Stock Market Today: Health Insurers Lead Another Slide in Stocks

Stocks remained in the red for another session Thursday but at least largely slowed their downward momentum.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

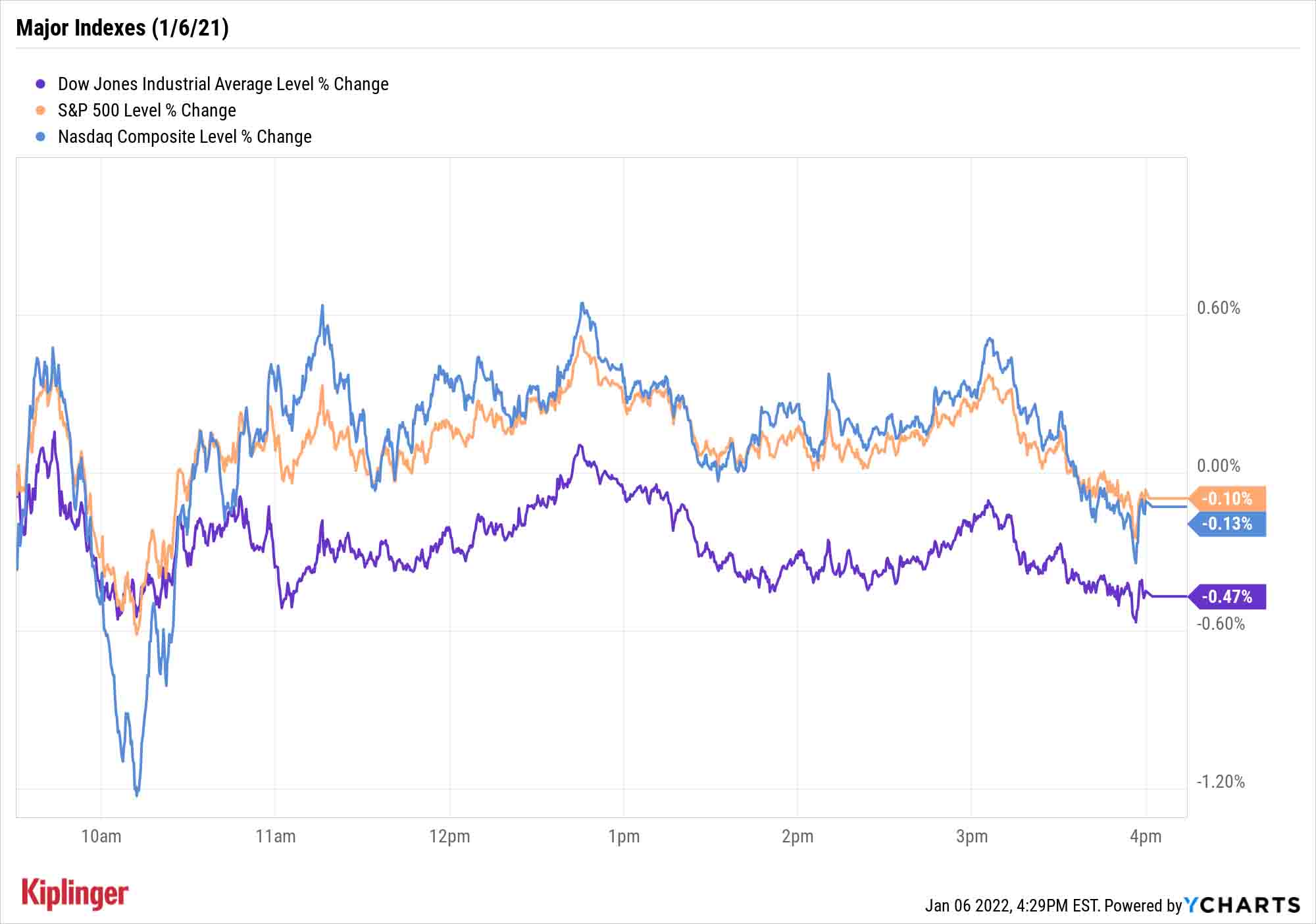

Investors didn't get a full reprieve from yesterday's heavy selling, but they were at least allowed to catch their breath in a calmer Thursday session that saw the major indexes finish modestly lower.

The first unemployment-benefits data of the new year was a tad disappointing, with the Labor Department reporting 207,000 initial claims for the week ending Jan. 1, higher than estimates for 195,000.

Treasury yields also continued to rise, with the 10-year touching 1.75% from 1.68% yesterday; that helped lift the financial sector (+1.5%), primarily regional bank companies such as Fifth Third Bancorp (FITB, +4.2%) and PNC Financial Services (PNC, +3.9%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Heading in the other direction were health insurers, which tumbled as a group after Humana (HUM, -19.4%) drastically lowered its membership-growth expectations for Medicare Advantage products, to 150,000 to 200,000 members from 325,000 to 375,000 previously. Names including UnitedHealth Group (UNH, -4.1%), Cigna (CI, -3.8%) and Anthem (ANTM, -4.1%) fell in sympathy.

The indexes were far less rowdy. The Dow Jones Industrial Average led the decline, off 0.5% to 36,236, while the S&P 500 (-0.1% to 4,696) and Nasdaq Composite (-0.1% to 15,080) also slipped again.

Other news in the stock market today:

- The small-cap Russell 2000 was up 0.6% to 2,206.

- Gold futures plunged 2% to end at $1,789.20 an ounce after Wednesday's minutes from the latest Federal Open Market Committee (FOMC) meeting suggested the central bank could hike interest rates sooner than anticipated.

- Bitcoin dropped yet again, by 1.8% to $43,217.10, amid unrest in Kazakhstan, which is actually the world's second-largest source of bitcoin mining. That mining was disrupted as Kazakh President Kassym-Jomart Tokayev ordered the national telecom provider to shut down internet service, taking numerous miners offline. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) stock jumped 8.0%, even after the home goods retailer reported dismal fiscal third-quarter results. Over the three-month period, BBBY recorded an adjusted per-share loss of 25 cents versus analysts' consensus estimate for the company to breakeven on a per-share basis. On the top line, Bed Bath & Beyond brought in $1.88 billion, falling short of the $1.95 billion analysts' were expecting. Pouring salt on the proverbial wound, same-store sales fell 10% year-over-year and the retailer lowered its full-year forecast to account for continued supply-chain headwinds.

- MGM Resorts International (MGM) improved by 3.0% after Credit Suisse analysts Benjamin Chaiken and Sarah Murray named the casino stock a "top pick" for 2022. "We see upside to MGM based on accelerating trends in Vegas, a more simplified operating structure that should aid valuation, an attractive capital structure (net cash position), upside to 2023 estimates and improving investor sentiment," they wrote in a note. With today's pop, MGM stock is now up more than 46% on a 12-month basis.

A Big Year for Energy Ahead?

Tops today, though, were energy stocks (+2.2%), which were the best S&P sector in 2021 with 53% total returns (price plus dividends) and are again leading the way with a 9.0% gain this year.

Thursday's gains came on the back of crude oil futures' 2.1% gain to $79.46 per barrel amid the aforementioned turmoil in major oil producer Kazakhstan, where protests over fuel prices have turned into broader anti-government riots.

It's a temporary tailwind for a sector most of Wall Street was bullish about heading into 2022 – though the pros had their own, longer-term reason. Specifically, an eventual full reopening of the global economy whenever COVID finally fades is expected to bolster energy demand, which should keep prices on the upward trajectory they traveled throughout 2021.

Today, we provide the last of our 11 annual sector look-aheads – our best energy stocks to buy for 2022. The energy sector often moves in unified fashion, with a rising tide of high commodity prices typically lifting most boats. But a few stocks seem better positioned than others to leverage those prices into shareholder gains in 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.