Stock Market Today: Stocks Try to Find Their Legs Ahead of CPI Report

Growth stocks enjoyed a lift Tuesday thanks to a momentary retreat in bond yields. But many investors looked ahead to Wednesday's latest inflation data.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

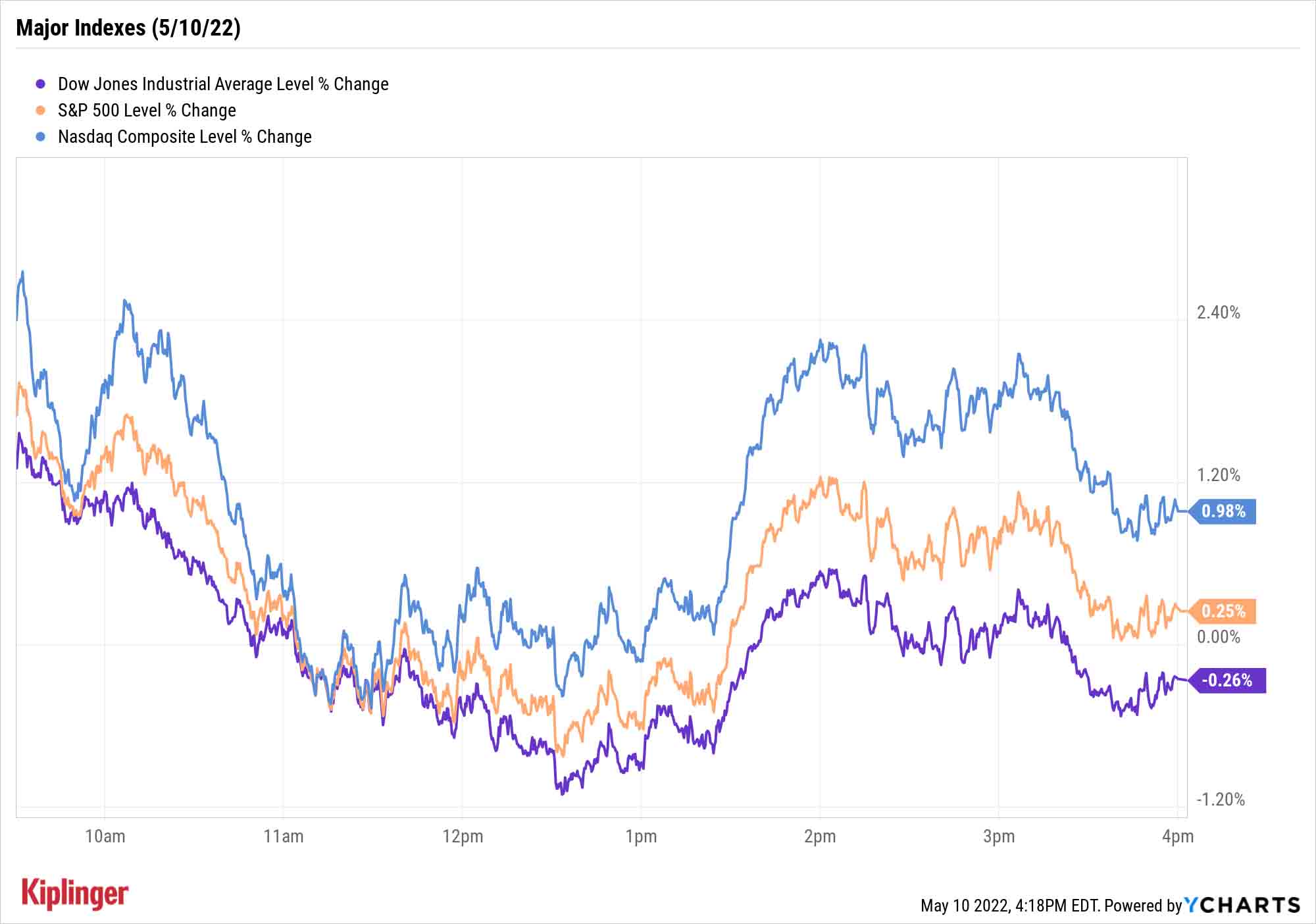

Wall Street searched for stability Tuesday, with a couple of the major indexes able to muster some gains ahead of a vital inflation reading tomorrow.

The 10-year Treasury note, after touching 3.2% yesterday, pulled back below the 3% threshold to as low as 2.94%. This retreat in interest rates removed some pressure from growthier stocks (which had been pummeled Monday), with technology (+1.5%) firms leading the session's relief rally. Semiconductor stocks such as Nvidia (NVDA, +3.8%), Broadcom (AVGO, +3.3%) and NXP Semiconductor (NXPI, +3.2%) were among the day's notable risers.

It wasn't all roses, though. Investors continued to punish once-hot companies showing any signs of weakness.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For instance, artificial-intelligence lending-platform maker Upstart Holdings (UPST) plunged 56.4% to trade around all-time lows. While it beat Street estimates for first-quarter earnings, the company reduced full-year revenue forecasts to $1.25 billion from $1.4 billion previously.

Work-from-home darling Peloton Interactive (PTON, -8.7%) continued its fall from grace after reporting a 15% year-over-year decline in sales, a $757 million net loss and a dwindling cash pile that CEO Barry McCarthy said left the company "thinly capitalized."

Even AMC Entertainment (AMC, -5.4%) was knocked lower despite a pretty encouraging report in which Batman and Spider-Man films helped the theater company to report a narrower-than-expected quarterly loss.

Still, the major indexes showed some strength. The Nasdaq Composite rebounded 1.0% to 11,737, while the S&P 500 improved 0.3% to 4,001. The Dow Jones Industrial Average brought up the rear, declining 0.3% to 32,160.

"Markets are clearly confused about what the Fed will do this year and just how aggressive it will get. That can be seen in the volatility in expectations for where the Fed funds rate will be at the end of 2022, as seen in Fed funds futures," says Invesco Chief Global Market Strategist Kristina Hooper. "And it is reflected in stock market volatility, with the VIX above 30."

The big story to watch tomorrow is the Bureau of Labor Statistics' consumer price index (CPI) report for April. BlackRock, for one, expects 8.1% headline CPI growth and 6.0% core growth following 8.5% and 6.5% increases in March.

"A weaker-than-expected CPI report later this week could help turn the tide and see investors embrace risk assets once again," says Brian Price, head of investment management for independent broker-dealer Commonwealth Financial Network.

Other news in the stock market today:

- The small-cap Russell 2000 slipped marginally to 1,761.

- U.S. crude futures slipped below the $100 per-barrel mark, ending the day down 3.2% at $99.76 per barrel.

- Gold futures fell 0.9% to settle at $1,841 an ounce.

- Bitcoin clawed out a 0.5% gain to $31,315.54. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Groupon (GRPN) slid 12.5% after the e-commerce marketplace swung to an adjusted loss of 80 cents per share in its first quarter, compared to a per-share profit of 25 cents in Q1 2021. GRPN also said revenue slid 41% year-over-year to $153.3 million, while global units sold slumped 29% to 12.7 million. The company gave soft current-quarter and full-year revenue guidance, as well. "The underperformance was driven by a weaker rebound in local following omicron impacts in January and February," says Credit Suisse analyst Stephen Ju, who maintained a Neutral (Hold) rating on GRPN. "As merchants found themselves in a high demand/low capacity environment, they were not incentivized to leverage discounting. Furthermore, April local billings continue to trend at Q1 2022 (as a percentage of 2019) levels and latest trends suggest an elongated recovery path."

- Vroom's (VRM) narrower-than-expected first-quarter loss sent shares up 32.4% today. In its first quarter, the online used auto dealer reported a per-share loss of 71 cents per share vs. a consensus estimate for a loss of $1.07 per share. Revenue of $923.8 million also came in higher than analysts had expected. VRM also announced a new business realignment plan for long-term growth that it anticipates will result in up to $165 million in cost savings through the rest of 2022. "Vroom is shifting to survival mode, understandably, swapping out more aggressive growth plans for a leaner, and potentially more profitable business model," says Baird Equity Research analyst Colin Sebastian (Outperform). "Given the current market environment, and challenges in scaling up an 'asset light' online sales platform, we think this pivot makes sense."

Stick to (Most Of) Your Guns

"More than anything, volatility is a test of investor mettle." So says Ross Mayfield, investment strategy analyst at research firm Baird, who notes that while we're often told volatility is the price to pay in the stock market's long-term gains, this glosses over the fact that volatility can take many forms.

"March 2020 featured a gut-wrenching drop, but also a relatively quick rebound. On the other end of the spectrum, markets are occasionally plagued by periods of high volatility that churn sideways relentlessly," he says. "Each is challenging in its own way; holding through a big drop requires a steel stomach, but longer periods of frustrating volatility require real fortitude."

While staying the course isn't easy, you can at least make it less difficult on yourself by homing in on higher-quality investments with a longer-term focus. Stock investors might look to the Dow Jones' top-rated components; fund investors should stick to well-managed products, such as these Vanguard funds commonly found in 401(k) plans.

But remember: Keeping a calm head doesn't mean you shouldn't ever sell in a downturn – on the contrary, the only thing worse than suffering losses in the first place is holding on to weak positions that will slather you in more red ink down the road.

With that in mind, we've taken a look at some of Wall Street's least favorite names at the moment. Remember: Sell calls are typically rare among the analyst community, so the fact that the pros are calling for more downside in these names, rather than saying to buy the dips, is noteworthy.

Check out Wall Street analysts' list of stocks to sell right now.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.