Stock Market Today: Stocks Notch Third Straight Loss on Earnings Eve

Third-quarter earnings season kicks off bright and early tomorrow morning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

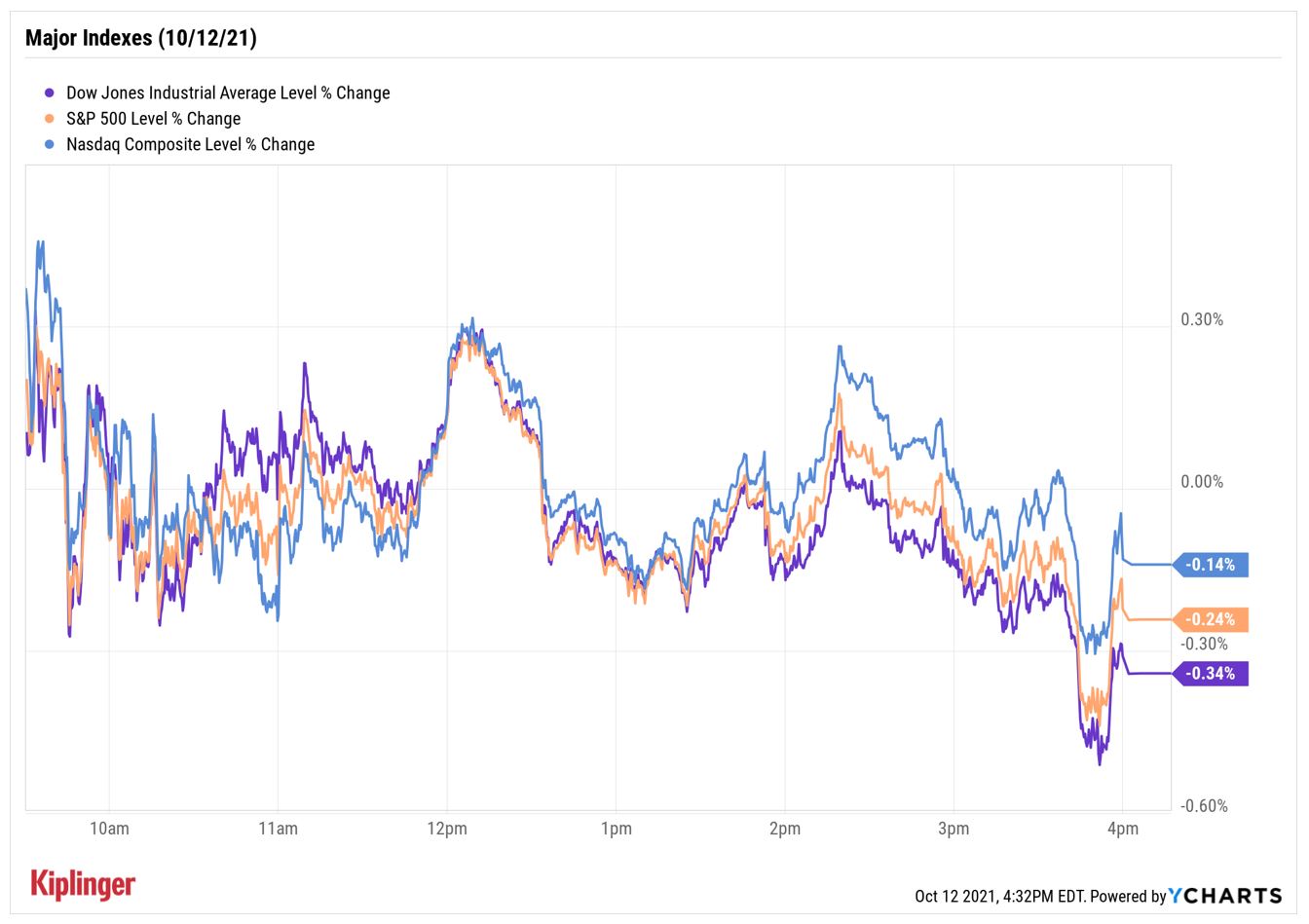

It was another choppy day as investors hesitated to make any big moves ahead of third-quarter earnings season, which kicks off tomorrow morning with big bank JPMorgan Chase (JPM, -0.8%).

"We are paying close attention to third-quarter earnings announcements along with management commentary to gain insight into potential issues surrounding the supply chain of companies and potential disruptions in getting goods or services to market along with company's ability to find workers," says Dustin Thackeray, chief investment officer at Crewe Advisors.

In economic news, the latest Job Openings and Labor Turnover Survey (JOLTS) showed that the number of job openings in the U.S. fell to a lower-than-expected 10.4 million in August.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This was hardly market-moving, though, considering "that is just below the upwardly revised record highs (11.098 million) in the prior month," according to Jennifer Lee, senior economist at BMO.

Communication services (-0.9%) was the weakest sector, followed by healthcare (-0.5%) and technology (-0.5%).

As such, the Dow Jones Industrial Average ended the day down 0.3% at 34,378, the S&P 500 Index slipped 0.2% to 4,350 and the Nasdaq Composite gave back 0.1% to 14,465 – each marking a third straight loss.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.6% to 2,234.

- MGM Resorts International (MGM) jumped 9.6% after Credit Suisse analysts Benjamin Chaiken and Sarah Murray upgraded the casino stock to Outperform from Neutral (the equivalents of Buy and Hold, respectively). "MGM has gone through a transformation, recently announcing four transactions, and we believe the market is not giving full credit," they say. Specifically, they point to several M&A moves MGM has made recently, including selling its the remaining stake in real estate investment trust (REIT) MGM Growth Properties (MGP, +1.2%) for $4.4 billion, which it called "a major deleveraging event."

- Airbnb (ABNB, +3.7%) got an analyst-induced lift today, as well. Cowen analyst Kevin Kopelman lifted his outlook on the real estate rental stock to Outperform (Buy) from Market Perform (Hold), saying Wall Street's estimates for ABNB's 2022 and 2023 EBITDA (earnings before interest, taxes, depreciation and amortization) and gross bookings are conservative. He also believes Airbnb will boost its share of the lodging market to 11% by 2026, compared to 8% this year.

- U.S. crude futures eked out a 0.1% gain to finish at $80.64 per barrel.

- Gold futures edged up 0.2% to settle at $1,759.30 an ounce.

- The CBOE Volatility Index (VIX) retreated 0.8% to 19.85.

- Bitcoin prices fell 3.9% to $55,276.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Prepare for 2022

It seems hard to believe, but 2022 is just around the corner.

"While a lot can still happen between now and the end of 2021, we don't think it's too early to start thinking about what stocks might do next year," say Jeff Buchbinder, equity strategist, and Ryan Detrick, chief market strategist for LPL Financial.

In addition to forecasts for higher-than-average economic growth and additional earnings gains in 2022 – both of which signal another strong year for stocks – they "expect interest rates to stay low enough to justify maintaining current valuations, which could set the stage for double-digit returns for the S&P 500 next year."

So how can you prepare? Consider being buyers on the dip, Buchbinder and Detrick note.

In addition to the relative bargains we've uncovered among Wall Street's most elite batch of dividend-paying names, we've also compiled a list of the best beaten-up tech stocks to buy right now. These companies have solid balance sheets and strong growth prospects, but thanks to the latest round of market turbulence, shares have pulled back to more attractive valuations. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.