Stock Market Today: Dow Leads in a Mixed May Start for Stocks

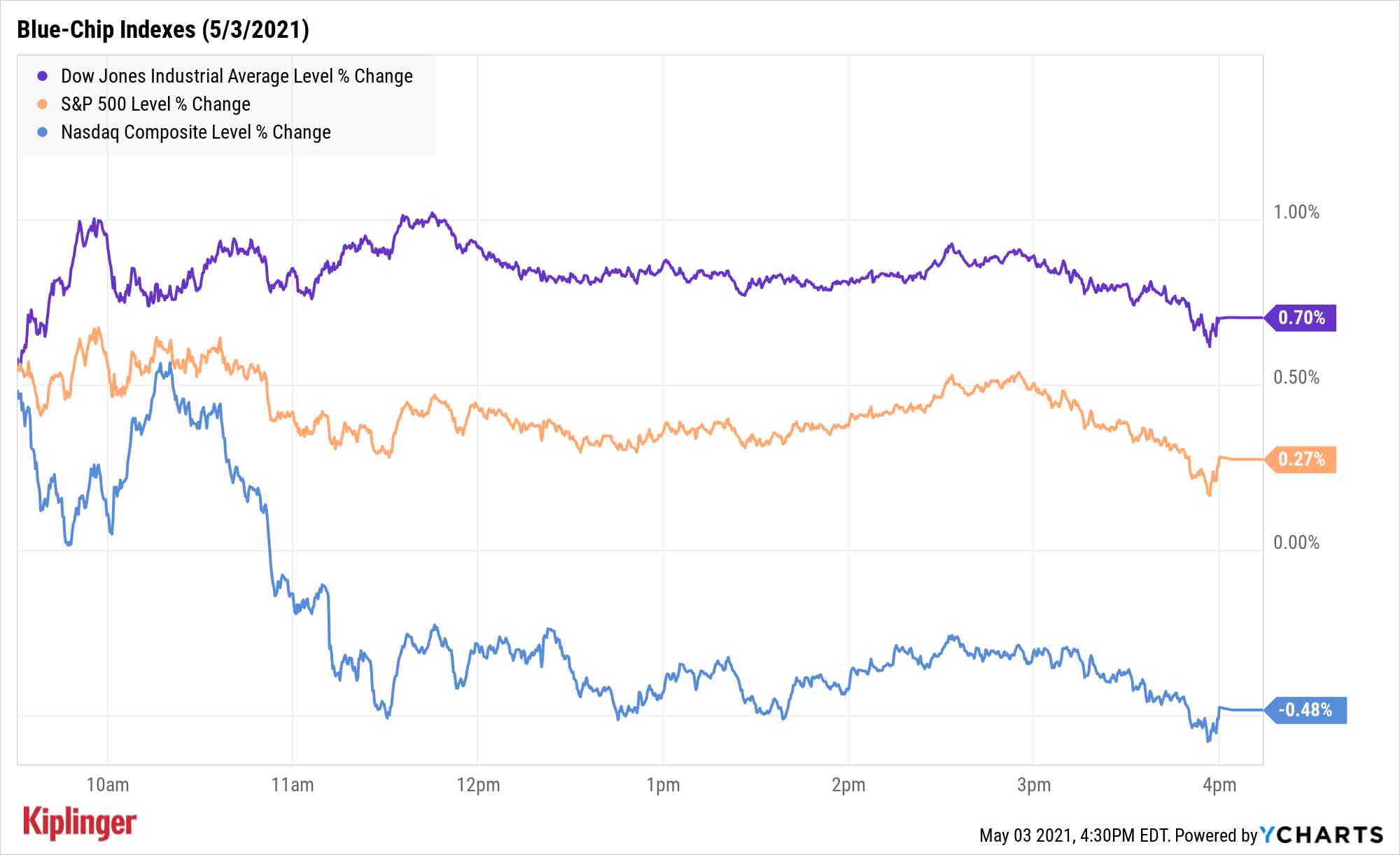

The "rotation trade" popped its head back up Monday, as the Dow advanced and the Nasdaq slipped to start the new month.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Dow Jones Industrial Average kicked off the month with a 0.7% gain to 34,113 on Monday that came despite a weaker-than-expected Institute of Supply Management manufacturing report.

Supply bottlenecks resulted in an April reading of 60.7 – a slower rate of expansion than March's 64.7 reading indicated, but expansion nonetheless.

"Although the composite was a fair bit below expectations (Barclays 64.5; consensus 65.0), the decline comes off of a robust March reading that was the highest since 1983," says Barclays economist Jonathan Millar. "Indeed, components of the composite continue to point to very strong growth, which comes as no surprise, given highly favorable demand conditions amid fiscal stimulus, easing of social distancing restrictions, and ongoing progress in vaccinations."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We're glad to see that at least some investors heeded our advice to ignore the urge to "sell in May and go away." But stocks weren't exactly up across the board. The Nasdaq Composite (-0.5% to 13,895) struggled, thanks to weakness in mega-cap tech and tech-esque names such as Tesla (TSLA, -3.5%), Amazon.com (AMZN, -2.3%) and Salesforce.com (CRM, -2.9%).

"For the first time in a while there is a clear value/cyclical bias while growth/tech is under pressure," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Tech wobbled last week despite blowout numbers from the mega-cap stocks. This is especially concerning as the rate environment remains in check."

Other action in the stock market today:

- The S&P 500 gained 0.3% to 4,192.

- The small-cap Russell 2000 also finished in the black, up 0.5% to 2,277.

- Berkshire Hathaway (BRK.B, +1.7%) held its 2021 annual shareholder meeting this weekend. Chairman and CEO Warren Buffett and Executive Vice Chairman Charlie Munger addressed a number of topics, including trimming Berkshire's stake in Apple (AAPL) in Q4 2020. "It was probably a mistake," said Buffett, adding that AAPL's stock price is a "huge, huge bargain" given how "indispensable" the company's products are to people. Also of note: Berkshire grew fourth-quarter operating income by 20%, to $5.9 billion, while cash grew 5% to $145.4 billion.

- Domino's Pizza (DPZ, +2.6%) was a notable winner today. The pizza chain revealed an accelerated stock buyback program, saying in a regulatory filing that it will pay Barclays $1 billion in cash for roughly 2 million DPZ shares.

- U.S. crude oil futures jumped 1.4% to end at $64.49 per barrel.

- Gold futures snapped a four-day losing streak, adding 1.4% to settle at $1,791.80 an ounce.

- The CBOE Volatility Index (VIX) declined 2.3% to 18.18.

- Bitcoin prices improved by 1.1% to $57,530.32. More impressive was the 18.6% improvement in Ethereum, to $3,300.64 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Another Big Week of Reports ... And Dividends

What should investors be looking forward to this week?

On Thursday and Friday, we'll get the latest weekly unemployment filings and April jobs data, respectively, but throughout the week, another heaping helping of earnings reports, anchored by the likes of General Motors (GM), Pfizer (PFE), Under Armour (UAA) and PayPal (PYPL).

And given that many companies tend to synchronize their dividend and buyback actions with their earnings reports, you also can expect plenty of news on the dividend-growth front.

In some cases, those raises might be token upticks meant to secure current or future membership in the Dividend Aristocrats. But others are bound to compete with this year's most explosive payout hikes – improvements of 15%, 20% or even 30% that drastically change the income aspect of current shareholders' investments. Ideally, of course, investors want the best of both worlds: income longevity and generosity.

These 10 dividend stocks just might fit the bill. This group of mostly blue-chip household names offer a strong history of payout increases, a sharp level of recent hikes compared to their peers, and the operational quality to continue affording these annual raises.

Kyle Woodley was long AMZN, CRM, PYPL and Ethereum as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.