Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

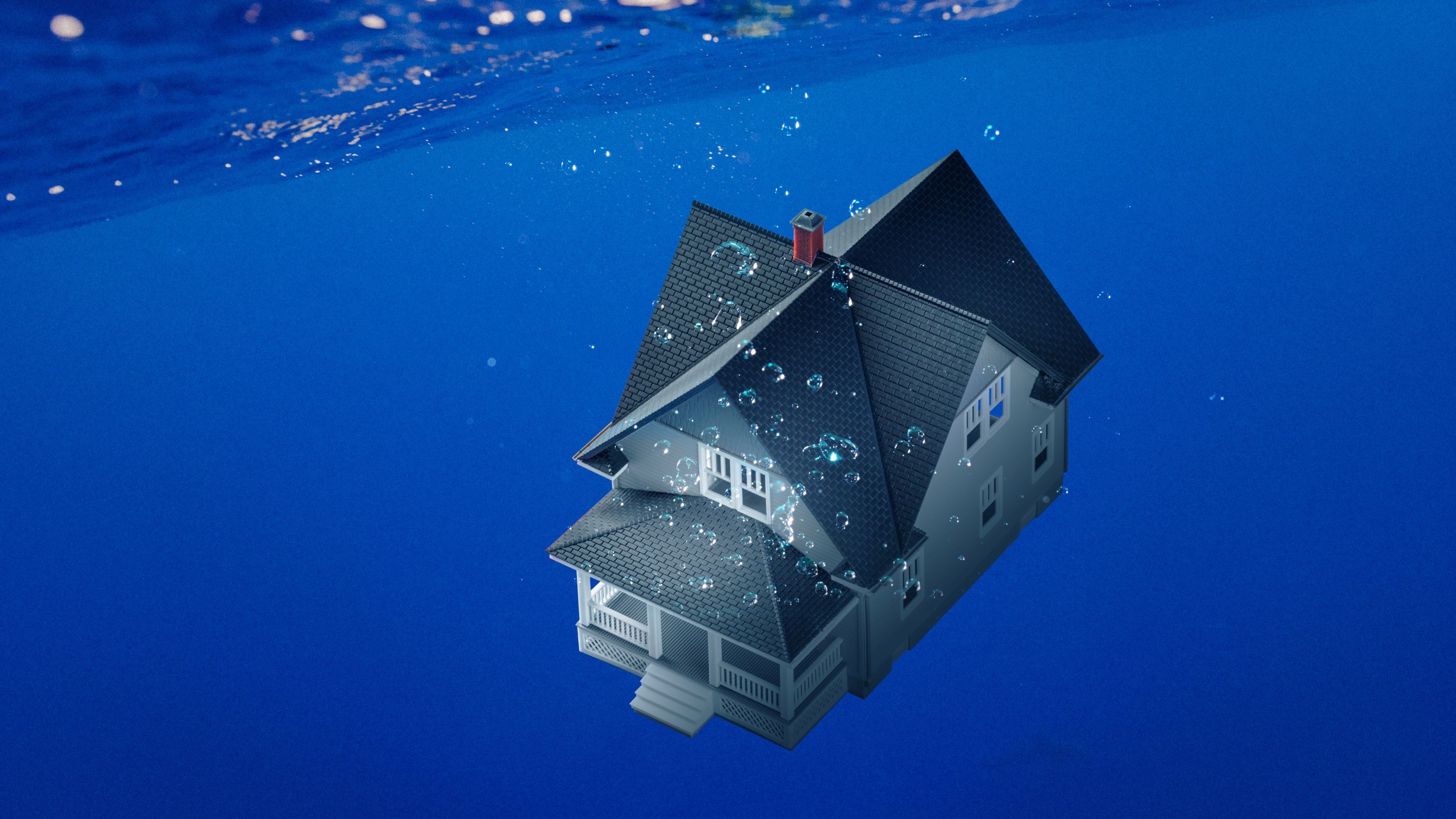

The banking crisis that has seen First Republic, Silicon Valley Bank and Signature Bank all collapse could become a moment of panic for savers. But it doesn’t need to be if you follow logic rather than emotion.

The important thing to remember with savings safety is that most accounts come with significant protection, such as the $250,000 per person safety net offered by the Federal Deposit Insurance Corporation, which means if your bank went bust and you didn’t have any more than that saved, you’d get your money back.

If you have money in a credit union you are covered up to $250,000 per member by the National Credit Union Administration. Similarly, investors are protected via the Securities Investor Protection Corp if the firm holding their money fails (not if the underlying investment tanks) by up to $500,000.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

I thought I’d lost my down payment for a home - but I was protected

I want to tell you a tale from my experience of a banking crisis and the emotional rollercoaster it can trigger, and why it is important to stay calm and follow your head rather than your heart when it comes to savings safety.

I am based in the U.K. and we, like the U.S., were hit badly by the financial crash of 2007-2009. Right in the thick of the crisis, when Lehman Brothers was going bankrupt, some U.K. banks experienced the same meltdown, even if they weren’t quite the size of Lehaman.

One of those was a lesser known name called Kaupthing Edge UK, which was the U.K. arm of one of the many Icelandic banks that had sprung up that decade and were offering highly attractive interest rates.

I took advantage of those high rates and put most of my savings into Kauthing, which I hoped to use to buy an apartment when the time was right (and I eventually did).

However, the Icelandic banking system crashed and took Kaupthing with it. I remember the day well when, as a personal finance journalist, I was gathering information from Kaupthing’s PR agency to help get that news out to worried readers and viewers, but I was also one of those worried individuals, which made it a strange experience.

My money was ultimately protected by a U.K. scheme similar to FDIC insurance, called the Financial Services Compensation Scheme. As Kaupthing was teetering on the edge, I resisted the temptation to take my money out as I knew it was protected, even though I would be lying if I said I wasn’t worried, nonetheless.

In the end, Kaupthing’s U.K. assets were gobbled up by Dutch bank ING Direct, so the central insurance scheme never had to be invoked for most savers.

That scheme acted like a safety blanket both literally but also emotionally. It meant I was able to stay calm, get through my work and not lose any sleep, even if those few days were hardly enjoyable.

By not rushing to take out my money, I played a tiny little part in maintaining the integrity of the banking system, too. After all, some banks have failed because of a rush on deposits, and when that happens, many do not have the underlying capital to survive.

That’s what I mean by acting based on logic rather than emotion. While Kaupthing’s U.K. arm had to be rescued by ING, who knows what would have happened if there was a bigger run.

This is all in the context of the banking crisis, though on a different note, now is a good reason to take your money out of a bank paying poor rates as higher interest rates mean better returns for savers, with the top deals paying close to 5%.

Use our tool below powered by Bankrate to find the best deals right now.

If you’re protected by FDIC insurance, let it be your safety blanket

While my story is a U.K.-based one, the point I am trying to get across is equally as important in the U.S. and anywhere in the world with a deposit insurance scheme. If your deposits are protected by the FDIC, then let that be your comforter for all the reasons above.

As long as you are protected by a central scheme, you don’t need to worry at all now, and even if your bank got into trouble, remember that insurance to help you stay calm even if others are flapping.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Guy has extensive experience in personal finance journalism having joined Future (Kiplinger's parent company) after 13 years at MoneySavingExpert.com, most recently as deputy editor, and working closely alongside Martin Lewis. He has also worked at the Daily Mail as a personal finance reporter and his work has appeared in The Sun, Guardian, Observer, Mirror and other national newspapers. As a money and consumer expert, Guy is a regular guest on TV and radio – appearing on BBC News, BBC Radio 4, Sky News, ITV News and more.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.