Stock Market Today: Fed Shows Its Teeth, Tech Shown the Door

The Fed's most recent meeting minutes hinted at yet another stimulus wind-down, which yanked hard on technology and real estate shares.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The broader markets absorbed a gut punch Wednesday afternoon after the minutes of the most recent Federal Reserve meeting hinted that the central bank is ready to get more aggressive about tightening monetary policy.

Investors have already had weeks to digest both the Fed's quickened pace of tapering of asset purchases and expectations for multiple rate hikes in 2022, made explicit in the post-Federal Open Market Committee meeting statement in December. But today, the release of the meeting minutes showed Fed members were starting to reach for another tool in their tool belt.

"Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate," the minutes state, referring to the eventual sale of some of its $8.3 trillion in bond holdings.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bob Miller, BlackRock's head of Americas Fundamental Fixed Income, explains that the Fed has a tall task in front of it. "The combination of aggressive fiscal and monetary policy responses to the COVID crisis has resulted in an epic increase in both the money supply and in household net worth, as well as record low real interest rates," he says.

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, says his firm believes the Fed is likely to raise interest rates quicker and potentially shrink their balance sheet sooner than many expect, prioritizing fighting inflation over protecting against a drop in economic activity. “What is harder to forecast is to what level of market selloff they are willing to tolerate before changing course," he says.

“We believe the Fed will endure some short-term volatility in the stock market in order to remove all of the monetary accommodation they’ve injected into markets," Zaccarelli adds. "However, they are still likely to heed warnings of recession from the stock market (e.g. a drop of close to 20%) and would pause their activities in that event."

Real estate (-3.3%) was the market's worst sector on Wednesday, but technology (-3.1%), with mega-caps such as Salesforce (CRM, -8.3%) and Microsoft (MSFT, -3.8%), had a far greater impact on the major indexes.

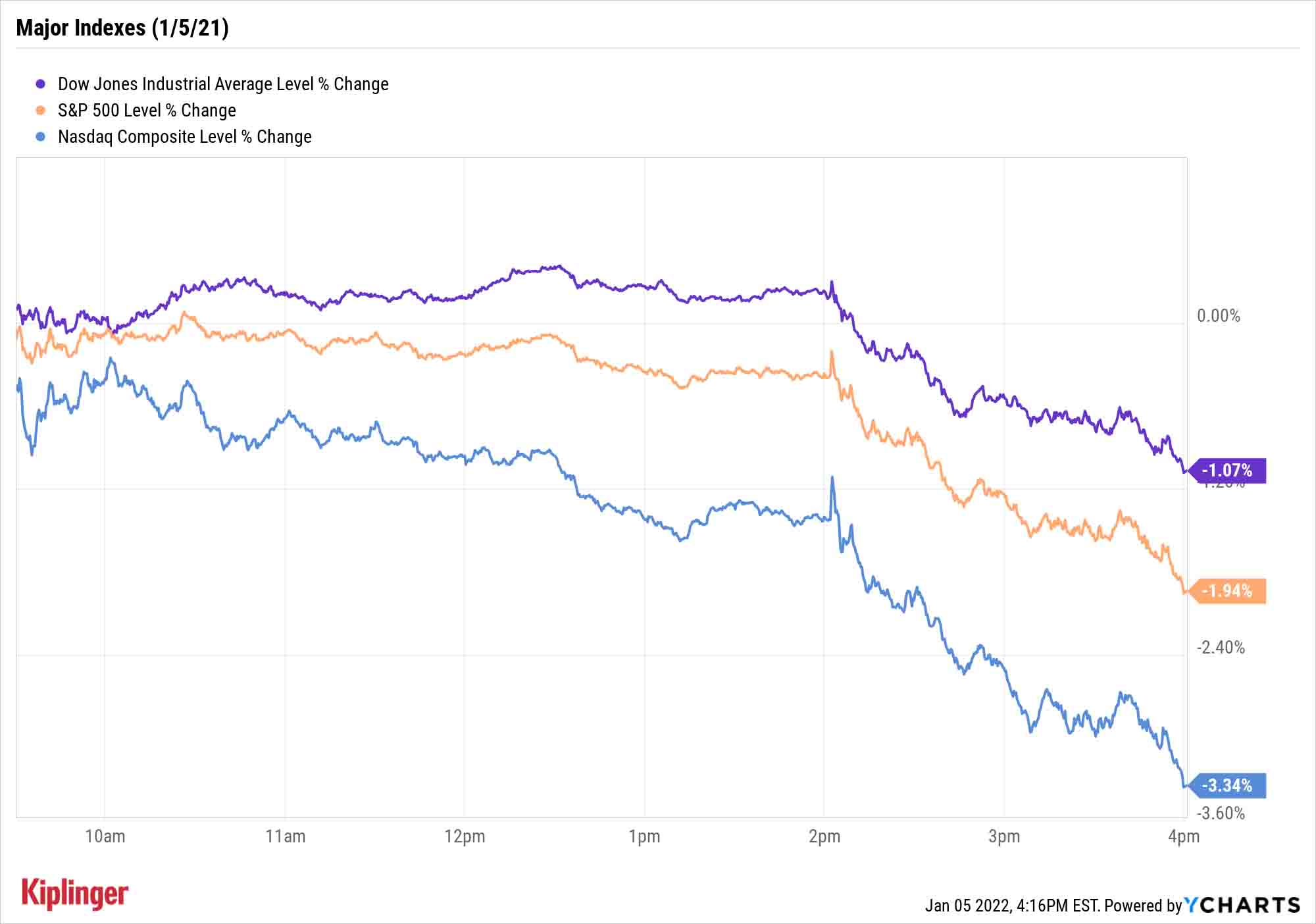

The Nasdaq Composite plunged 3.3% to 15,100, while the S&P 500 lost 1.9% to 4,700. The Dow Jones Industrial Average fared best Wednesday, with a relatively modest 1.1% decline to 36,407.

Other news in the stock market today:

- U.S. crude oil futures settled up 1.1% at $77.85 per barrel after the Energy Information Administration reported a sixth straight weekly decline in domestic crude inventories.

- Gold futures closed higher for a second consecutive day, adding 0.6% to end at $1,825.10 an ounce.

- Bitcoin wasn't excused from the selling, diving 4.9% to $44,012.43 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Rivian Automotive (RIVN) was a notable decliner, with shares of the electric vehicle (EV) maker sliding 11.2%. Sparking the selloff was news Stellantis (STLA, +0.3%) – a company formed when Fiat Chrysler and PSA Group merged in early 2021 – tapped Amazon.com (AMZN, -1.9%) to be the provider of its in-car dashboard software and cloud services. The collaboration will also allow Amazon will to be the inaugural commercial customer for STLA's battery-electric vehicle, Ram ProMaster, which is scheduled to debut next year. RIVN announced a deal with Amazon in December, which would make Amazon Web Services its preferred cloud provider. Since hitting a record high around $150 in mid-November, Rivian stock has shed roughly 40%.

- Enphase Energy (ENPH) plunged 11.8% after BofA Securities analyst Julien Dumoulin-Smith downgraded the solar energy stock to Neutral (Hold) from Buy and slashed his price target to $187 from $297. That represented less than 5% upside based on ENPH's Tuesday close of $178.28; shares finished Wednesday at $157.20. Shares peaked at $272 in late November, but have since slumped by more than 40%.

The 2022 Outlook for Small Caps

Small-cap stocks didn't escape the pain either, with the Russell 2000 off 3.3% to 2,194 – rough early going for a space that the pros are nonetheless bullish on as we begin 2022.

Most outlooks for the new year typically revolve around large and mid-cap stocks, whether that's a look at the year's top stock opportunities, or more targeted previews focused on the market's various sectors and industries.

But small caps shouldn't be ignored; investors who appreciate a decent bargain should be especially focused on the long-term value potential of diminutive companies.

"While large and mid caps trade at a 35% to 40% premium to history, small caps now trade in-line with history," writes Jill Carey Hall, equity and quant strategist at BofA Securities. "Valuations today imply high-single-digit annualized returns for small caps over the next 10 years."

That brings us to Kiplinger's annual glimpse into the new year's best small-cap stocks. We've scoured the entire Russell 2000 in search for some of the top picks among small companies, and these 12 shine compared to their peers thanks to factors such as sterling fundamentals, attractive prices and, in a few cases, analyst expectations for triple-digit upside in just the next 12 months or so.

Kyle Woodley was long CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.