Work From Home ETF (WFH): What You Need to Know

The Direxion Work From Home ETF (WFH) puts investors in touch with dozens of companies benefiting from the suddenly accelerating trend of remote work.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Buying "work-from-home" stocks just got a lot easier.

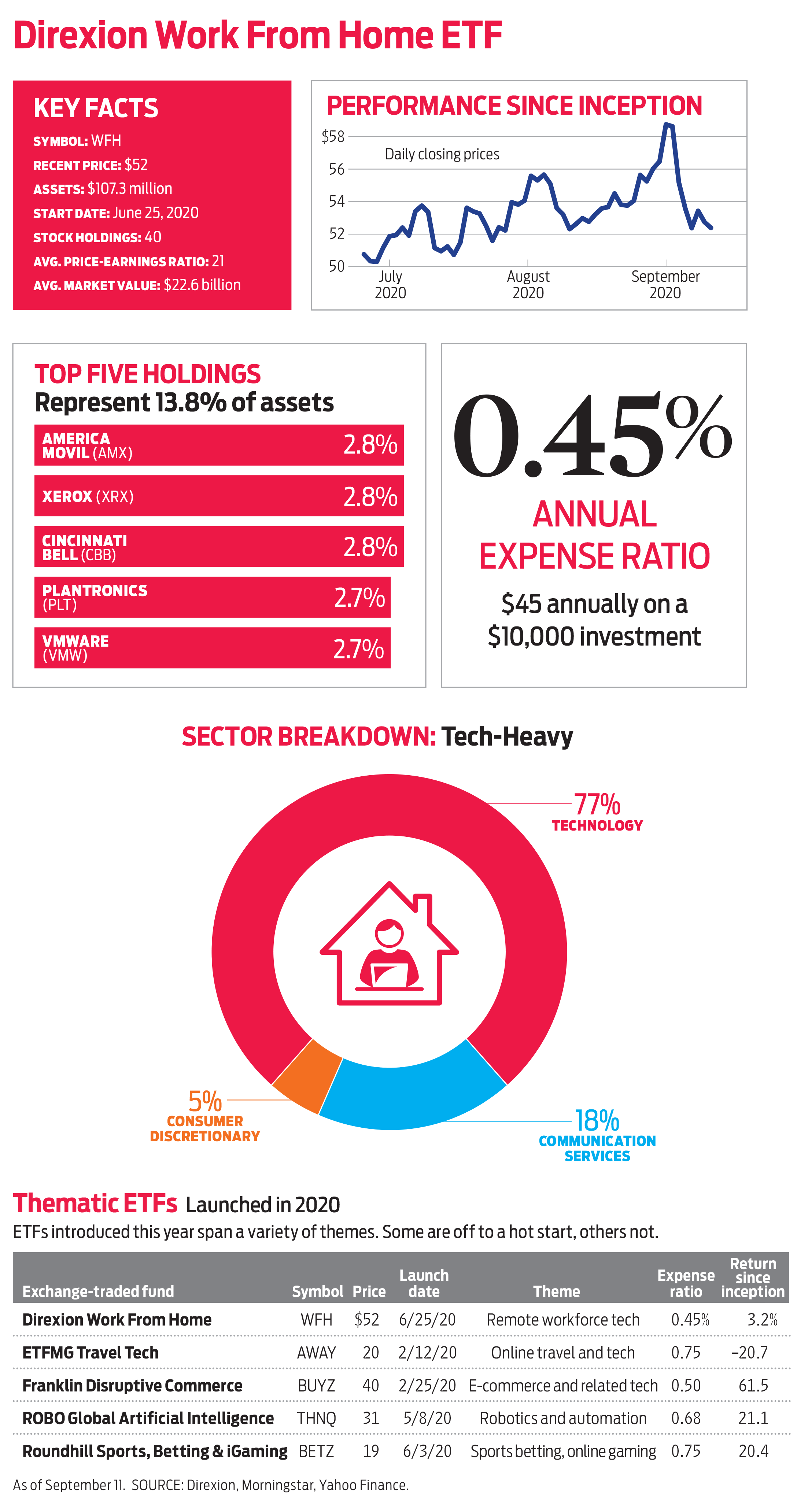

Direxion launched the Direxion Work From Home ETF (WFH) in June, providing the market with its first one-stop shop for a trend that has been around for years but been magnified because of the COVID-19 pandemic.

Remote work might just be a months-old concept to many Americans, but this more flexible work style has been on the rise for years. Direxion points out that even in 2017, 43% of employed Americans were spending "at least some time working remotely."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, the coronavirus outbreak has rapidly changed the landscape of working from home. More than half of U.S. companies say they plan on making remote work a permanent option in the wake of COVID-19, and three-quarters of Fortune 500 CEOs say they plan on accelerating their companies' technological transformations.

In other words, the success of tech stocks related to the work-from-home push likely aren't just a flash in the pan.

"We've never faced a global pandemic like this that has impacted countries around the globe," says David Mazza, Managing Director, Head of Product, Direxion. "And unlike a natural disaster where we see a swift economic recovery, how we get there this time will require us to change."

The WFH exchange-traded fund is the first such product to give investors pure-play access to this rising trend.

A Look Inside WFH

The Work From Home ETF tracks the Solactive Remote Work Index, which focuses on four technologies crucial to keeping companies operating efficiently with remote workforces: cloud technologies; cybersecurity; online project and document management; and remote communications.

The resulting portfolio is an equal-weighted group of 40 stocks – many of which have become much more popular with investors (and American workers) in 2020.

Top 10 holdings include the likes of Zoom Video (ZM), Box (BOX), Crowdstrike Holdings (CRWD) and Twilio (TWLO).

Like many of these companies, Twilio — which provides communications infrastructure for companies — is enjoying the dual burst of COVID-specific demand, as well as pick-up as firms move to improve their technology.

"(Twilio is) powering the communication structure that New York City is going to use for their contact tracing. The voice calls and the SMS text messages are being powered by this firm," Mazza says. "While they're also powering the ability for people to communicate remotely and work more efficiently and effectively, their technology can allow a city which is devastated by COVID to have one of the key requirements to see a successful recovery."

While the fund also holds mega-caps such as Amazon.com (AMZN) and Microsoft (MSFT), equal-weighting the portfolio ensures that they don't have an outsized pull on the fund's performance like they do in cap-weighted products.

WFH charges a competitive 0.45%, or $45 annually on a $10,000 investment, in expenses. Investors can get a closer look at the fund at the Direxion provider site.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Financial Abuse Is on the Rise: What It Is and What to Do About It

Financial Abuse Is on the Rise: What It Is and What to Do About ItDomestic violence almost always includes financial abuse. Here’s help on identifying and understanding it and how to get help and leave in a safe way.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

2023 Investment Outlook’s Big Question Focuses on Recession

2023 Investment Outlook’s Big Question Focuses on RecessionFundamentals, earnings and diversification are key after a year that left us feeling like we have a bit of a hangover.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Stock Market Today: S&P 500, Nasdaq Close Lower for a Second Straight Day

Stock Market Today: S&P 500, Nasdaq Close Lower for a Second Straight DayToday's economic data included updates on home prices and consumer confidence.

-

3 Healthcare Stocks Set to Prosper in a Post-Covid World

3 Healthcare Stocks Set to Prosper in a Post-Covid WorldDo-it-yourself (DIY) investors should keep an eye on these investing opportunities the analyst community has identified.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

How to Avoid Financial Panic When a Recession Threatens

How to Avoid Financial Panic When a Recession Threatensretirement planning More Americans are worried about a recession with record inflation and a downturn in the stock market. If you’re among them, here are a few steps you can take that could help you sleep better at night.