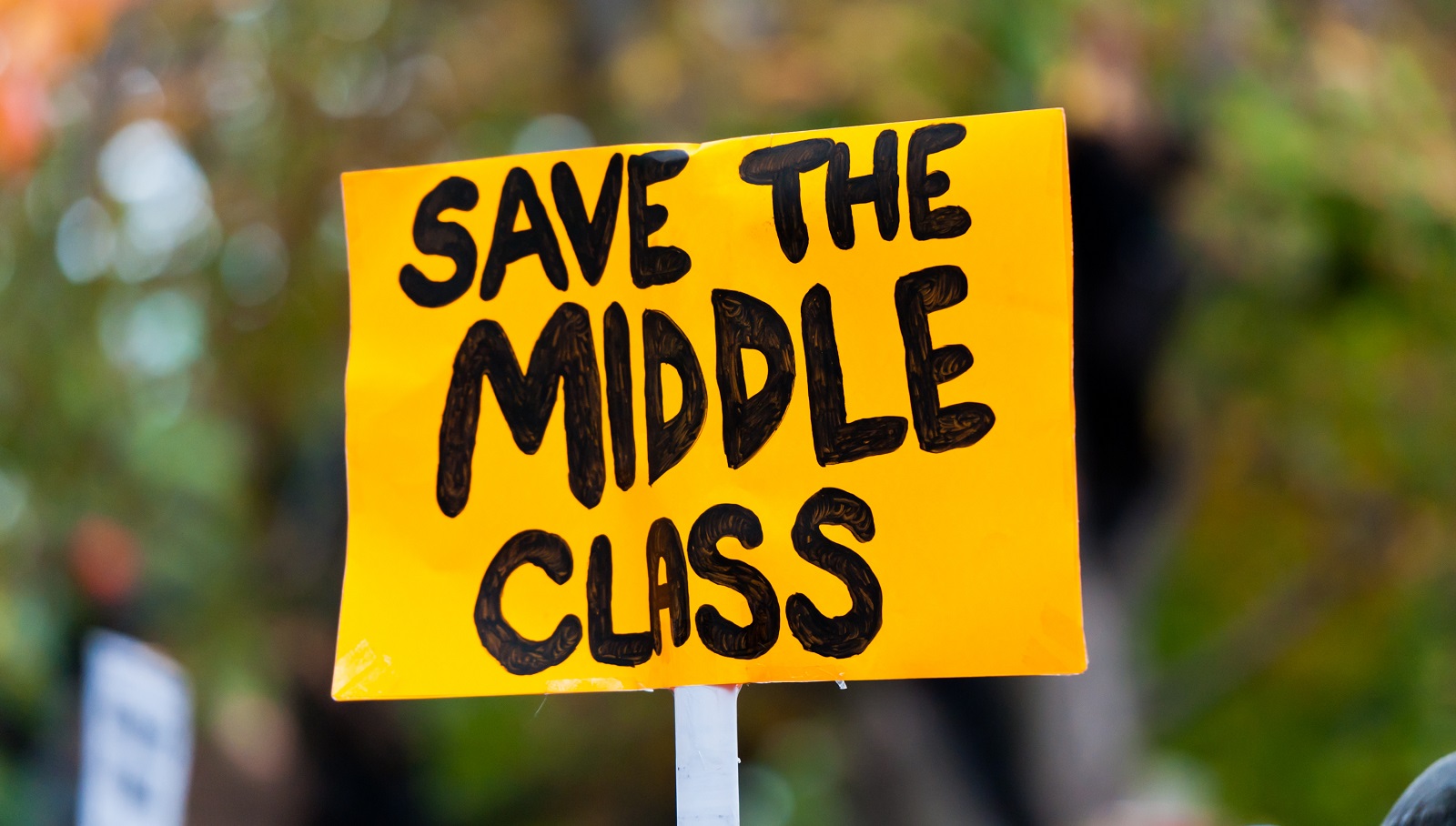

The Middle Class is Shrinking - Are You Still In It?

The middle class is being affected by a variety of factors including inflation, the aging population and remote work, report shows.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The middle class is shrinking as a result of several factors including surging inflation, an aging population, and the rise of remote work, according to a new report from ConsumerAffairs.

The federal poverty level for a family of four is $30,000 this year, according to the Department of Health and Human Services. Before taxes, the median (middle class) household income was $74,580 in 2022, according to the most recent U.S. Census Bureau data.This stands at a 2.3% decrease from the 2021 estimate of $76,330.

Some families that were considered middle class in 2020 may no longer be as inflation has surged, peaking at 9% in June 2020, according to ConsumerAffairs.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Financial insecurity and rising debt are just some of the growing issues that U.S. households face.

Using the Pew Research Center’s income calculator that determines the minimum annual income required to be middle class in each state, ConsumerAffairs made some calculations based on 2018 data.

ConsumerAffairs then put those findings into the inflation calculator of the U.S. Bureau of Labor Statistics to refine the data further to show the state-by-state minimum annual income required for a family of four to be considered middle class this year.

Lowest and highest numbers

From that list, here are the top-five states with the lowest minimum required income: Alabama ($51,798), Arkansas ($51,798), Arizona ($57,964), West Virginia ($59,197), and Mississippi ($60,431).

The top-five states with the highest minimum required income are: Hawaii ($82,630), the District of Columbia ($81,396), New York ($81,396), Connecticut ($80,163), and New Jersey ($80,163).

ConsumerAffairs cites Oliver Rust, head of Product at independent inflation data aggregator Truflation, as saying that the middle class, which historically has been the engine of economic growth, now accounts for a lower share of income than it did from 1960 through 1980. Rust said this is partly because of demographic changes “as the population has seen a particularly steep increase at the extreme bottom and top of the economic spectrum” since the mid-2000s.

More changes may lie ahead, he said, as factors including the combination of an aging population, which usually lives off savings and generates little income, and an increased number of immigrants, tend to lower median incomes.

Another factor, Rust said, is remote work wage-earners who relocate from one state to another where their dollars might stretch further.

To stretch dollars further

Another factor could also be that some wage-earners are looking to make their dollars go further by relocating to a state with a lower tax burden. Kiplinger recently looked at each state’s median annual salary and calculated the average annual tax spent for three main tax categories: state income tax, property tax and sales tax on essential items.

Check out the full report for details on why these states made the list: Wyoming, Nevada, Tennessee, Florida, North Dakota, Alaska, Arizona, Washington, South Dakota, and Louisiana.

RELATED CONTENT

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joey Solitro is a freelance financial journalist at Kiplinger with more than a decade of experience. A longtime equity analyst, Joey has covered a range of industries for media outlets including The Motley Fool, Seeking Alpha, Market Realist, and TipRanks. Joey holds a bachelor's degree in business administration.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.