Stock Market Today: Stocks Polish Off a Productive First Half

The major market indexes all had double-digit percentage gains in the first six months of 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

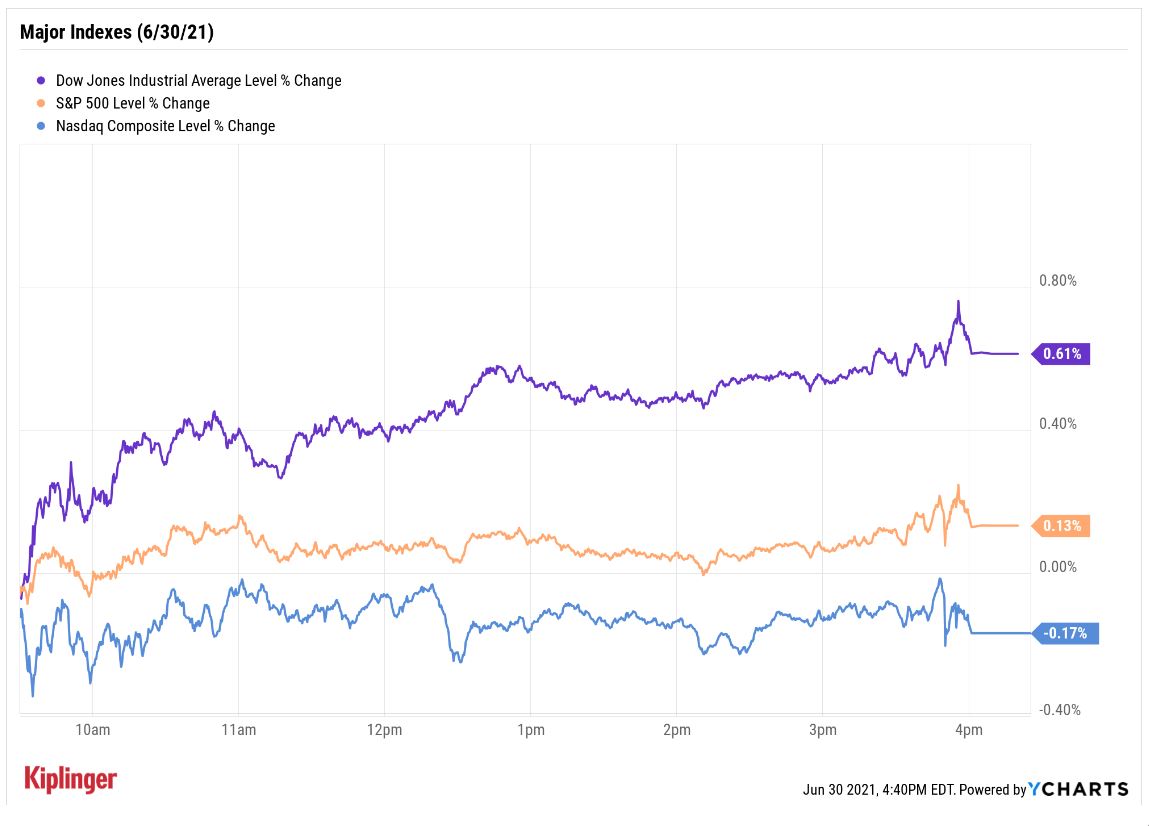

Wall Street might have closed Wednesday on a jumbled note – one that investors have become accustomed to over the past couple months – but the major indexes still capped what has inarguably been a fruitful first six months of 2021.

In economic news, a regional manufacturing indicator, the Chicago PMI, dropped a worse-than-expected 9.1 points in June, to 66.1 (which still signals growth, just at a slower rate). U.S. pending-home sales jumped 8% month-over-month in May to stun economists, who collectively were looking for a small decline.

And on the employment front, ADP's monthly jobs report showed a massive 692,000 private-sector payrolls added in June, which was well more than the 550,000 jobs expected.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, Jennifer Lee, senior economist at BMO Capital Markets, says it has "no implications for Friday's nonfarm report," an indicator that gets much more attention, pointing out that ADP's release has missed private payrolls by more than 400,000 on average over the past four months.

The Dow Jones Industrial Average led the major indexes, gaining 0.6% to 34,502. It was led by Walmart (WMT, +2.7%), which announced a deal to provide its own branded insulin via a partnership with Novo Nordisk (NVO, -0.04%), and Boeing (BA, +1.6%).

The S&P 500 Index scratched out its 34th record high of 2021, gaining 0.1% to close at 4,297, while the Nasdaq Composite actually retreated by a mere 0.2% from yesterday's record close to 14,503.

But my, what a half! The S&P 500 finished the first six months of 2021 with a 14.4% gain. The Dow (+12.7%) and the Nasdaq (+12.5%) produced similar results, but took vastly different paths to get there.

Other action in the stock market today:

- The small-cap Russell 2000 edged up 0.07% to 2,310.

- Bed Bath & Beyond (BBBY) was a featured earnings report this week, and its results were well-received. While the home furnishings retailer missed on the bottom line (5 cents per share reported vs. 8 cents per share expected) in its fiscal first quarter, revenue of $1.95 billion beat the consensus forecast. BBBY stock closed the session up 11.3%.

- Constellation Brands (STZ) also got a lift after earnings, finishing the day up 1.3%. The beer maker reported a per-share profit of $2.33 in its fiscal first quarter, less than analysts were expecting, but revenue of $2.03 billion came in above estimates.

- U.S. crude oil futures rose 0.7% to end at $73.47 per barrel after data from the Energy Information Administration showed domestic crude inventories declined for a sixth straight week.

- Gold futures gained 0.5% to settle at $1,771.60 an ounce.

- The CBOE Volatility Index (VIX) slipped 1.2% to 15.83.

Crytpo Closes Out Volatile 1H21

Another first half worth noticing is the performance cryptocurrencies put up – for better or worse.

Bitcoin prices are up 20% through the end of June, but the granddaddy of this field had surged by roughly 120% through April before retreating by 0.9% to today's $34,790. Ethereum (+202% YTD) and Dogecoin (+6,200% YTD) are similarly well off their earlier-year peaks. (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

So are these coins fads, and losing their fight?

"Bitcoin is different in that it has done this before, and each time has gone on to make successive new highs," says Chris Kuiper, vice president at CFRA Research, who also points out that Bitcoin's practice of "halving" every four years helps it to resume price appreciation. "Of course, history does not repeat, but it can rhyme, and these indicators suggest there is still a good probability bitcoin is still in the bull phase of the current cycle."

Investors who are still about diving into cryptocurrencies can certainly just stick in a toe – Kuiper notes that there are "several related equities that offer varying degrees of exposure." But much like blue-chip stocks are suggested as a starting point for new investors getting accustomed to the water, if you do have an interest in cryptocurrencies, it helps to start with the biggest cryptocurrencies, as they're easier to research thanks to a wealth of existing information.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Stocks Bounce Back With Tech-Led Gains: Stock Market Today

Stocks Bounce Back With Tech-Led Gains: Stock Market TodayEarnings and guidance from tech stocks and an old-school industrial lifted all three main U.S. equity indexes back into positive territory.