Wasatch Emerging Markets Small Cap Goes Its Own Way

This emerging-markets stock fund isn't afraid to stray from the pack.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

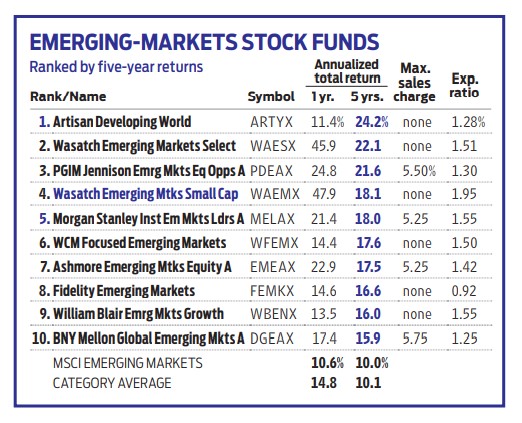

The MSCI Emerging Markets index includes 27 countries and more than 1,400 stocks – a broad assortment, to be sure. Finding the most promising investments among those stocks and thousands of other candidates can't be easy. But the four managers at Wasatch Emerging Markets Small Cap (WAEMX) have a disciplined approach.

They start with a quantitative screen that "tees up good ideas," says Ajay Krishnan, a comanager. The screen helps them zero in on high-quality companies with healthy profits (measured by return on capital) and cash flow. Then they research each prospective firm from bottom to top and top to bottom.

The process results in a portfolio of roughly 50 to 80 stocks. It's a diversified list, but in some ways not as diversified as other emerging-markets stock funds. Not every sector finds a place in Emerging Markets Small Cap, for instance. The profitability screen makes sure of that. And only nine emerging-markets countries are represented.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That's because the managers invest where their research takes them, even if it strays from what other emerging-markets funds are doing. India stocks make up 34% of the portfolio, three times the average exposure of peer funds. And Chinese companies – the top country in most emerging-markets stock funds – account for just 5% of Emerging Markets Small Cap's assets. "India's firms have been focused on profits," says Krishnan, while Chinese companies have been more focused on being "the biggest and the baddest."

The fund's hefty tilt toward India has been a plus. Over the past 12 months, the MSCI India index climbed 49%. But Chinese stocks declined 16%, amid a crackdown on some of its big tech firms. "The best way to invest in China is to focus on small companies," says Krishnan. "Stay under the radar, but buy good businesses." Among the fund's biggest winners over the past year are MindTree, an Indian tech consulting firm (up 253%), and Momo.com, a Taiwan-based social networking and messaging app firm (up 224%).

Over the past three years, the fund's 47.9% annualized return beat 99% of its peers. The trade-off was slightly higher volatility than its peers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.

-

What's the Difference Between a Bond's Price and Value?

What's the Difference Between a Bond's Price and Value?bonds Bonds are complex. Learning about how to trade them is as important as why to trade them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: U.S. Savings Bonds

Bond Basics: U.S. Savings Bondsinvesting U.S. savings bonds are a tax-advantaged way to save for higher education.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.