Down But Not Out: 4 Reasons Why the Dollar Remains the World Heavyweight

The dollar may have taken a beating lately, but it's unlikely to be overtaken as the leading reserve currency any time soon. What's behind its staying power?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every few years, predictions resurface that the U.S. dollar is on the brink of losing its dominant role in global finance. Lately, those warnings have grown louder. Clients ask: "Is dollar dominance finally ending?"

The list of concerns is familiar: A national debt exceeding $37 trillion, a trade deficit near $1.2 trillion, stubborn inflation, the rise of cryptocurrencies, a stock market bubble and a belief that a BRICS (Brazil, Russia, India, China and South Africa) currency will soon take over.

Yet history tells a different story. In the 1990s, many believed Japan's yen would dethrone the dollar. Later, the euro was expected to replace it. More recently, attention has shifted to China's yuan, or even digital currencies. Despite each wave of predictions, the dollar remains firmly at the center of global finance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why? Because reserve currencies aren't chosen by headlines. They are earned through deep structural advantages that take decades to build and even longer to replace. The U.S. continues to dominate in money, message and muscle, likely giving the dollar staying power well beyond 2026.

Here are four reasons why it would be hard to dethrone.

1. The world's largest and most innovative economy

The U.S. remains the largest economy on earth by a wide margin. By the end of 2025, U.S. GDP was roughly $30 trillion, compared with China's $19 trillion. Other major economies — Japan, Germany, India — each produce only $4 trillion to $5 trillion, a fraction of U.S. output. America alone accounts for more than a quarter of global economic activity.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

But size alone doesn't completely explain dollar dominance. The U.S. innovation and productivity ecosystem is unique. Over the past century, many of the world's most transformative technologies, from airplanes to semiconductors to the internet and artificial intelligence, were developed or originated in the United States.

Today, the U.S. technology sector remains unmatched. By late 2024, just seven American tech companies generated more than $130 billion in quarterly revenue, with several achieving market values larger than $3 trillion — more than the entire GDP of over 172 countries.

This innovation advantage is also reflected in scientific leadership. U.S.-based researchers have won 294 Nobel prizes in science. The runners up are the U.K. with 94, followed by Germany, France and Japan. Russian scientists have received 16 Nobel prizes, and for China that number is five.

These achievements aren't purely symbolic — they reflect productivity, economic growth and global investment.

Investors worldwide often seek exposure to growth, entrepreneurship and cutting-edge industries. The U.S. has historically played a significant role in these areas, supported by the deep and most liquid capital markets in the world.

That combination creates constant demand for dollar-denominated assets and reinforces the dollar's central role in global finance.

2. Rule of law, democracy and open markets

Trust is essential for any reserve currency, and the U.S. benefits from one of the strongest legal and institutional frameworks in the world.

American markets operate under a transparent system of rule of law, strong property rights and an independent judiciary. Investors have confidence that contracts will be honored and assets protected. That predictability matters enormously when trillions of dollars are at stake.

This stands in sharp contrast to more authoritarian systems. In countries where courts answer to political authorities or rules change without warning, foreign investors face risks that cannot be easily hedged.

In 2024, roughly 45% of the world's population lived under authoritarian regimes where the rule of law is weak, and an additional 15% lived under "hybrid" or dubious democracies, according to the EIU Democracy Index 2024.

In such places, wealthy individuals and foreign governments are understandably wary of holding local currency or assets.

The U.S. system is decentralized and accountable — from Washington down to local governments and homeowners' associations — allowing individuals to shape policy and reform. That flexibility keeps the system dynamic and adaptable.

Openness is equally important. Capital flows freely in and out of the U.S. with few restrictions. Foreign investors can buy American companies, bonds, real estate and infrastructure with ease.

About a quarter of U.S. federal debt — over $9 trillion — is held by foreign governments and investors, not because they are forced to, but because they want dollar-based assets.

Few countries allow this level of access to their markets and assets. The U.S. does, and that openness continually reinforces global demand for dollars.

3. Free convertibility and global trust

A reserve currency must be easy to use across the world. The U.S. dollar excels here.

The dollar is fully convertible and freely traded. Anyone can exchange dollars for other currencies at market rates without capital controls. This may sound technical, but it's essential. For global trade, finance and reserves, money must move quickly and without government permission.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

Many currencies fail this test. China, for example, tightly manages the yuan and restricts capital flows. Investors cannot freely move large sums out of the country without approval. Numerous emerging-market currencies, including India, impose similar controls, discouraging international adoption.

The dollar has no such limitations, and the network effects are powerful. Today:

- Over 80% of global trade invoices are denominated in dollars

- Major commodities such as oil, gold and wheat are priced primarily in dollars

- Roughly 60% of global foreign-exchange reserves are held in U.S. dollars

The euro, the closest competitor, accounts for about 20% of foreign exchange reserves. China's yuan represents only about 2% of global reserves.

This dominance reflects trust built over decades. The Federal Reserve has generally preserved purchasing power better than most global counterparts since the 1980s. Transparent monetary policy, an independent central bank and deep financial markets all contribute to confidence.

4. Military and geopolitical power

History shows that the world's leading currency usually belongs to its leading power. The British pound dominated during the era of British supremacy. The dollar rose alongside American leadership after World War II. That pattern has largely persisted over time.

The U.S. spends more on defense than the next several nations combined — about $916 billion in 2023, roughly 40% of global military spending.

Together, the U.S. and its close allies account for around 60% to 70% of all global defense spending, according to the Peter G. Peterson Foundation, underpinning global security, trade routes and financial stability.

This matters because wealth seeks safety. Governments and institutions holding reserves want assurance that the issuing country can defend its interests and maintain global order. During crises, capital reliably flows into dollars, not away from them.

Beyond military strength, America's soft power also plays a role. U.S. universities, technology platforms, legal systems and cultural institutions enjoy global familiarity and credibility.

That familiarity makes foreign governments and investors more comfortable holding dollars than currencies issued by opaque or authoritarian regimes.

The bottom line: Why the dollar isn't easily dethroned

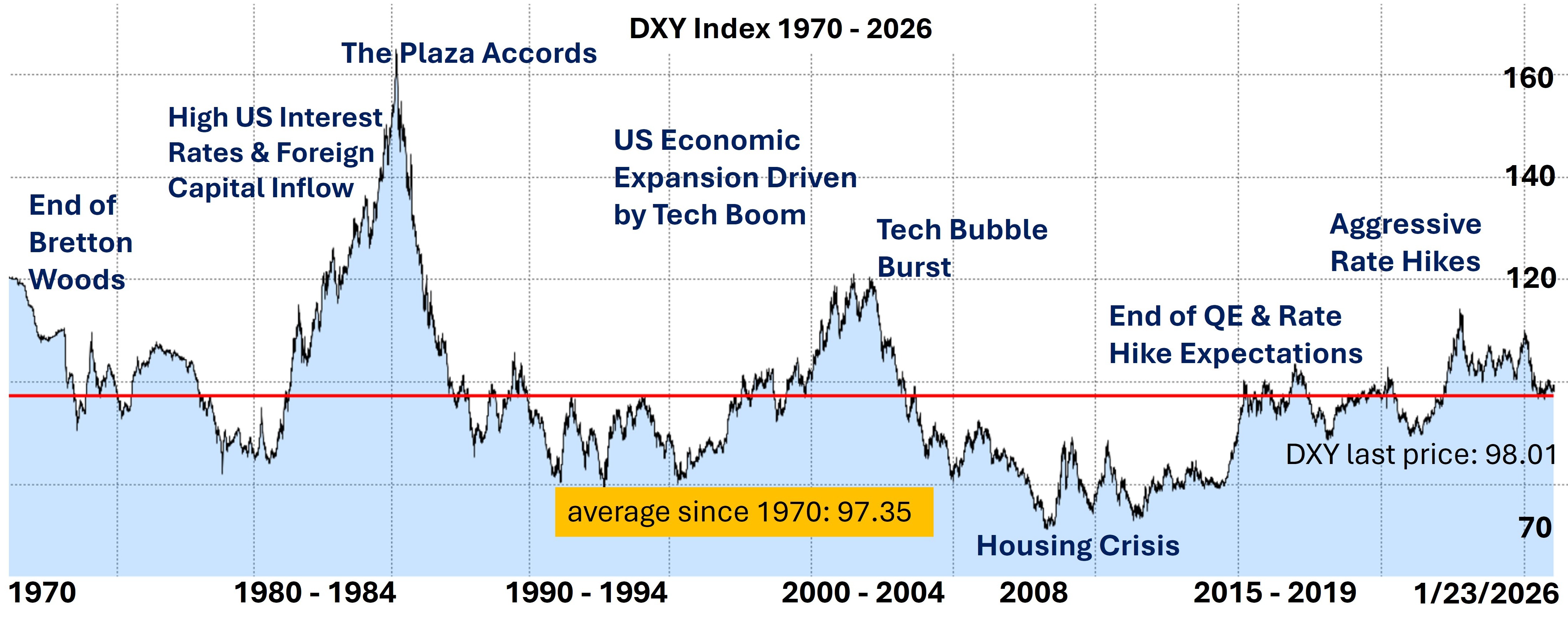

The U.S. Dollar Index (DXY) tells an important story. Over the past 50 years, the dollar has experienced cycles of strength and weakness — peaking in the mid-1980s, early 2000s and again in 2022, while hitting lows in the late 1970s and during the 2008 financial crisis.

Source: Bloomberg's U.S. Dollar Index

These swings are normal for a freely traded currency. What matters is the long-term trend: The dollar has not shown a permanent decline. In fact, it remains stronger today than its historical average.

Dollar dominance rests on structural pillars that don't disappear overnight: Economic scale, innovation, legal stability, open markets, global trust and unmatched geopolitical power. No rival currency comes close to matching that combination.

Could the system evolve over decades? Possibly. But meaningful challenges to the dollar would require a complete reordering of economics and geopolitics. That is not a 2026 story.

Despite recurring warnings, the dollar remains the backbone of global finance — and it is likely to stay that way for years to come.

This article is provided for informational and educational purposes only and reflects general economic observations as of the date of publication. It is not intended as investment advice, a recommendation, or a forecast of future market conditions. Economic and market conditions are subject to change, and no assurance can be given that any views expressed will prove correct. Past trends are not indicative of future results.

Related Content

- Is the Dollar's Role as the Top Currency Safe?

- The Dollar Index Is Sliding. Is Your Portfolio Prepared?

- The Impossible Trinity: Why Countries Can't Have It All

- Trump Reshapes Foreign Policy

- What to Expect from the Global Economy in 2026

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Feroz Ansari has over 30 years of experience in leading organizations, working with clients and teaching graduate students. His experience includes wealth management, treasury management and asset management. He is also the chairperson of the Todd & Lisa Holbrook Center for Investment and Wealth Management, a center of excellence and research at the Paul Merage School of Business, UC-Irvine. His unique focus on Total Wealth development and the integration of 3As (Awareness, Action and Acceptance) is at the core of his wealth management practice, research and teaching.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.