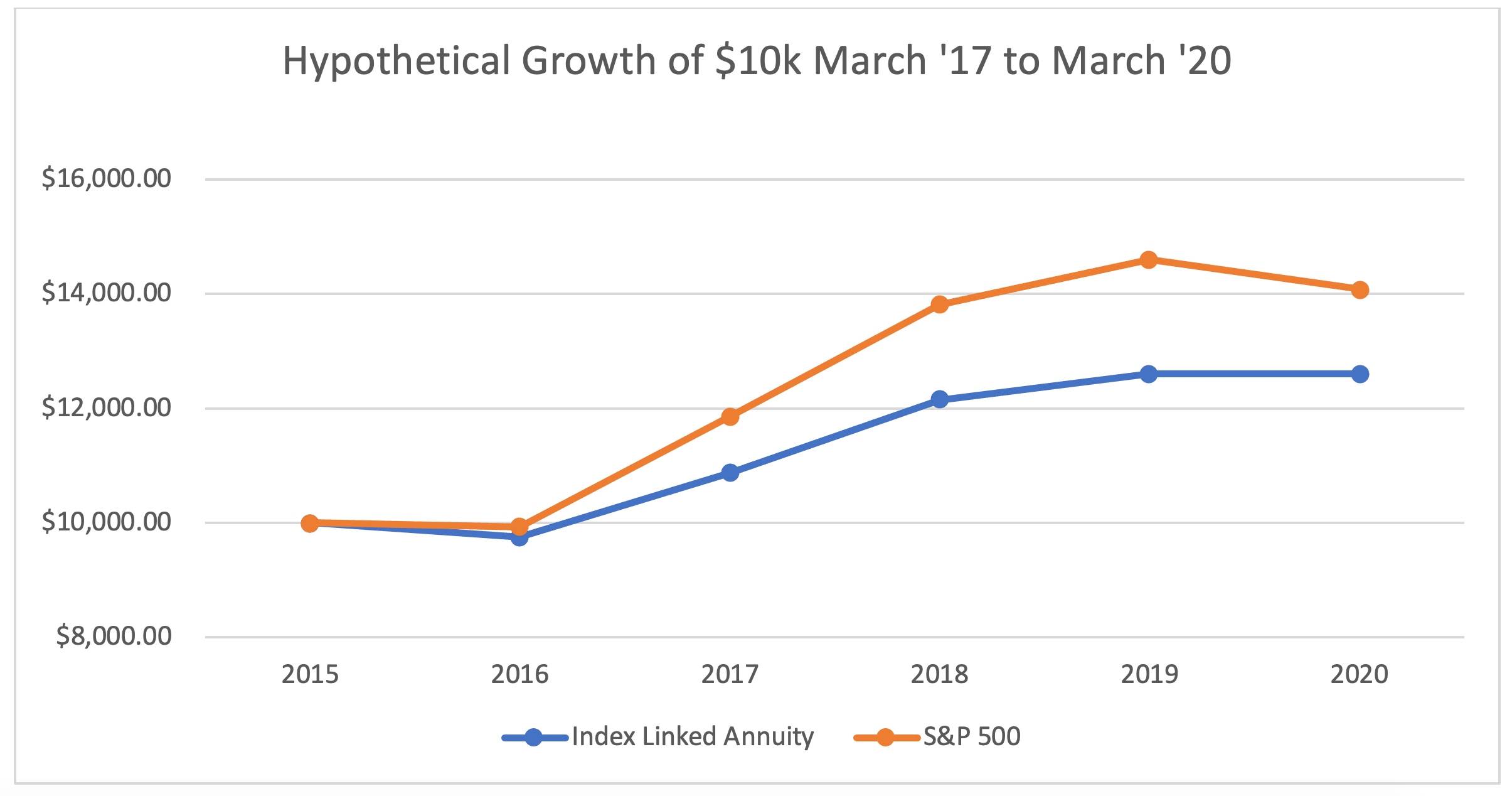

Using historical returns, let's look, for instance, at the hypothetical growth of $10,000 in a hypothetical index-linked annuity.

For this comparison I made the following assumptions:

Tax-Deferred investment in Hypothetical ILA

Details

Point-to-point annual crediting method following the S&P 500 index (minus dividends)

Cost

0.25% poduct fee (Collected annually)

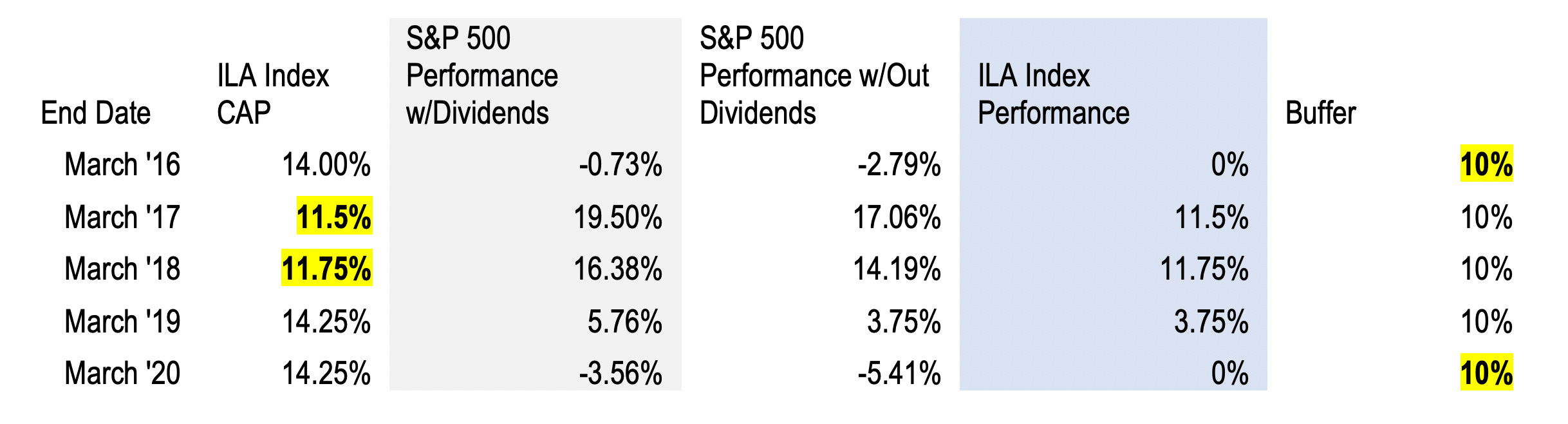

Index Caps* for '15, '16, '17, '18, '19

14%, 11.5%, 11.75%, 14.25%, 14.25%

Buffer

10% (Meaning investors lose nothing until the S&P's losses surpass 10%)

Note that the index “Caps” are the maximum performance you may be credited in a given year via the chosen crediting method. Depending on the buffer chosen, those caps may be set at something like 10% or 20%, or they may be uncapped, meaning that an investor would be credited for the full index performance in a given period (without dividends factored in). Caps are reset annually based on interest rates, which is why we list a different cap for each year in the table above. Read this index-linked annuity article for the basics.

Method

For our purposes I simplified the math and calculated the gains annually from historical returns in economist Robert Shiller's market data set via the The S&P 500 Dividends Reinvested Price Calculator at dqydj.com. I then subtracted the ILA fees (0.25%) at the end of each term to arrive at the annual gain (without dividends).

Results

In the table above I highlight instances where the hypothetical ILA cap and buffer came into play during the five-year stretch from March 2015 to March 2020.

From March 2015 to the following March, global markets experienced tremendous turbulence tied to a decline in oil prices, the devaluation of the Yuan, slowing Chinese GDP growth and Brexit. In that period, the S&P lost 2.79% (without dividends factored in) — losses that would have been protected by the ILA's 10% buffer.

Markets rebounded strongly in the following period — with the S&P 500 ending at +17.06%, sans dividends, in March of '17. As a result, 11.5% of investment gains would have been credited to the ILA.

Performance of the S&P 500 from March 2017 to March of 2018 S&P 500 was also terrific: 14.19% without dividends factored in. In that case, performance was again higher than the cap, so the ILA crediting method would have hypothetically returned 11.75%.

Later in 2018, however, the S&P 500 posted its largest annual loss since 2008, before rebounding again in 2019. In the period from March '18 to March '19, the S&P returned 3.75% without dividends, the full amount of which would have been credited to the ILA's performance for that year.

And the bull kept running into 2020 before slamming into the COVID-19 wall. In March of this year, returns in the S&P 500 index fell to -5.41% — inside the buffer — so the loss would have been absorbed and the ILA crediting method would have been flat for the year.

Though the sell-off of 2015/16, crash of 2018, and coronacrash of this year were shocking events, markets rebounded rather quickly.

Comparing Performance of ILA vs. S&P

If you were to chart the ILA's performance using the S&P 500 as a benchmark (see chart above), the ILA would have underperformed (26% return for ILA va. 41% for S&P), but that can be misleading. That sort of comparison implies that an ILA has the same risk/return profile as equities, which it does not, and it presumes a typical equity investor stayed the course over that five-year span, riding out three major dips and subsequent rebounds.

Research from Dalbar may suggest otherwise. In their 26-year "Quantitative Analysis of Investor Behavior" study, researchers from Dalbar have learned that investors often get in the way of themselves. While the S&P 500 index averaged a 9.85% return of the 20-year period ending 12/31/2015, the average equity fund investor earned only 5.19%.

Why? Investor behavior is capricious. Fear and greed can spoil the best long-term investing goals. We buy high and sell low and generally submarine our best efforts to accumulate wealth. And this isn't just some of us. This is many of us.

So the question is: How would the same hypothetical ILA perform against the average equity investor over that same volatile period? Or what could really happen when we get punched in the face?

What an ILA Could Accomplish for You

An index linked annuity certainly isn't a one-size-fits-all solution. But for investors facing sequence of returns risk, allocating a portion of a portfolio to an ILA may protect their metaphorical mugs from a devastating haymaker in the "fragile decade." Portfolio losses during this period can be difficult to make up and may impact lifestyle choices for decades.

This is a behavioral protection: Transferring some risk to an insurance company for some certainty of a defined outcome. The promise of some return and protection against losses may inspire the confidence to stay in the market and on track to hit investing goals, rather than waiting around for the next punch in the face.

If you are loss averse, behavioral tools to help you stay the course can be powerful in times like this. Keep your guard up and talk to your financial adviser about your options.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Stone is founder and CEO of RetireOne™, the leading, independent platform for fee-based insurance solutions. Prior to RetireOne, David was chief legal counsel for all of Charles Schwab's insurance and risk management initiatives. He is a frequent speaker at industry conferences as well as an active participant on numerous committees dedicated to retirement income product solutions.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.