Are You Financially Resilient? 5 Steps to Boost Your Economic Security

Being able to bounce back from adversity is a necessity, because chances are you’re going to face one (or more) setbacks during your lifetime. From a job loss to a health crisis, here’s how to take a punch, pick yourself up and get back in the fight.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A young woman lost in the Land of Oz asks how to get back to Kansas. “If I were you,” she is unhelpfully told, “I wouldn’t start from Oz.” But if Oz is where you are, you have no choice; from there is where you must start.

That is how it is with many financial hardships. We must start where we are, in the thick of it.

A Beautiful Example of Resilience

After battling stomach cancer at the age of 72, the artist Henri Matisse was confined to a wheelchair. This made it difficult to paint or sculpt. But his passion for making art was undeterred. So, Matisse cultivated a new artistic medium: paper cut-outs. By cutting out shapes and forming collages, he created a late-stage body of work that is as celebrated as his early paintings.

Matisse’s artistic reorientation was an act of creative resilience. The kind of resilience that’s becoming more of a necessity in our financial lives. Research from the National Endowment for Financial Education shows that 96% of Americans experience four or more income shocks — a health crisis, job loss or other life transition — during their working years.

Often people face these shocks from less-than-ideal starting points. Most Americans say they would have trouble paying for a $1,000 emergency expense.

What Is Financial Resilience?

I like to think of financial resilience as the ability to overcome a financial hardship and still make the best of life. It is more art than science, because each person’s situation is different. But we all proceed from the thick of it.

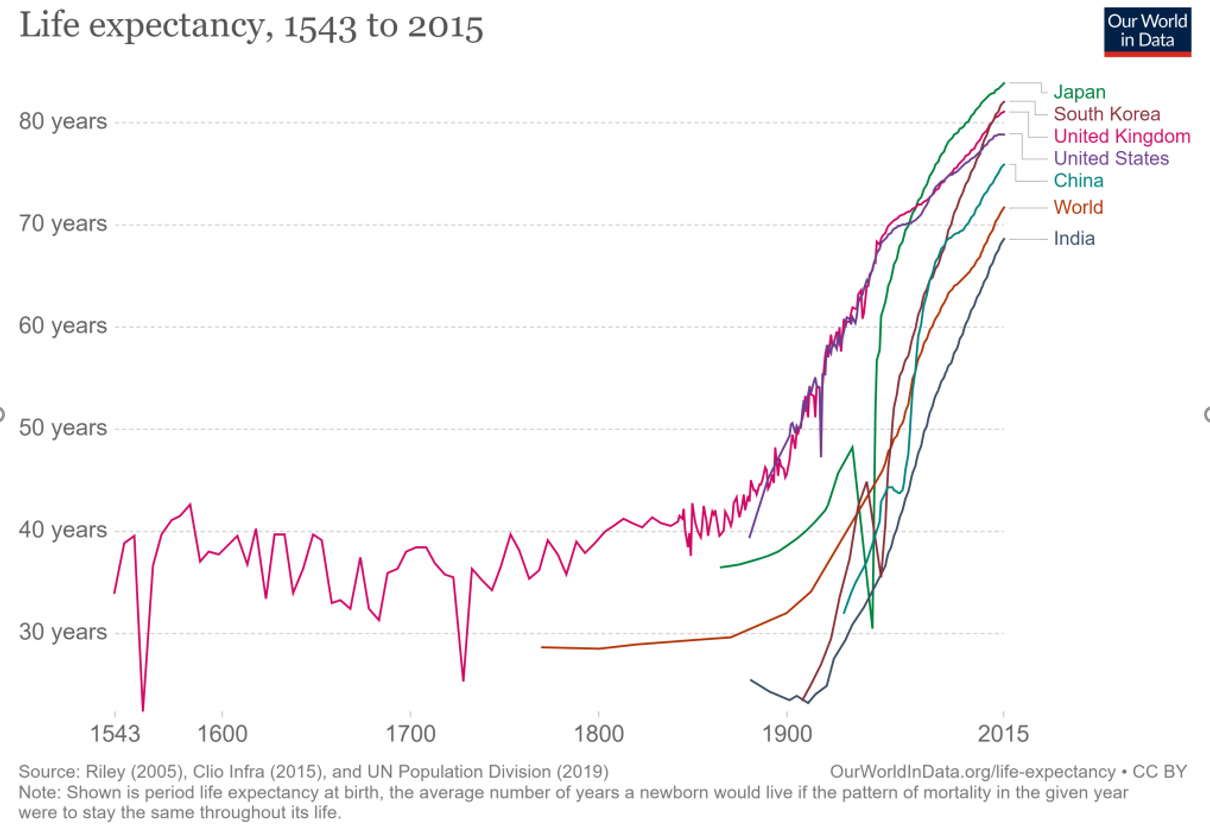

And conditions seem to be getting thicker. For one, life expectancy is rising, which means younger generations will need to save for a longer retirement than previous ones. Another downside of living longer is the chances are greater for experiencing unfortunate events.

Simply starting to save for retirement is a challenge for most young adults, who typically enter the workforce saddled with more than $30,000 in student loan debt.

Meanwhile, many people who grew up in the post-war years, when a degree was expected to translate to a good-paying job, a yearly vacation, some college savings for the 2.5 kids, and a comfortable pension or retirement fund, are finding that isn’t always so.

A survey from Allianz Life found that half of Americans are forced out of the workforce earlier than they planned. The leading reason was unanticipated job loss, something experienced by around 900,000 Americans between the ages of 60-69 as a result of the pandemic, according to the Bureau of Labor Statistics. An unexpected exit from the workplace can mean missing out on additional years of peak earnings, potentially lower retirement benefits and the need to start drawing down assets early.

How You Can Become Financially Resilient

It is important to conceptualize your finances in concrete terms: how much to save in a 401(k), what type of investments to buy, when to file for Social Security, etc. But it is also important to think abstractly, because it is difficult to account for adversity — a pandemic, a cancer diagnosis, the automation of your job.

Although our financial pictures are all different, the elements of financial resilience can be crafted along the lines of a paint-by-numbers kit:

1. An emergency fund of three to six months’ worth of expenses.

The entire purpose of this money is to alleviate the pain of an unanticipated financial hit.

2. Insurance coverage — health, home, auto, life.

Sure, it’s not as sexy as gaining triple-digit investment returns, but insurance will likely save your neck more than the market will. Take time to understand what your policies cover, and compare coverage by more than just the price.

3. A decent sized nest egg.

The appropriate amount varies based on your desired lifestyle. But for someone who makes less than $100,000, it’s a good idea to save around seven to 10 times your salary by the age of 65. Retirement savings are not only to help fulfill your goals or dreams, but also to preserve your lifestyle as your age and health leaves you more vulnerable to financial shocks.

4. Updated job skills.

Skills help us earn better pay and keep us in the game. A Brookings report estimates approximately 25% of U.S. jobs will be highly impacted by automation in the coming decades. So, it is worthwhile to learn a new skill or take an educational workshop every couple years.

5. Some kind of financial planning.

Seems obvious, right? Unfortunately, many of us for myriad reasons are simply winging it. A plan won’t prevent adversity. But financially speaking, when you have a full awareness of your situation — your cash flow, bank account balances, etc. — you are better able to adapt.

As with Matisse, resiliency is finding a new angle. It is creating a new path so you can keep moving when the world around you, as if a whirlwind, suddenly changes.

Or, in the wise words of the 13th century Persian poet Rumi: “As you start to walk on the way, the way appears.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.