Stock Market Today: Retail Roars Back, Markets Build Positive Momo

Discount retailers Dollar General (DG) and Dollar Tree (DLTR) were at the forefront of a second straight session of broad market gains.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The major indexes staged a second consecutive sizable rally Thursday amid a number of encouraging retail reports and more signs that perhaps the recent downturn was a touch overdone.

Michael Reinking, senior market strategist for the New York Stock Exchange, noted an important potential sea change in yesterday's trading – namely, Dick's (DKS) and other retailers reversed early losses and led the market higher. "That type of price action where stocks rally despite 'bad news' suggested that expectations, at least in the short-term, had been sufficiently reset," he says.

The retail industry then followed through on Thursday with some straight-up good news.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Discount retailers Dollar Tree (DLTR, +21.9%) and Dollar General (DG, +13.7%) both enjoyed double-digit pops on Street-beating earnings. The former, which also has Family Dollar under its corporate umbrella, earned an adjusted $2.37 per share last quarter to skate past calls for $2.00 per share, and raised its 2022 sales outlook to $27.8 billion-$28.1 billion from $27.2 billion-$27.9 billion previously. The latter topped earnings estimates by earning $2.41 per share (vs. $2.32 est.) and raised both its revenue and same-store sales guidance.

Upscale home-goods retailer Williams-Sonoma (WSM, +13.1%) piled on with top- and bottom-line beats, as did Macy's (M, +19.3%), which also topped earnings and sales expectations and upped its profit forecast for 2022.

"The underpinning for today's market climb higher suggests that last week's doom and gloom about the all-important U.S. consumer might have been overdone, along with the dire recession headlines," says Quincy Krosby, chief equity strategist for LPL Financial. He acknowledges that data suggest the economy is slowing and that the Fed is poised to deliver at least two more 50-basis-point rate hikes, "but the notion that the consumer – 70% of the U.S. economy – is on a spending strike, is overblown as earnings reports coupled with positive guidance indicate otherwise."

Also help pushing stocks ahead were chipmakers Broadcom (AVGO, +3.6%), which announced a $61 billion deal to acquire virtualization and cloud firm VMWare (VMW, +3.2%), and Nvidia (NVDA, +5.2%), which cratered in Wednesday's after-hours trade after forecasting revenue deceleration in its second quarter, but rebounded in Thursday trade.

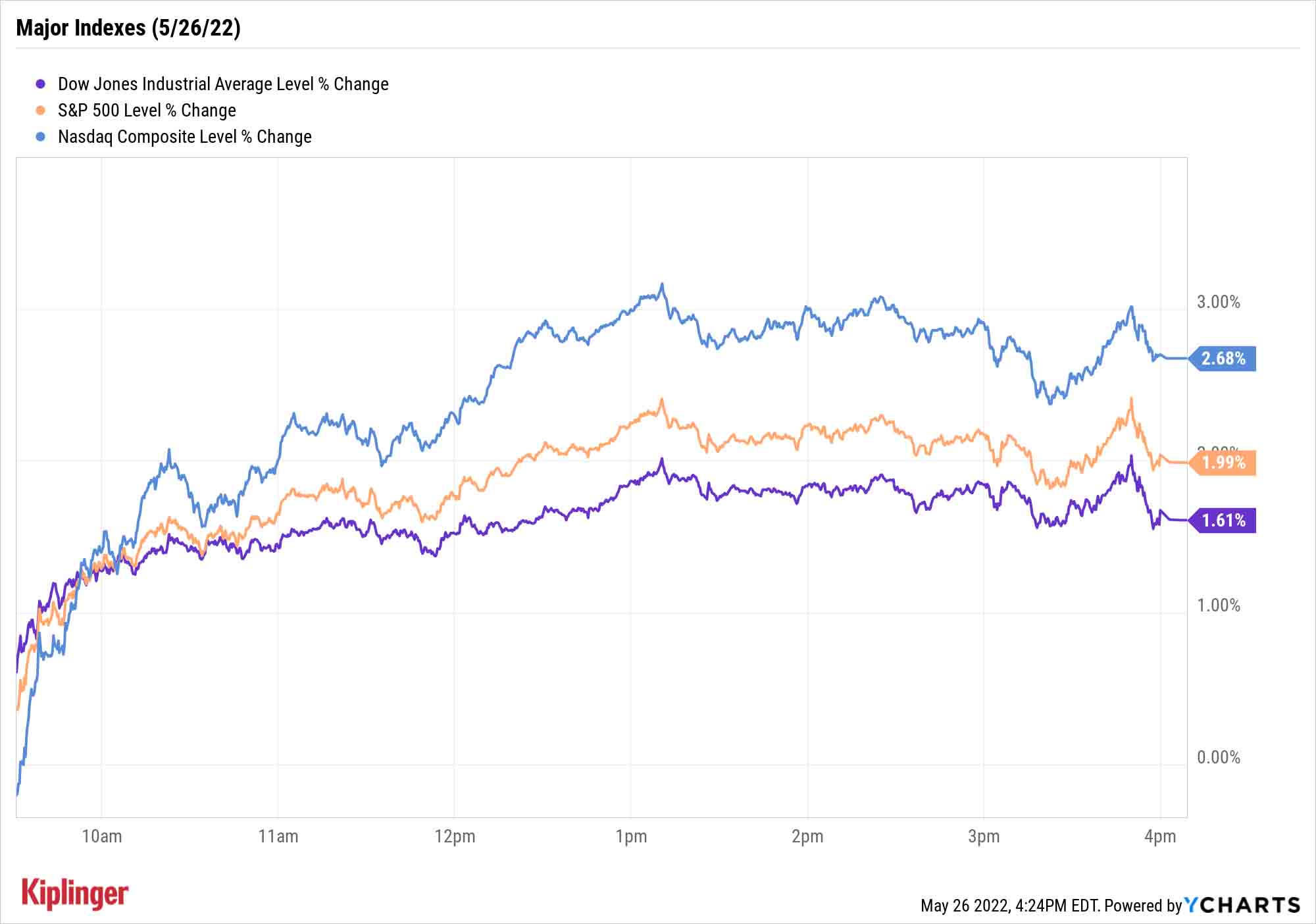

They helped the Nasdaq Composite (+2.7% to 11,740) take the pole position in today's rally, followed by the S&P 500 (+2.0% to 4,057) and Dow Jones Industrial Average (+1.6% to 32,637).

Other news in the stock market today:

- The small-cap Russell 2000 popped 2.2% to 1,838.

- U.S. crude futures shot up 3.4% to settle at $114.09 per share.

- Gold futures gained 0.1% to end at $1,847.60 an ounce.

- Bitcoin didn't join the rally in the broader markets, slipping 0.9% to $29,362.18. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) "The bubble in crypto tokens that started shortly after the Fed started its massive liquidity injection, continued to deflate," says Jay Hatfield, chief investment officer of New-York based investment advisor Infrastructure Capital Management. "The Fed has already reduced the monetary base this year by $550 billion through open market operations and is likely to continue to reduce the base by up to another $1 trillion putting further pressure on speculative assets that benefited from the Fed’s inflation of the U.S. dollar."

- Nutanix (NTNX) plunged 23.0% after the enterprise cloud platform reported earnings. In its fiscal third quarter, NTNX reported an adjusted loss of 5 cents per share on $403.7 million in revenue – both figures representing solid improvements over the year-ago results. Billings of $204.7 milion were also up on an annual basis. However, the company said it expects fourth-quarter revenue and billings below analysts' consensus estimates, and it also lowered its full-year revenue outlook. "The biggest problem is NTNX's outlook – supply-chain constraints are starting to impact hardware deliveries, ultimately postponing and delaying software purchases," says CFRA Research analyst Janice Quek, who downgraded the cloud stock to Hold from Buy. "To a smaller extent, higher sales force attrition is also reducing productivity."

- UBS Global Research analyst Cody Ross downgraded Kraft Heinz (KHC, -6.1%) to Sell from Neutral (Hold), saying the consumer staples stock lacks the pricing power needed to power through higher inflation. "We believe it will be difficult for KHC to pass through additional pricing next year and by that time, KHC will likely be battling trade down pressure as consumers' budgets are squeezed further," Ross writes in a note to clients. Most analysts are on the sidelines when it comes to KCH. While three Wall Street pros say it's a Strong Buy, 14 have it at Hold, two say Sell and one says Strong Sell, according to S&P Global Market Intelligence.

An "Alternative" Way to Fight Volatility

One of the cleverest summations we've seen about whether the recent rally is fool's gold comes from Steve Sosnick, chief strategist for brokerage firm Interactive Brokers:

"Here's the paradox – if everyone is looking for capitulation [effectively, buyers giving up hope], it is another way of trying to figure out when the market has bottomed," he says. "So if everyone is actively looking for a market bottom, it means that they haven't thrown in the towel about stocks going up again. Thus, true capitulation only presents itself when people have stopped actively looking for it."

And so far, while the bear market has been unpleasant, "we don't see the sort of existential fear that accompanies capitulation," he says.

We say hope for the best, but at least be prepared for less.

In recent days we've covered various forms of investor defense, from great stocks for an actual bear market to stalwart buy-and-hold 401(k) mutual funds that should pan out over the long run.

But another tack you can take is once-esoteric alternative strategies, such as long-short and market-neutral funds. Says our writer Andrew Tanzer: "Alternative strategies were previously available only to high-net-worth individuals, institutions or financial advisers. Today, a growing number of alternative strategies are available via mutual funds for mom-and-pop investors."

Read on as we look at nine such alternative-strategy funds to keep calm in this roller-coaster market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.