Time for Small Companies to Shine

The environment is right for investing in small companies. These five managers divide and conquer the small-cap market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

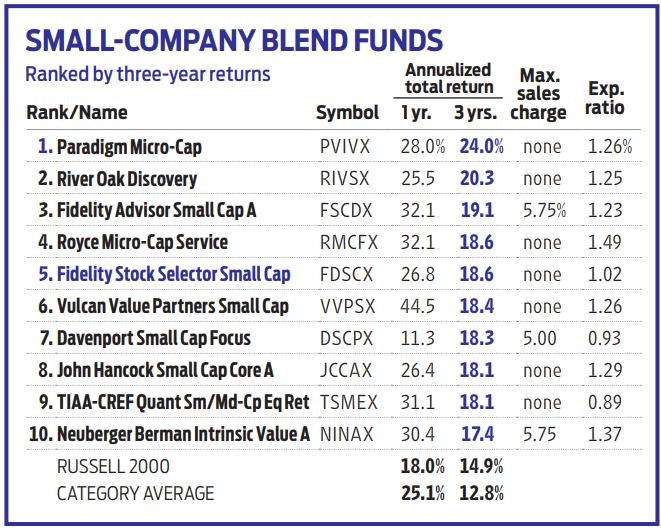

Now is proving to be a “super-exciting time to be investing in small companies,” says Shadman Riaz, a comanager of Fidelity Stock Selector Small Cap (symbol FDSCX). A growing economy and higher interest rates make a good environment for small-capitalization stocks. What’s more, a rush of initial public offerings means there are more under-the-radar companies on the market—and thanks in part to the popularity of indexing, fewer analysts who research them, says Riaz. All told, “there’s an opportunity for active managers to outperform,” he says.

Stock Selector Small Cap has a unique setup. Five managers run the fund, but the portfolio is divided into three different sleeves, managed separately. Two parts hold a diversified mix of stocks across many sectors. One of those favors growing, high-quality firms; the other tilts toward so-called cyclical, or economy-sensitive, value-oriented opportunities. The third sleeve focuses only on health care stocks.

The managers collaborate, but they don’t work by consensus. “We make individual decisions,” says Riaz. However, they all look for businesses with a competitive edge, run by smart executives, that trade at a discount to the managers’ estimate of fair value.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

No matter where they fit in the overall portfolio, stocks in the fund typically meet one of three sets of criteria. Some companies are steady businesses with strong competitive niches, pristine balance sheets and reasonable valuations. Business services provider ExlService Holdings is “growing at a good clip and has good cash flow,” says Riaz. Others are innovative companies with in-demand products. SiTime, for example, makes timing devices embedded in gadgets such as earbuds and smartphones to help them sync quickly. The third group includes out-of-favor cyclicals. Oil refinery HollyFrontier, for instance, has been trading at a low price relative to book value (assets minus liabilities), says Riaz.

The portfolio structure has delivered good results. Over the past three years, the fund’s 18.6% annualized return outpaced 97% of its small-blend peers (funds that invest in small companies with either a growth or value tilt).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: U.S. Savings Bonds

Bond Basics: U.S. Savings Bondsinvesting U.S. savings bonds are a tax-advantaged way to save for higher education.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.