SPACs, SMRs and How to Invest in the Nuclear Insurgency

Big nuclear deployments are in process, but small modular reactors could be a better way to meet rapidly rising electric power demand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was a major deal at the Pennsylvania Energy Summit in July when Westinghouse revealed plans to build 10 large nuclear reactors in the U.S.

President Donald Trump — who in May signed four executive orders aimed at accelerating development of nuclear energy and set a target of quadrupling domestic nuclear generation capacity by 2050 — was in Pittsburgh for the event.

Westinghouse, the historic electric company now owned by Brookfield Renewable Partners (BEP) (51%) and Cameco (CCJ) (49%), designs reactors such as the AP1000 and provides other nuclear fuel and plant operation services.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As interim CEO Dan Sumner (PDF) noted in his remarks at the July summit, more than 50% of the reactors operating right now use Westinghouse technology, and the company services more than 60% of the world's operating nuclear fleet.

Sumner made headlines, though, when he said Westinghouse has "taken the call-to-action" under Trump's executive orders and plans to partner with companies in its industry to begin construction by 2030 on 10 AP1000 reactors in the U.S.

The first AP1000 became commercially operational in September 2018 in China. Two have been deployed in the U.S. at the Vogtle plant in Georgia. Another, at the V.C. Summer project in South Carolina, was cancelled because of Westinghouse's March 2017 bankruptcy filing.

Now, however, management sees an opportunity to leverage its experience amid a far more favorable licensing environment for a large-scale domestic deployment, which should streamline processes and hold down costs.

The Trump administration is actively loosening constraints, old-school utility investor Roger Conrad identified during our conversation last spring about how to invest in the nuclear revolution.

Positive nuclear proliferation

Big reactors such as the AP1000 will certainly be there when this nuclear revolution generates more power.

Stocks such as BEP and CCJ as well as electric power utility Constellation Energy Group (CEG), which owns and operates the largest fleet of nuclear power plants in the U.S. at a total capacity of 19,000 megawatts (MW), reflect as much.

Through August, CEG is up 38% year to date and 50% over the trailing 12 months. BEP has rallied 17% this year and is now positive for the trailing 12 months with a 10% return. CCJ has been one of the best stocks to own in 2025, with a gain of 51%. The uranium producer is up 90% in the past year.

Meanwhile, another front has reopened for investors, with the potential for upside rewards to match such a high-risk endeavor: SPACs are back, and they're providing financial fuel for small modular reactors (SMRs) that represent the true insurgent force in this nuclear revolution.

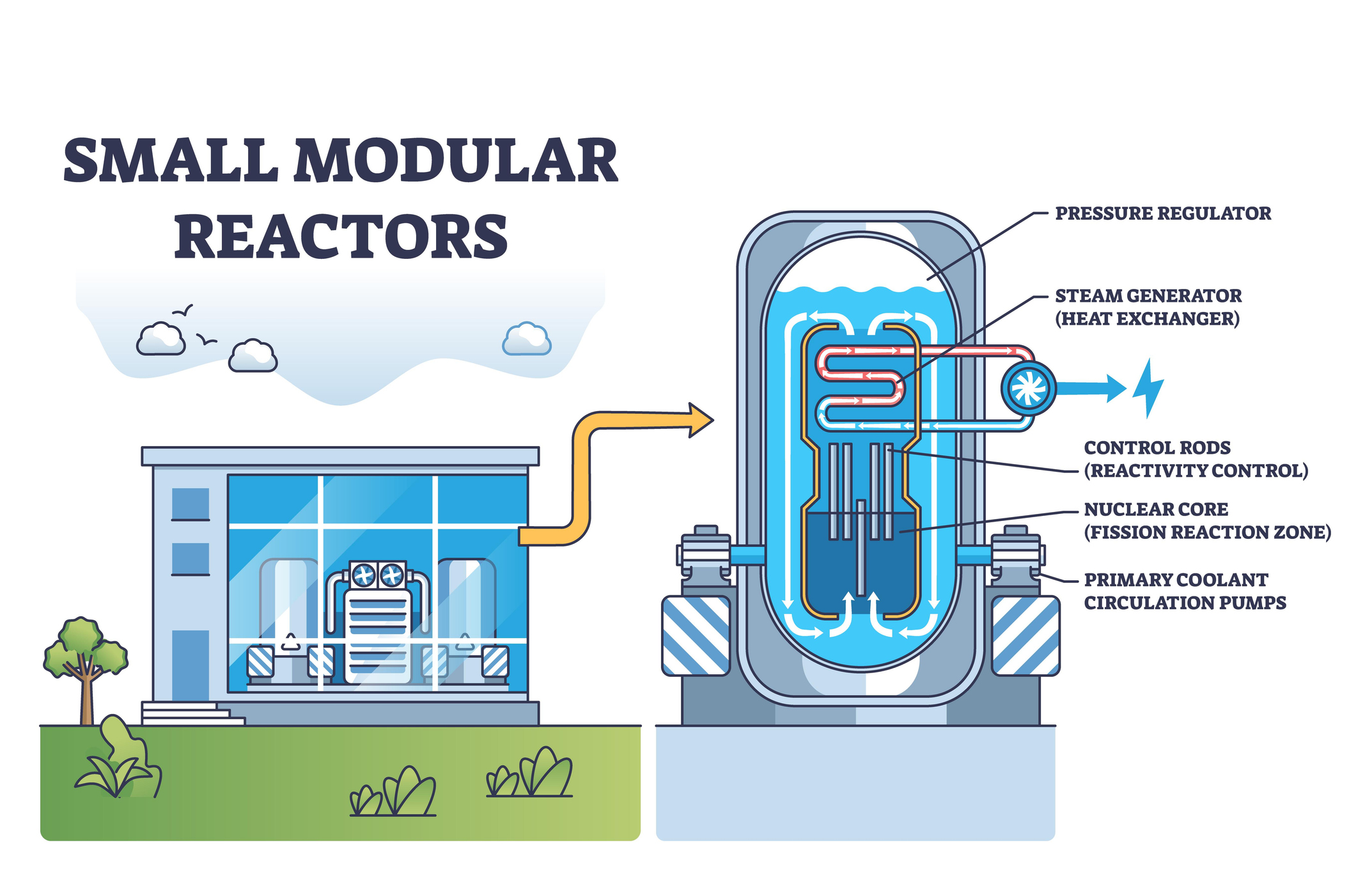

An SMR is a fission-based system that can generate 300 MW, designed to be made in a factory and transported as movable components. These features make for shorter construction timelines, lower costs and flexibility to add capacity.

SPACs' nuclear attack

SPACs — special purpose acquisition companies — are as notorious as their most vocal sponsor-promoters, including Chamath Palihapitiya. People such as the "SPAC King" get behind massive themes such as AI, fintech and biopharma — and new-school energy plays.

Palihapitiya recently declared "there's no crying in the casino" as he launched yet another SPAC with the major equity indexes hovering near all-time highs. It's a broad indication of risk-on sentiment for the broader market, as well as in his general area of specialty.

Take good note of Palihapitiya's string of SPAC failures, though, which include Virgin Galactic (SPCE) and Clover Health (CLOV). SPACs alone are high-risk vehicles: formed with no operations but with the sole purpose of streamlining the initial public offering (IPO) process for real non-public companies.

At the same time, multiple "blank check" companies have already turned into real nuclear energy stocks, including NuScale Power (SMR) and Oklo (OKLO).

NuScale went public in a 2022 merger with Spring Valley Acquisition. SMR stock is up 228% since its stock-market debut.

Oklo completed its SPAC merger with AltC Acquisition, a blank-check company led by OpenAI CEO Sam Altman, in May 2024. OKLO is up more than 770%.

Those kinds of returns amid growing demand for new, reliable, clean sources of electric power for the AI revolution, still-rampant data center growth, rapid advances in quantum computing and cryptocurrency mining, plus a significant catalyst by Trump, mean more SPAC SMR offerings are on the way.

Here are three nuclear power SPACs for investors with high risk tolerance to track for potential debuts from now to the end of 2025.

Eagle Energy Metals/Spring Valley Acquisition II

Eagle Energy Metals, a uranium miner that's also developing proprietary SMR technology, has agreed to a deal to go public through a merger with blank-check company Spring Valley Acquisition II.

Spring Valley Acquisition II's Chairman and CEO Chris Sorrells and Chief Financial Officer Robert Kaplan led the NuScale Power SPAC merger.

The deal gives the combined company a value of $312 million. Eagle Energy has said an unnamed investor has agreed to invest $30 million in the deal via a convertible preferred stock offering.

Its primary asset is the Aurora uranium deposit on the border of Oregon and Nevada. Aurora has more than 50 million pounds of near-surface uranium. Aurora's pre-feasibility study preparation is targeted to begin in 2026. The company has a second site, Cordex, which is adjacent to Aurora.

Eagle Nuclear Energy is expected to be listed on the Nasdaq in late 2025.

Terra Innovatum/GSR III Acquisition

Terra Innovatum is developing SOLO, what it calls "the world’s first micro modular nuclear reactor," to provide "scalable, off-grid, zero-carbon power to industrial, remote, and high-demand sectors."

In April, Terra agreed to merge with GSR III Acquisition with the intention of listing on the Nasdaq under the ticker symbol NKLR sometime before the end of the year.

The agreement provides Terra up to $230 million in gross proceeds and values the company at $475 million.

SOLO has a generation capacity of one megawatt. It requires no emergency zone area, operates off the existing electrical grid, and, according to Terra, is designed for use by data centers and hospitals as well as for mining and other industrial purposes.

Reactors will be built in factories but assembled on site, and they can be grouped together for increased generation capacity. Point-of-demand deployment is SOLO's critical advantage. As GSR III co-CEO Gus Garcia told the Financial Times, "The whole world is a customer."

Terra submitted its regulatory engagement plan to the Nuclear Regulatory Commission in January and targets commercial deployment by 2028.

Terrestrial Energy/HCM II Acquisition

Terrestrial Energy plans to raise $280 million through a SPAC merger with HCM II Acquisition to fund the development of a nuclear reactor that uses molten salt rather than water as a coolant.

The combined entity is expected to list on the Nasdaq Stock Market under the ticker symbol "IMSR" during the fourth quarter.

According to Terrestrial Energy CEO Simon Irish, "2025 for nuclear technology is what 1995 was for the tech sector," recalling the explosion of the internet as a social and commercial force.

As Irish explained to The Financial Times, "Many investors have now converged on the unavoidable conclusion about energy choice: We can't meet surging power demand in an environmentally responsible way without nuclear."

HCM II CEO Shawn Matthews is the former CEO of Cantor Fitzgerald. The merger values Terrestrial Energy at $925 million.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Dittman is the former managing editor and chief investment strategist of Utility Forecaster, which was named one of "10 investment newsletters to read besides Buffett's" in 2015. A graduate of the University of California, San Diego, and the Villanova University School of Law, and a former stockbroker, David has been working in financial media for more than 20 years.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.