Stock Market Today: Jobs Data Delivers Blow to Stocks

The September jobs report confirmed the economy has more slowing to do before the Fed can stop hiking rates.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks finished the week far from where they started as Friday's jobs data all but confirmed that the Federal Reserve still has a long way to go to slow the economy.

Earlier today, data from the Labor Department showed the U.S. added 263,000 jobs in September. While this marked a 17-month low in terms of the number of jobs added, it was still higher than economists were expecting. What's more, the unemployment rate dipped to a 50-year low of 3.5%.

Wall Street's top minds were quick to weigh in on the implications of the September jobs report, including Rick Rieder, BlackRock's chief investment officer of global fixed income. "The Fed has made it clear that to achieve an inflation reduction from today's excessively high, and stubbornly sticky, levels of inflation; that economic and employment demand will probably have to decline," Rieder says. "That was not the case yet with today's nonfarm payroll data printing at 263,000 jobs gained, and with service sector employment in particular showing strength, it still doesn't seem anywhere close enough to where the Fed can take its foot off the tightening brake."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

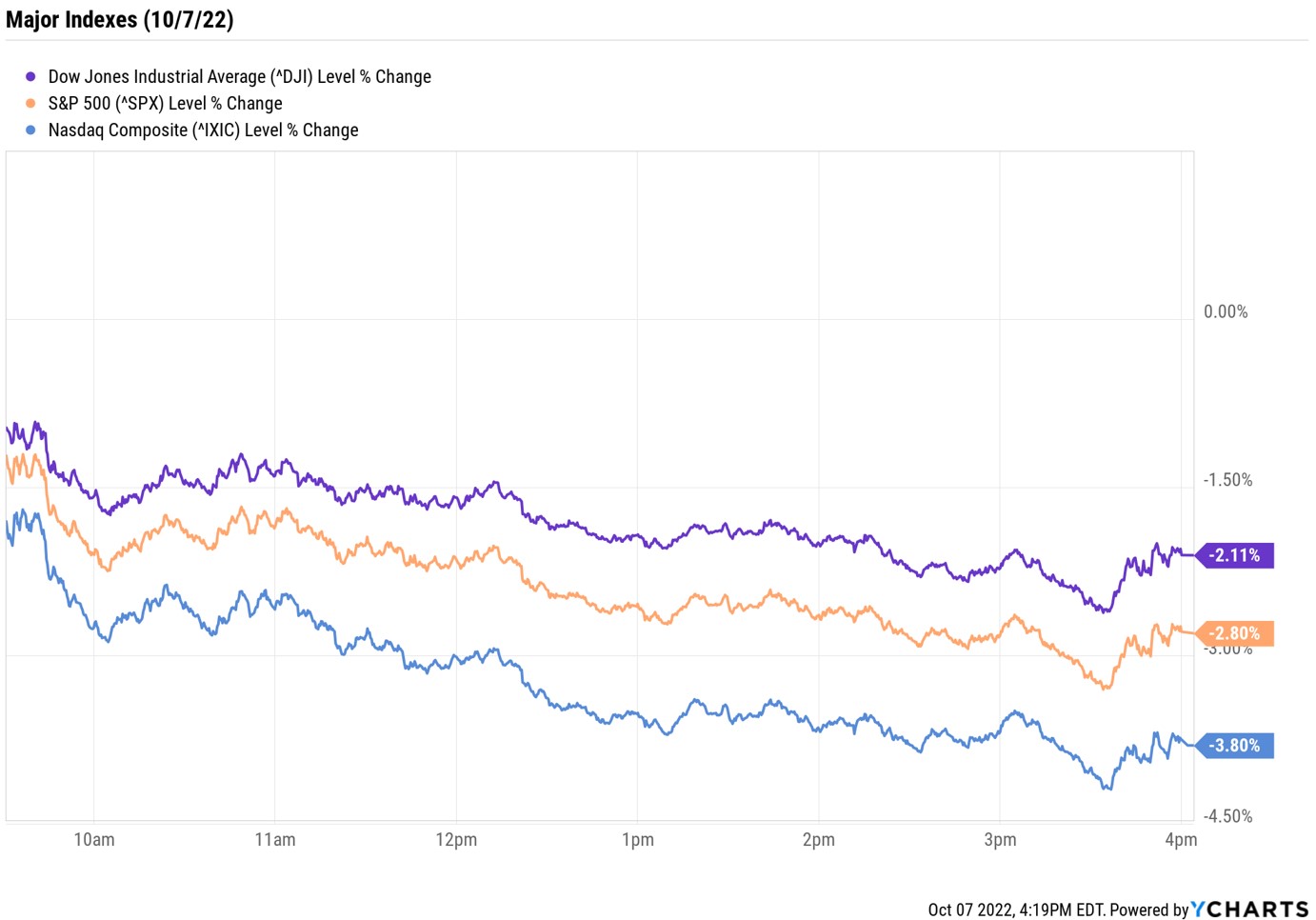

And that last point –- the one that suggests the Fed will continue to hike rates – is what sparked a major selloff in stocks today. The Dow Jones Industrial Average fell 2.1% to 29,296, the S&P 500 Index shed 2.8% to 3,639, and the Nasdaq Composite gave back 3.8% to 10,652. Still, all three major market indexes were higher on a weekly basis thanks to the monster gains they scored Monday and Tuesday.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.9% to 1,702.

- U.S. crude futures skyrocketed 4.7% to $92.64 per barrel, bringing their weekly gain to 16.5% thanks to the decision by OPEC+ to cut oil production.

- Gold futures fell 0.7% to $1,709.30 an ounce.

- Bitcoin fell 2.7% to 19,463.71 (to $20,012.81). (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

A Positive Catalyst for Pot Stocks

Similar to the broader equities market, weed stocks went on a roller-coaster ride this week amid an onslaught of headlines. Most notable among this week's cannabis news was Thursday's move by President Joe Biden to pardon thousands of individuals who had been convicted at the federal level for "simple marijuana possession." But perhaps more importantly, Biden said he has directed the attorney general as well as the secretary of Health and Human Services to review how marijuana is classified under the federal law.

"While the president cannot in fact deschedule/reschedule cannabis unilaterally with an executive order, he can order executive agencies to consider doing so," says Jefferies analyst Owen Bennett. And this, Bennett adds, creates "a path to federal rescheduling without congressional action."

For investors, a rescheduling of marijuana from its current Schedule 1 status could be a positive catalyst for pot stocks. Here, we take a closer look at three such names that could climb on the potential for federal policy changes down the road.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.